BTC and ETH: simple choice between decline scenarios.

BTCUSD and ETHUSD: decline scenarios remain fully intact. I have no reason to maintain immediate rally scenario - so keep watching the scenarios posted yesterday. Support regions are shown on the Primary counts charts - and inability to hold over these regions enables the Alternate scenarios to head to lower targets.

ETHUSD: I have totally revised the Primary count. Scenario presented on the chart is the way to save impulsive (i) - (ii) count to the upside - though this is not a high probability scenario as of now. Alternate count remains alive.

Both counts are pointing lower - and only a break over 167.67 could invalidate these scenarios and force me to elaborate a new counts (for instance, leading diagonal to the upside).

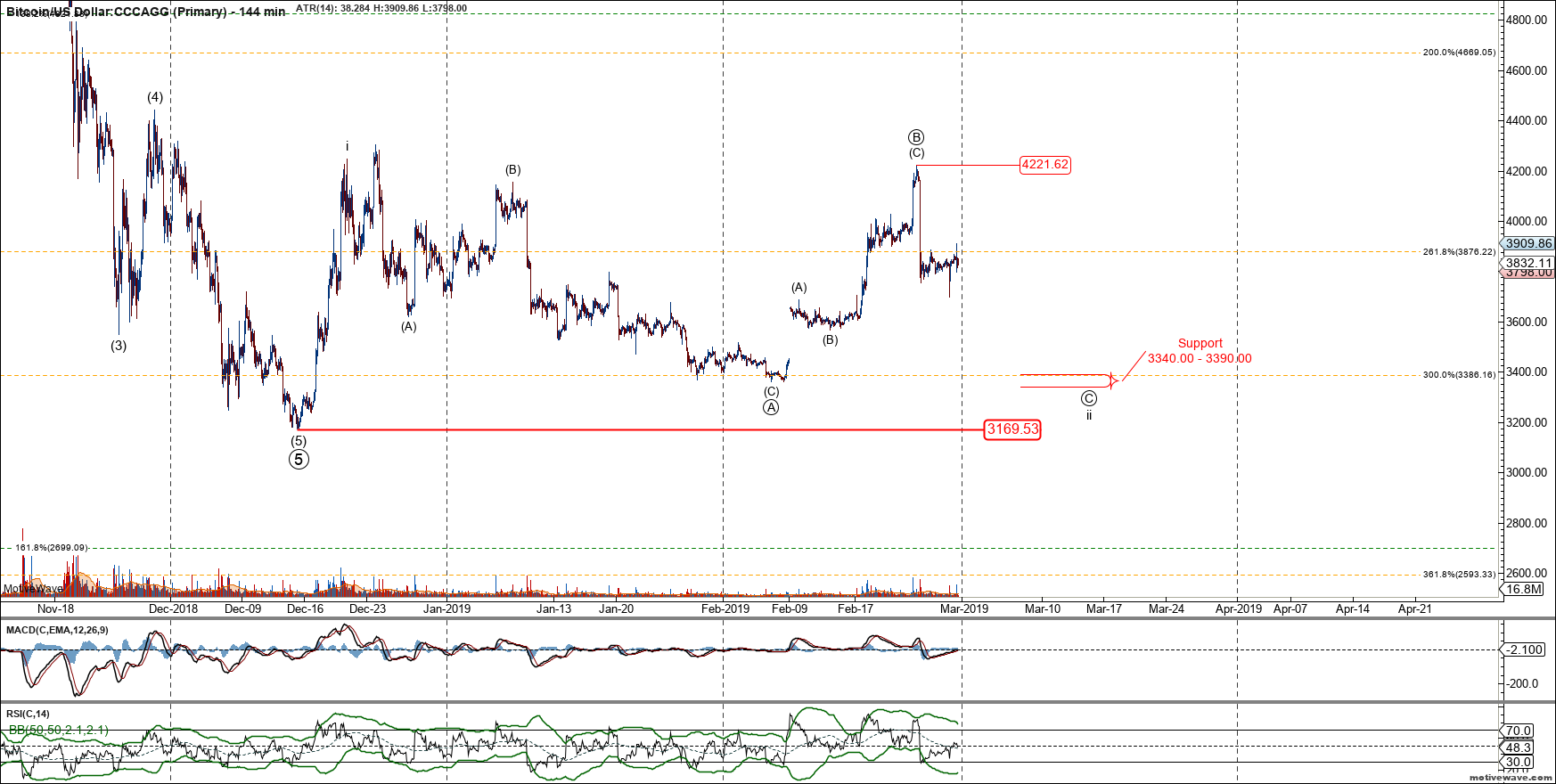

BTCUSD: similar analysis applies here. I do not see any signs of coming reversal to the upside - and below 4221 I have two main scenarios presented pointing down.

Key support region is 3340 - 3390 and inability to hold over this support opens the door to 2820 region.