Approaching Some Kind Of A Top?

As we noted in our report last weekend, "All of our indicators are strongly on the sell side, however we have some initial signs of a buy signal coming up very soon. If this happens, we will enter back in long and ride it as long as the buy signal remains active."

What actually happened is we got the buy signal early in the week and ended the week strongly at all time highs.

As for what's ahead, options data is bullish on review today. Internals are neutral. Price action is short term bullish, medium term bullish and long term bullish. We entered longs very early in the week with some leverage and then managed/reduced leverage as the indicators guided us throughout the week.

Right now, the options data we track is very bullish. Internals, on the other hand, are neutral and not exactly supportive of where price is right now. This could be a warning sign of us getting close to some kind of top ... but price is still the ultimate arbiter. We are currently holding C-Class longs/and half sized longs in our longer term portfolios. In the coming week, I think we will hit some significant resistance at the round number of 4300 on the Emini S&P 500 (ES) as we usually tend to do. And how we react there will determine what next.

For now, our indicators support a half sized long position in all accounts and we will continue to hold what we have until this changes.

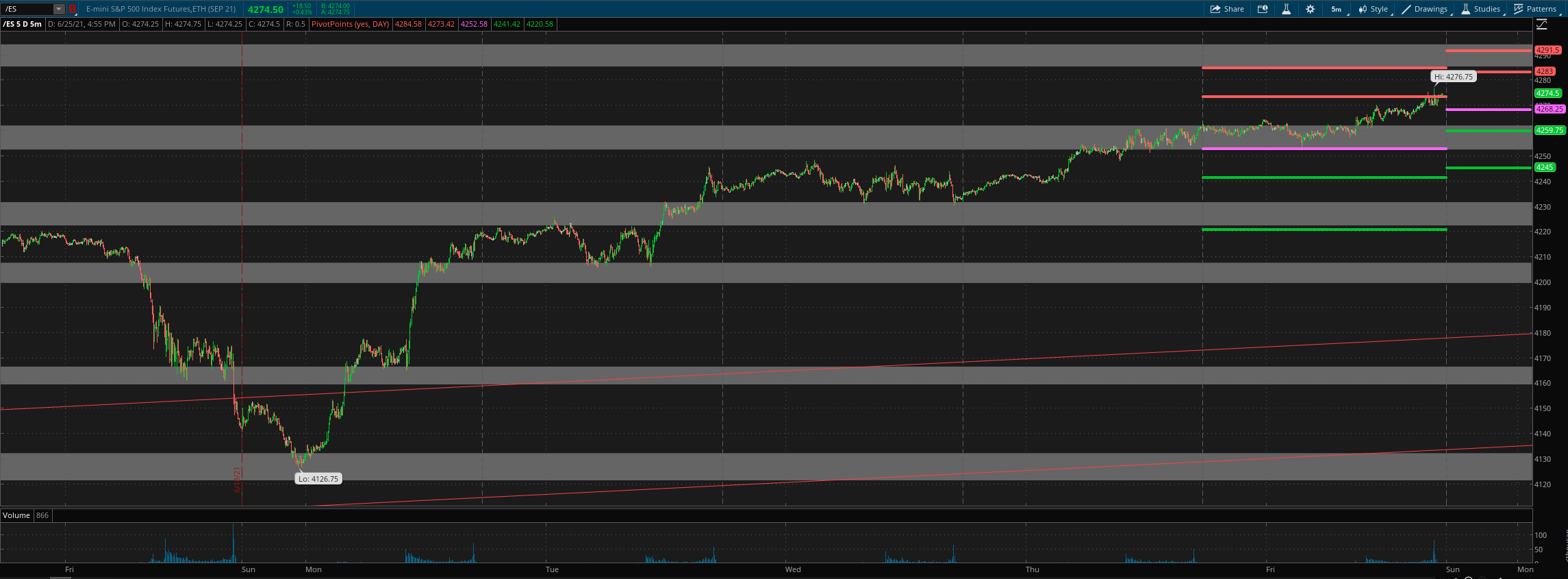

Grey zone resistance at 4285-95 and then in the 4310 area. Support is at 4262-52, 4231-23, 4207-4200, 4167-60 and then at 4132-21.

For Monday, daily pivot is at 4268. Resistance R1 is at 4283 and R2 at 4291.5. Support S1 is at 4260 and S2 at 4245.

All the best to your trading week ahead.