BTC: The Top?

BTC: The top?

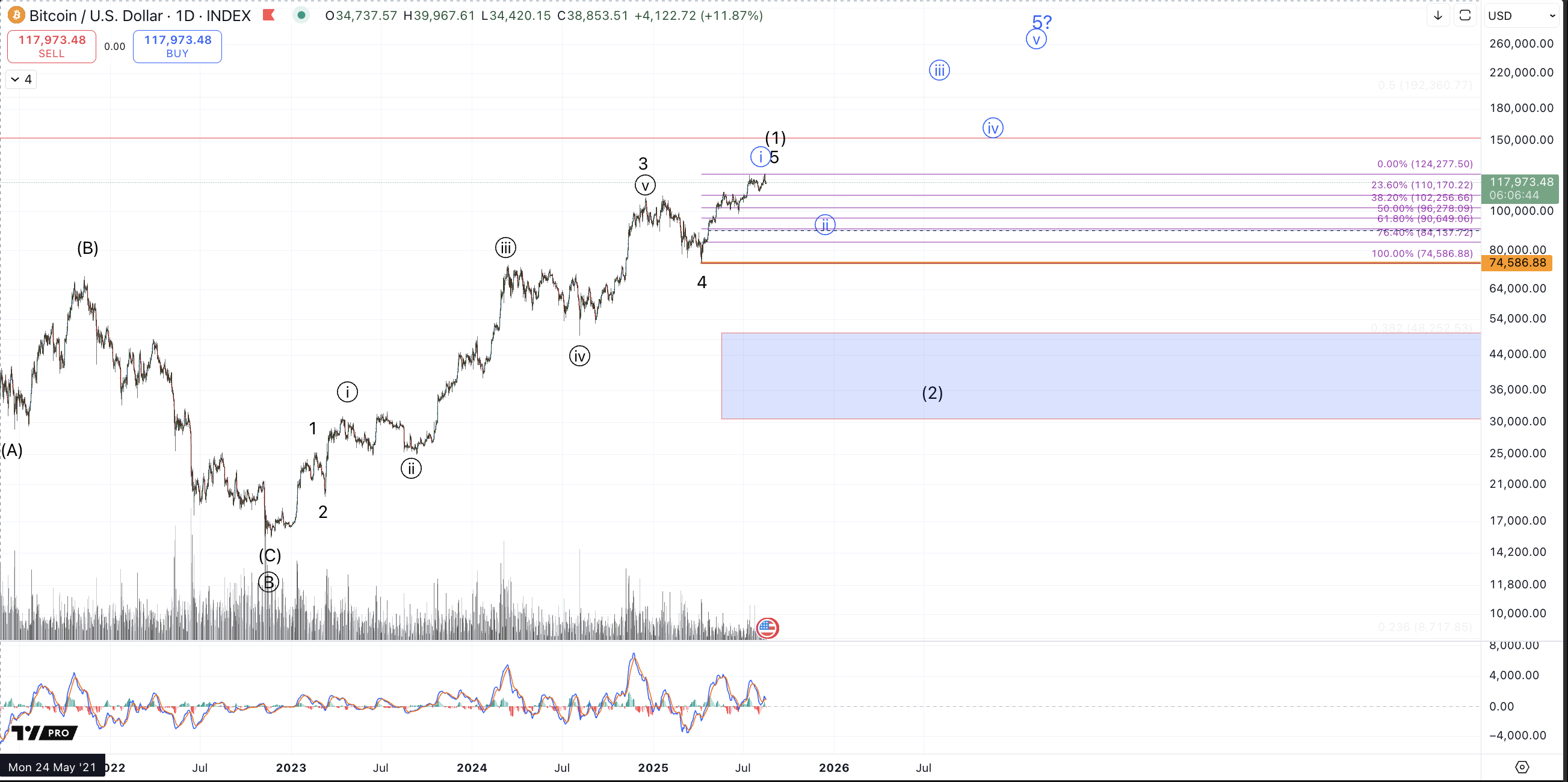

In the past several weeks, I've endeavored to strike a balance between conveying lower timeframe bullishness amidst higher timeframe caution. In a simple way, the viewpoint has been that so long as price has respected the supports that have been provided here, the expectation would be for a sufficient number of waves to fill in to the upside and for price to reach $125k+...

