BTC Once Again Snubs Buyers Looking for Anything Resembling a Standard Pullback

BTC once again snubbed buyers looking for anything resembling a standard pullback as has been the case for much of this rally since September of last year.

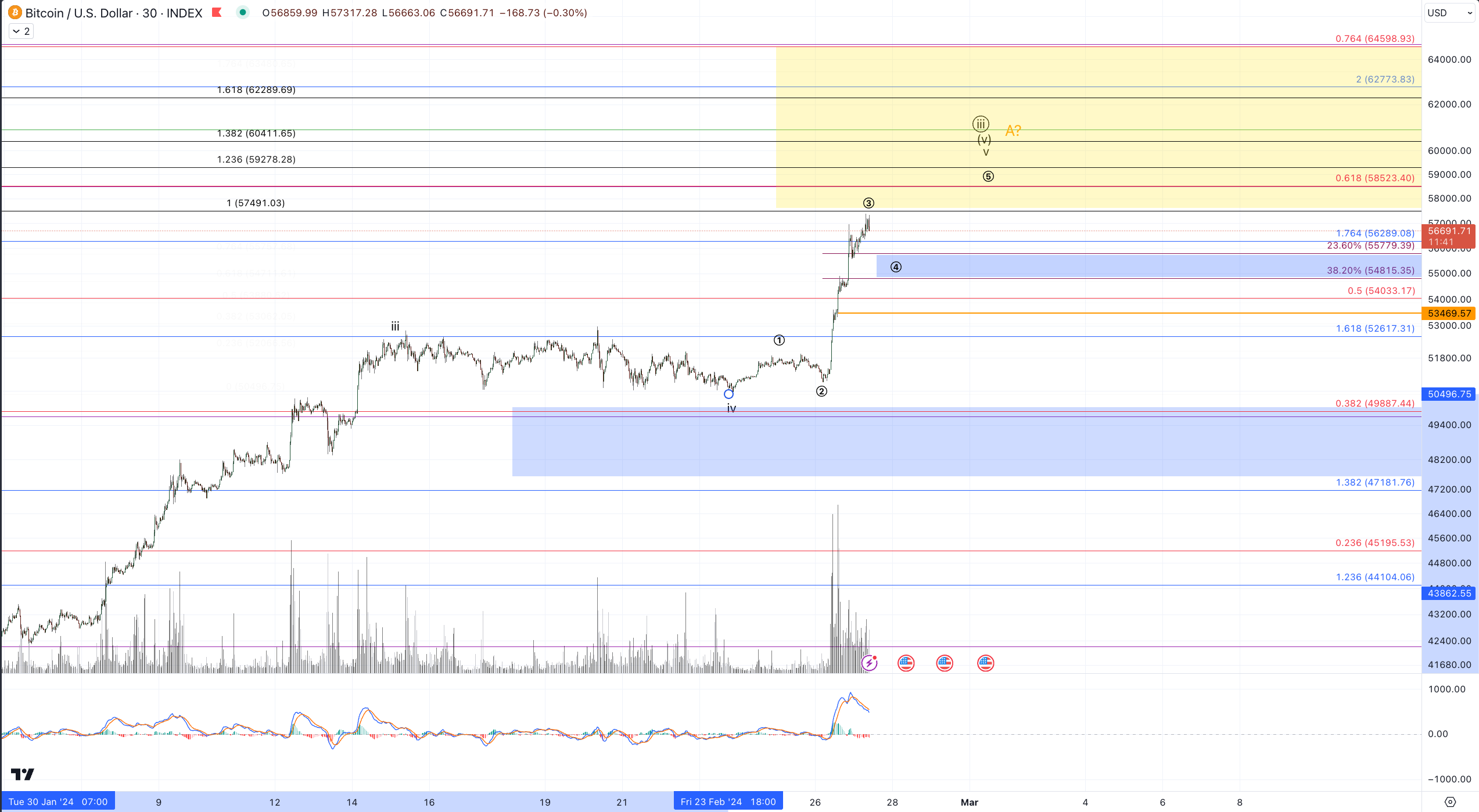

Within all counts price is coming up into a target region of great significance from which a pullback is expected. On the 30minute chart, the black fibs represent extension of wave i of (v) from the wave iv low and the red fibs are extension of waves (i)-(iii) from the wave (iv) low. These two to sets coalesce to form a target region between $57.5k-$64.6k. With the current price action and the closeness of the upper end of this target region to the all-time highs, I would not at all rule out a spike through (and likely reversal) $69k. The general gist here is that I expect an important top to form here in the coming days/weeks but perhaps with one more circle 4-5.

Micro support is $54.8k-$55.8k. So long as this region holds I expect one more push up to complete the pattern from last week's low. However, any sustained and/or meaningful break below $53.4k will be a strong signal of a top in place.

