A Top Call Explained: MDGL (Madrigal Pharmaceuticals)

Written by Mark Malinowski with charts and commentary by Zac Mannes

A madrigal is a song arrangement from 14th century Italy, without accompaniment, for multiple voices. I would like to think it created the roots for the acapella group or the barbershop quartet. Just like those songs, the Madrigal pharmaceuticals chart has shown its range and diversity in movement.

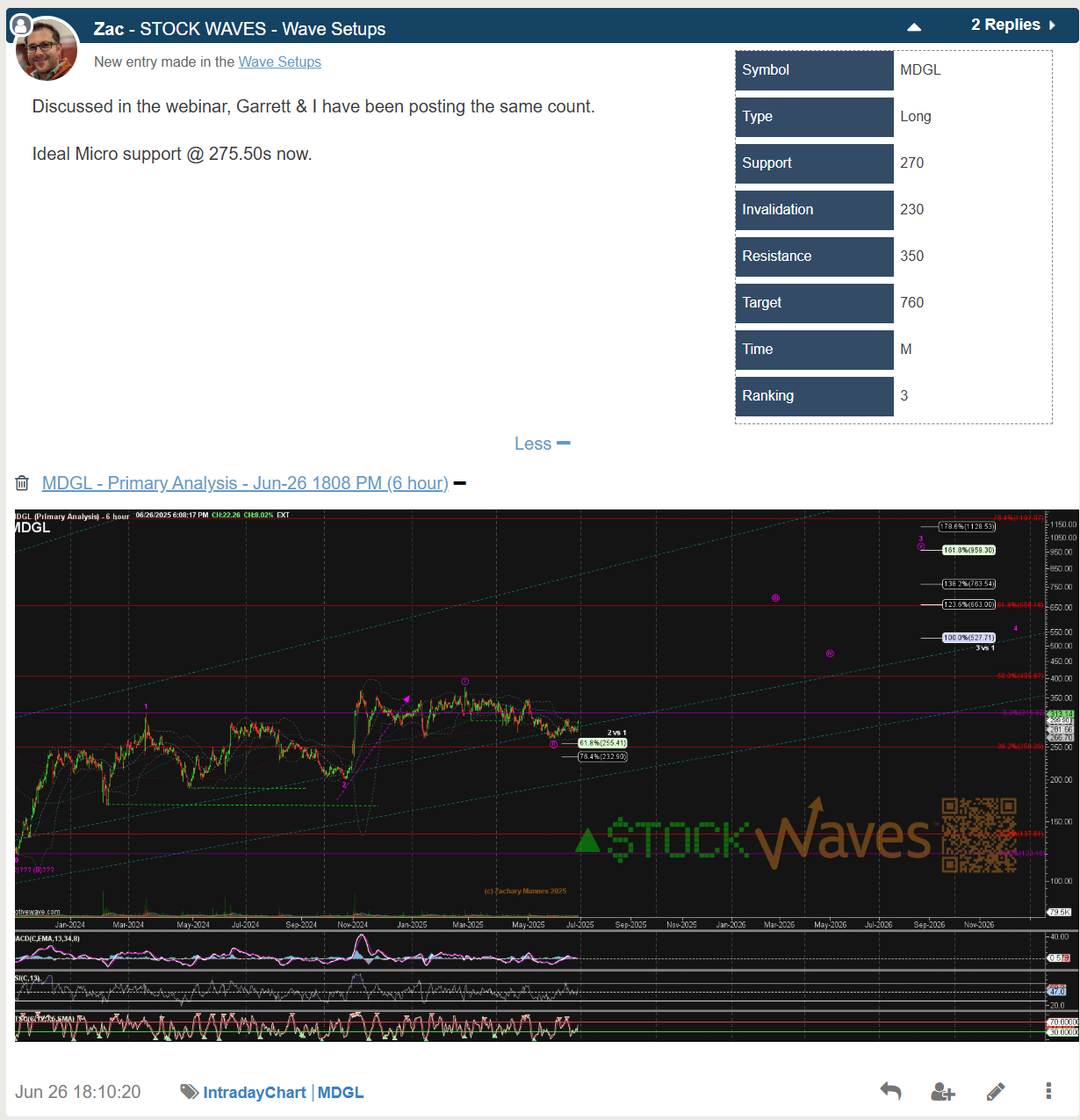

We have been tracking MDGL for several years, but the most recent Wave Setup for subscribers to the Stock Waves service at Elliott Wave Trader (elliottwavetrader.net) began back in June this year. For those who have not followed our work, the term Wave Setup has specific meaning. It defines the parameters for price support, resistance and invalidation of the structure and count we show on a chart. It is up to subscribers to decide if and when they want to take any Wave Setup. This particular setup was shared with subscribers on the evening of June 26th after the Weekly Live Video that is part of the service. This setup had a M (months) timeframe and was given a Ranking of 3 on a scale of 1 to 4. It is typical for only the best of the best charts to be made into Wave Setups.