This past week has satisfied one of those conditions while averting the other. That is to say the price action has filled in enough waves to consider the move from the August low complete and given that it printed higher highs than those seen in July, BTC has also fulfilled expectations from a wave count standpoint of the move from the June 22nd low. Had this not occurred so close to $125k I'd be more resolute in a more immediately bullish outlook so long as trailing support continues holding. But with 5 up now from the June low and price printing within $1k of the $125k target I believe it behooves us to be cautious here.

As discussed in the previous series of articles, Bitcoin has filled in more than enough waves on the higher timeframes to very reasonably consider completion of the rally from the 2022 cycle low, albeit for an incomplete structure from the April low. This past week has fulfilled the lower time frame expectations and as such we can consider the lower and higher timeframes more reasonably aligned.

Please note, this is NOT me calling the top in place. In order to do so, I'm content to make that call in hindsight after a few degrees of support are broken.

The purple count on my 1hr chart shows the potential of completion of the entire rally from the June 22nd low. The anemic quality of the wave v that this interpretation suggests is rather unsatisfying from a probabilistic standpoint with what reasonably looks like a double top in conventional technical analysis terms (albeit with a new high printed in August). This is much like what was seen in December 2024 and January 2025. My commentary on this price action is that I'm neutral as to whether the high on 8/13 completed all 5 up from the June low or just provided a more extended iii after a very protracted 4 of iii.

The next few weeks should provide an answer to this uncertainty / neutrality between the black and purple counts. In order to favor the purple count, I'll need a sustained break below $115.9k (as marked on the 1h chart) and I'd consider this "confirmed" upon a break below the August low.

Should price remain without a sustained break below $115.9k, the black count is in play and suggests another rally up to $128k-$135k to complete the move from the August low and the June 22nd low.

Lastly for the micro count, though I'm not considering it as high probability as the black and purple counts (of which I'm neutral between the two) I'd be remiss to ignore the prospect for a more immediately bullish run to $160k+ as shown in green on the Uber Bullish 4h chart. This setup is viable (albeit not expected) so long as price remains above the August low.

In summary regarding the micro count, price needs back below the August low, $111.9k to confirm a top (of sorts) in place.

Regarding the larger degree, assuming we see a break below the August low in the coming weeks, whether directly or after another high to $128k-$135k (as suggested by the black count), we'll still need to distinguish between whether all 5 waves from the November 2022 low have completed or whether the recent high (or upcoming high) will complete just the wave circle i of a more extended 5th. This pertains to the blue count which has been discussed for the past few months which entails a larger move setting up for $200k+ from the April low.

Based on the current high, $124.3k, standard Fibonacci support for a larger wave circle ii pullback is $90.6k-$102.3k. So long as this region is holding I cannot with confidence confirm a top in place for wave 5. Instead, assuming this region is tested in the coming weeks, I'll need to see $85k resoundingly broken to become confident that the entire rally from the 2022 low has completed with the larger correction of the bull cycle underway, ie a bear market. From a risk management standpoint, please consider that $85k is about 28% from current levels as of writing this draft.

In summary, Bitcoin has now satisfied all conditions for a reasonable completion of this bull market with the exception of the $125k target which was missed by under 1%. This is an especially important region to exercise caution within while maintaining an open mind for immediately higher prices to target either $128k-$135k or $160k so long as the August low remains unbroken. Below the August low, our remaining prospect for higher within this cycle is the blue count which entails a run to $200k+ (more ideally $250k) after a test of the previously untested breakout region in the rally from the April lows, roughly $90k-$102k. Lastly, a sustained break below $85k favors the completion of the rally from the 2022 low and below $74k, ie. the April low, this bearish thesis becomes confirmed