BTC: Is it time for Hodl'ers to get cautious?

BTC: Is it time for Hodl'ers to get cautious?

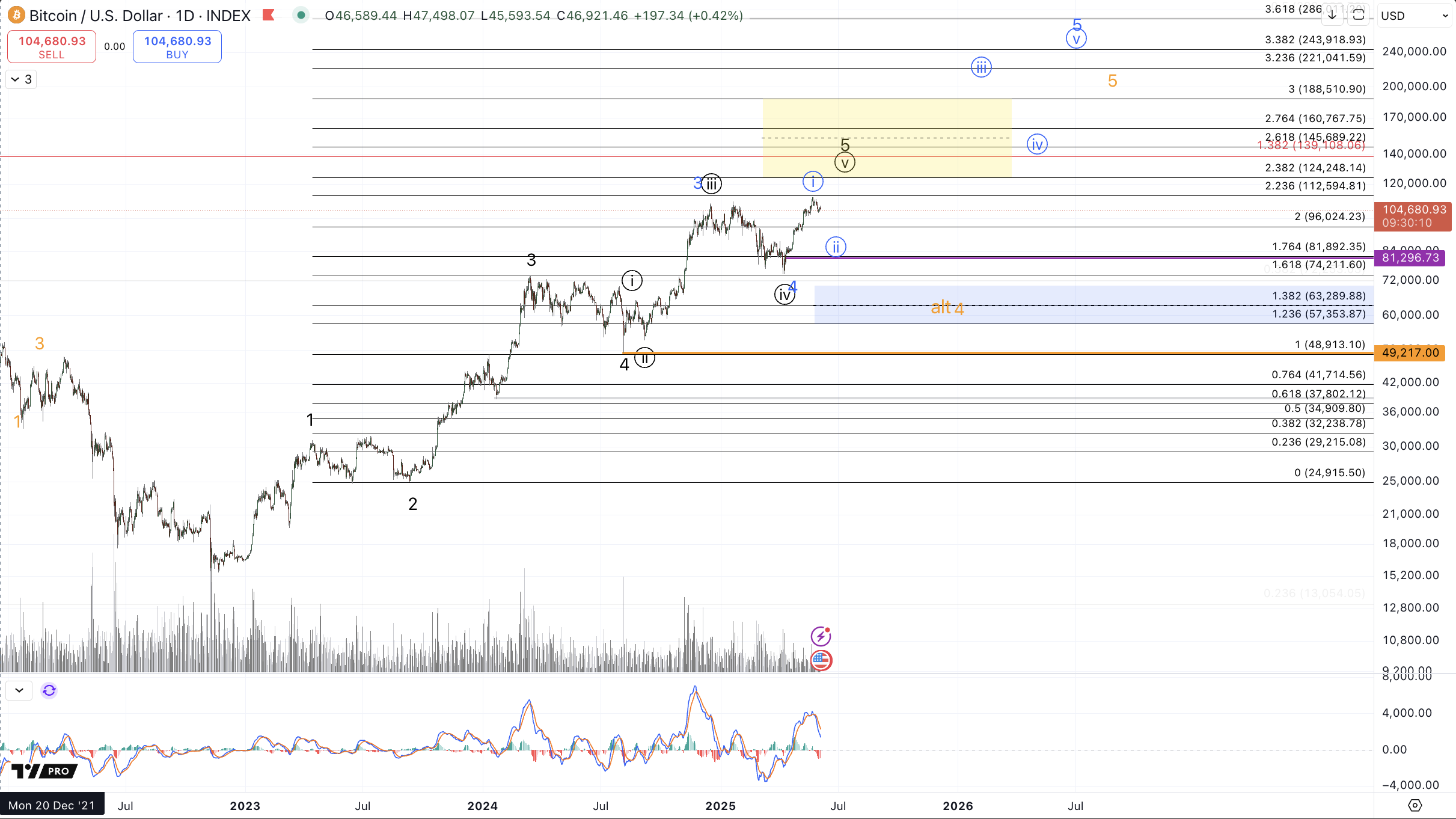

Though price action has been somewhat muted in term of upside strength in recent weeks, Bitcoin did break the January high in this past month (May) achieving a top of nearly $112k. While this is shy of the $125k minimum target we've had since the outset of this move from the 2022 low, the current high is only 11.5% below, which is quite near in terms of Bitcoin's volatility.

Anecdotally, this action does not seem characteristic of what has occurred at previous highs and so on that note I do maintain some optimism. Quantitatively, measures of over/under value such as the MVRV Z-Score https://www.bitcoinmagazinepro.com/charts/mvrv-zscore/ are well under where they've been at previous major highs. But I'll note, again with caution, that some of the cycles in the sequence since Bitcoin's inception are achieving progressively lower measures at major highs.

From the Elliott Wave perspective we now have a clean 5 wave structure from the 2022 lows with what can count as a complete 5 wave move from the August 2024 bottom, the wave 4 low (within the black count's interpretation) and a clean 5 waves from the April 2025 low (wave circle iv of 5 within the black count). This is to say, we have enough waves in place to reasonably consider the entire move off the 2022 low complete and hence, caution should be warranted.

Please note that this text is very different than calling a top.

Just because we have the minimum number of waves in place at all degrees does not mean we can not see price extend considerably higher, subdividing within this 5th wave.