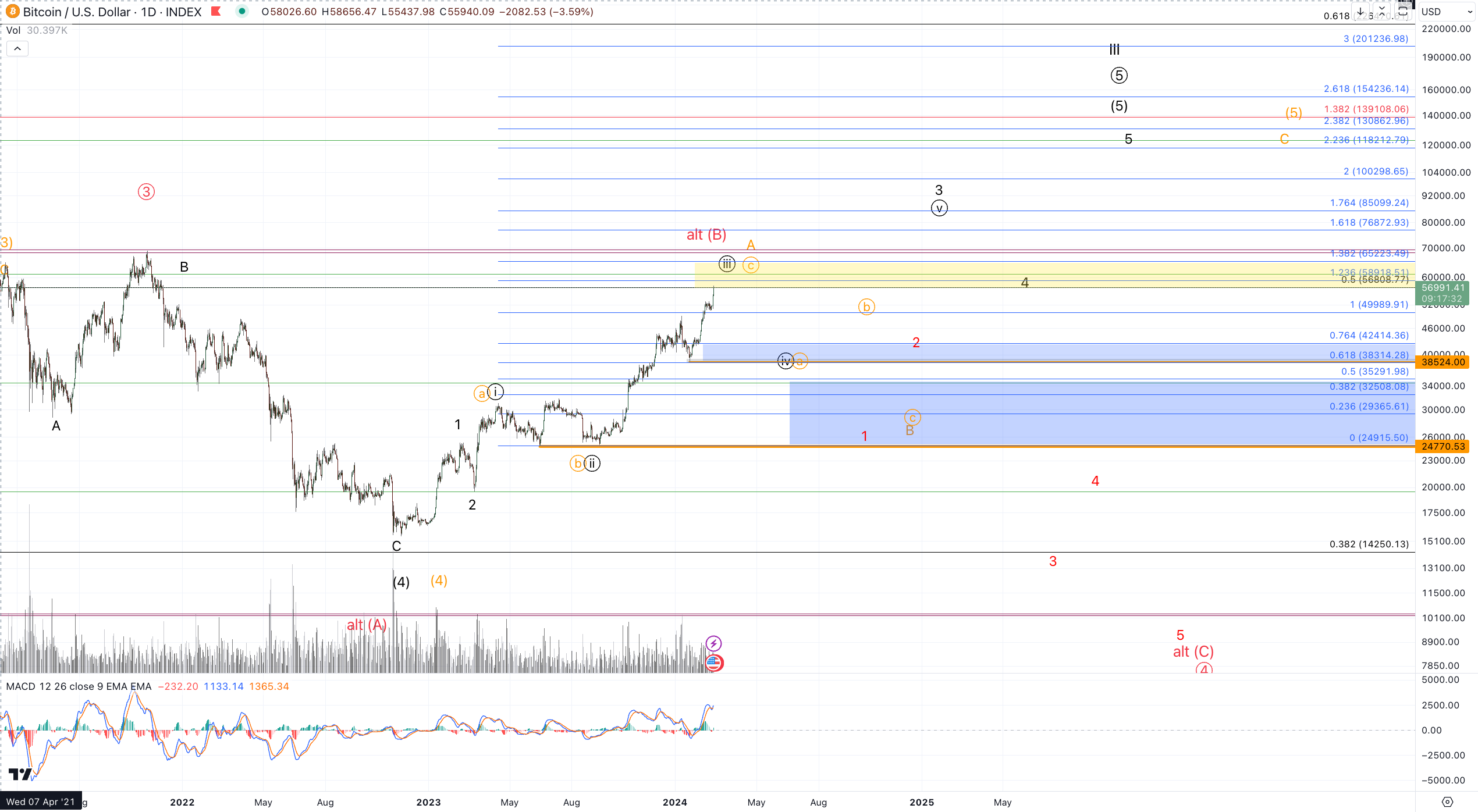

As for the larger degree, nothing substantial has shifted from previous updates so here's a recap.

My primary thesis is that price is headed to $100k from the 2022 lows. This can take shape as either

The black count: in which we've been in the heart of iii of 3, what's expected to be the strongest part of the rally from the 2022 lows and needs a iv-v, 4-5 to complete north of $100k and this can take us out into year's end or next years as a very general approximation. Assuming price makes no sustained break above $65k on this rally support for iv of 3 is $38.3k-$42.4k. As I mentioned in the webinar a few weeks ago, price should make no sustained break below January's low, $38.5k, within this count. That means, a deep iv would entail a test of that low and possible spike and reverse but for all intents and purposes $38k needs to hold.

The orange count: Price is in a large ending diagonal from the 2018 low and the 2022 low was still wave (4) of that move. That entails, that the path to $100k+ should take place as an A-B-C for the (5). In this interpretation, price is nearing the top of a standard 3 wave a-b-c move for A of (5) and the upcoming expected pullback will be B of (5). This entails a substantial pullback as support for this prospect is roughly $25k-$35k. That would allow for a pullback up to roughly 60% before resumption of the bull up to $100k+

Lastly, we have my alternative thesis which entails a (B) wave top forming, shown in red. This would mean that the entire rally from the 2022 low is a (B) wave component of a larger degree corrective flat. If so, we'd be looking for the (C) down to target $6k-$13k.

How do we distinguish between the counts?

Black needs to hold upper support, currently with a low end of its range around $38k. Depending on how high the currently rally extends, I may be shifting the wave iv support higher. Nevertheless, so long as price remains over the low end of upper support, currently $38k, the black count is a reasonable prospect that's intact.

Below $38k opens the door to red/orange counts.

So long as no sustained break below $24k develops, the orange count is preferred, but we'll need to evaluate the structure of the upcoming pullback to glean whether orange would continue to remain favored in this case. With B waves being 3 wave moves, for the orange count, we'll want to ideally see a 3 wave flat type of structure to provide strong evidence of the decline being corrective. The red count on the other hand portends a (C) wave down which is a 5 wave type of structure. So, if the upcoming decline is impulsive looking that may shift odds in favor of the red count.

Keep in mind, with respect to a break below $38k and needing to distinguish between orange and red: A corrective type of move does not absolutely rule out the red count and more direct impulsive looking move does not negate the orange count. The comparison between structures referred to in the previous paragraph helps with clues about the story in advance of what ultimately transpires but price is king. For orange we'll want to see that price makes no sustained breaks below $24k. A meaningful break below that starts to raise stronger concerns about a break below the 2022 low.