BTC: New All-Time Highs Are On Deck

BTC: New All Time Highs are on Deck! How high can this swing from the April low take price?

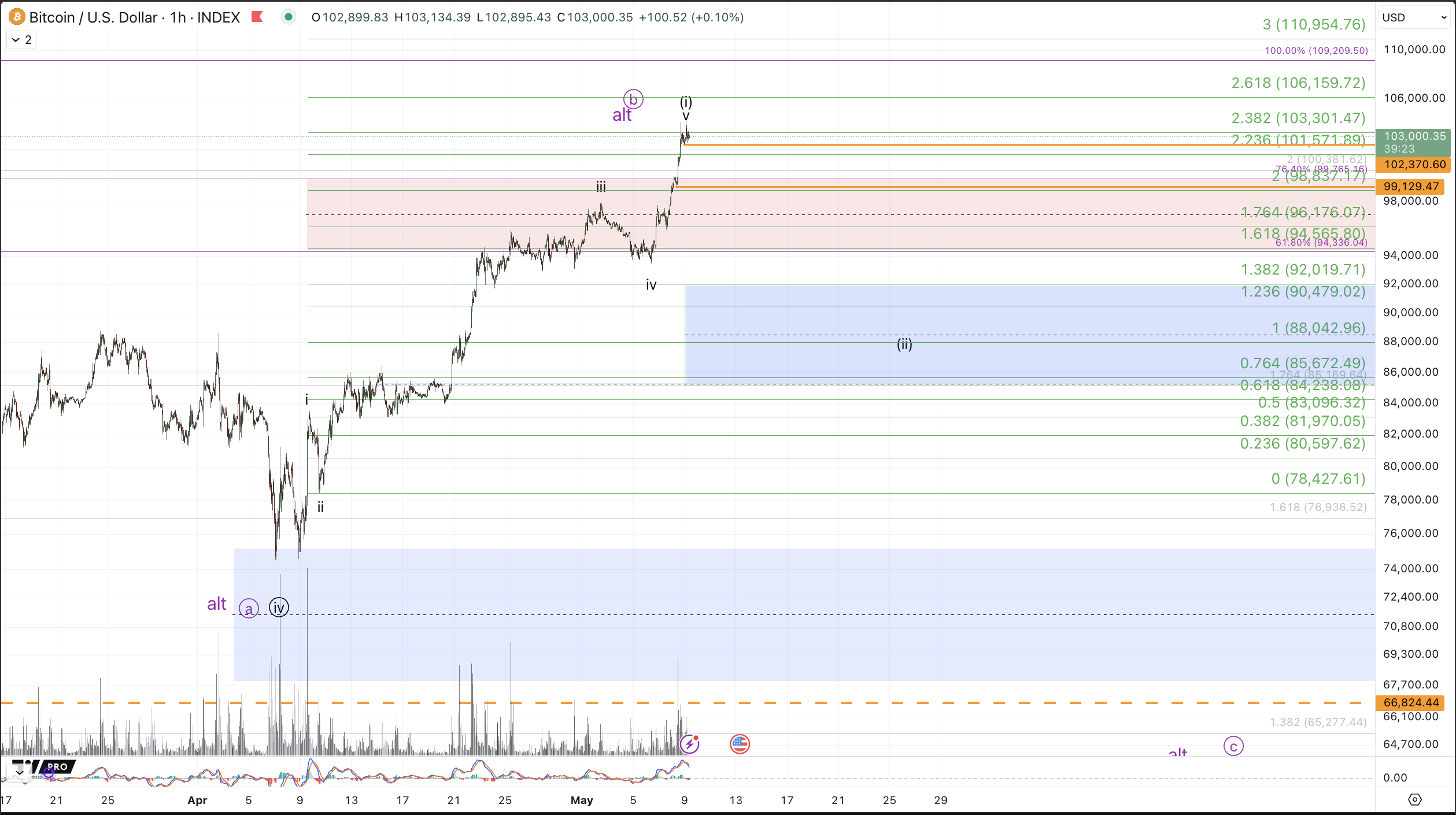

BTCUSD: The first sign of a potential top in place is a break below $102,370 with better evidence coming upon a break below $99.1k. Until then further direct extension higher is not to be ruled out.

Wave (ii) support is in the $85k-$92k zone and we'll be able to dial this zone in more precisely once there's confirmation of a top.

In the bigger picture, price action looks favorable for the prospects of reaching the long term target region, $125k-$140k on BTC. If we get a more clear wave (ii) pullback, as shown within the black count, it's increasingly likely that BTC can exceed this target region as the medium timeframe pattern off the April low would suggest an outsized wave circle v. All that said, if price continues up directly to new all-time highs without a clear wave (ii) pullback, that will technically satisfy expectations for the wave circle v higher, and should price break above $115k, that would confirm, this circle v filling out more directly without a more clearly defined subwave path as presented in the black count.

Regarding the purple count, price would need an immediate downturn and an impulsive break below $81.3k to favor this alternative wave 4 path.

Also, considering where price is within the pattern from the November 2022 lows, it would be wise to be protective once BTC reaches new highs. While upside extensions are not be ruled out and would be welcomed, at the larger degree, this now looks like a very clean 5 up from the 2022 low which suggests that once the move from the April low fills in its own 5 wave structure, BTC can complete this entire 2.5+ year rally. Hence the importance of being very mindful of the downside risks, particularly after a new all-time high is struck