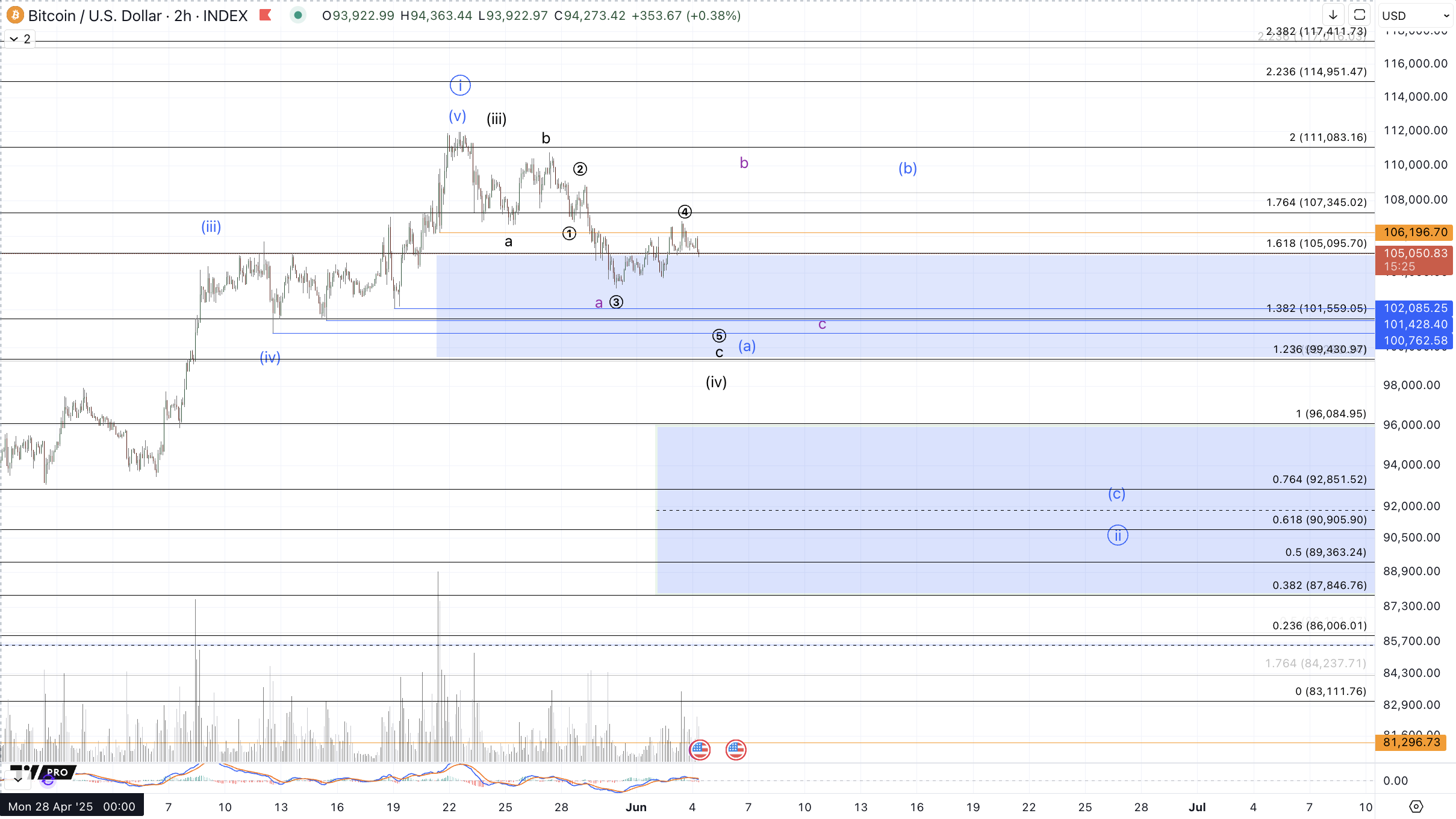

At the smaller degree: Though I can count 5 waves up in the micro chart from the April low, my preferred interpretation is that we have 3 waves up and price is filling in the wave (iv) which can ideally test, and hold, $99k-$105k region before turning back up to new highs.

The alternative is that 5 waves up has completed from the April low which entails two possibilities

1) This cycle's entire rally from the 2022 low has completed. I see that as less likely given the smaller degree primary interpretation, and that BTC has not yet reached the $125k target

2) Price is completing a larger wave circle i up from the April 2025 low. This entails that the January high completed a more extended 3rd wave up from the 2022 low, and that the drop down to $74k was a shallow wave 4. While this higher high (above January) reached in May would technically satisfy a complete 5th, the scale of this move, in comparison to the larger degree waves 1-3, is quite small and thus argues more for just wave circle i of 5 completing (within the context of interpreting the January high completing the larger 3)

Support for this perspective is $87k-$96k and a successful test of this region could launch Bitcoin much higher, into $250k+ for a big 5th wave to complete the cycle from 2022.

For now, we're best to take a level by level approach. That entails considering a wave (iv) support in black, and so as long ask $99k is holding expectations are for a more direct move higher into the $125k-$140k long term target. Should this transpire, somewhat paradoxically, it would make the blue count (for a move to $250k) much less likely. If price breaks $99k and heads down into lower support for the blue circle ii, $87k-$96k, the bullish thesis would be the blue count whereas the bearish thesis would be that the move from the 2022 low has topped and that price has entered the early stages of a larger bear market.

Technically speaking, the April low, roughly $74.4k, will need to break to invalidate the blue count but a move below $80k would be the early warning of likely impending invalidation. More specifically, I'm watching the $81.3k level which is an old low just below the 76.4% retrace (given the current $112k~ high). So long as price is above that level I can favor bullish outcomes within the conditions of the blue count but a sustained break below it will make me significantly more cautious. Please be mindful of these risks given that we now have enough waves in place at all degrees