There were multiple chart updates between June 26th and the next chart Wave Setup update to let subscribers know that the initial resistance identified had been tagged along with an update to support and invalidation levels. This update allowed for those who took the trade to look at their time horizon and consider 1. trimming profits 2. updating their stops to 3. look for potential opportunities for additional tranches if one were so inclined.

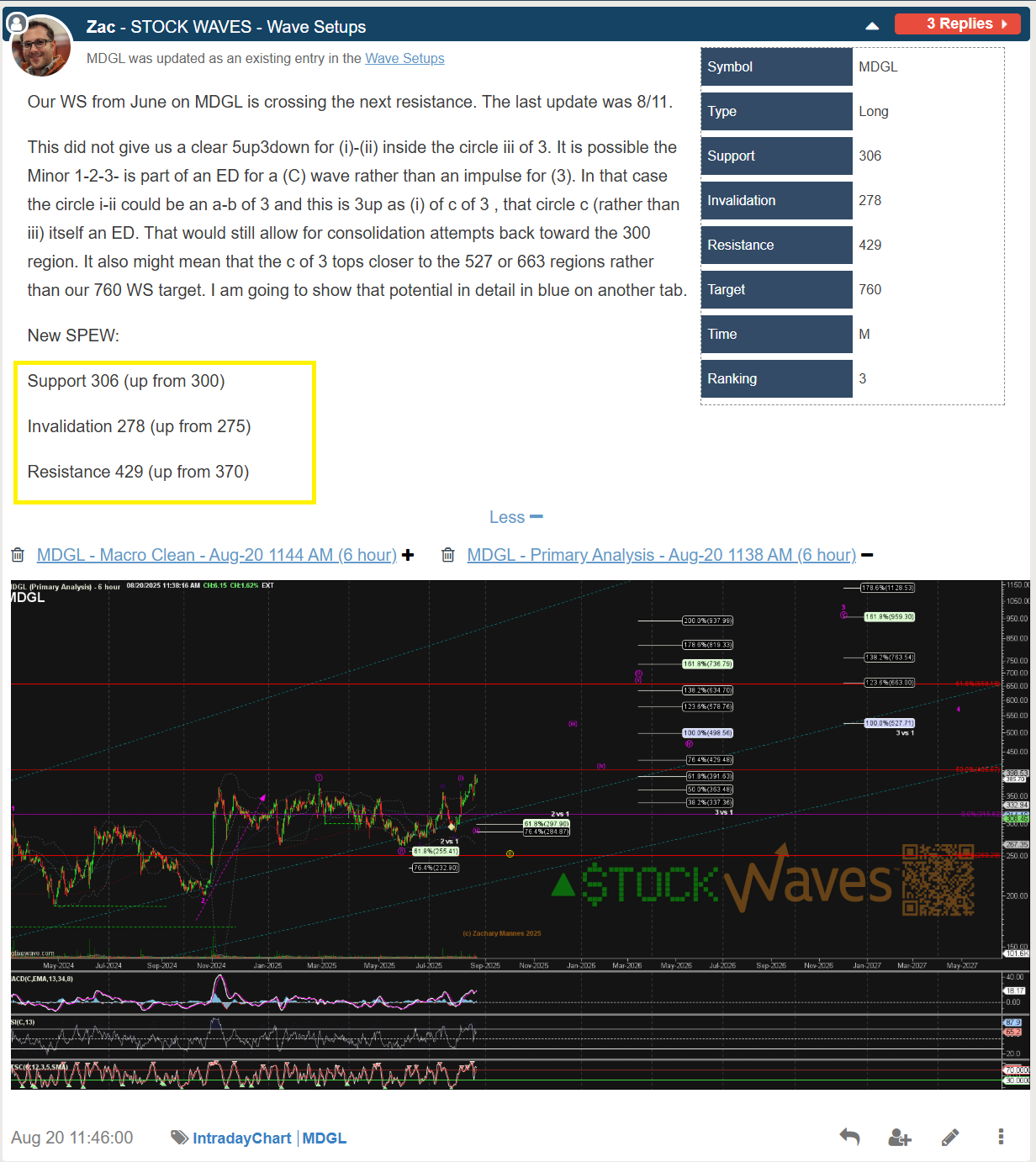

The next two updates came in fairly rapid succession (August 20th and August 28th) to the 2nd one as price started to accelerate and required a small revision to the count. While there was a week between these two updates, continued positive progress was made. The larger picture trend breaking through resistance allowed for stops to be moved to profitable after a short period of time. So, despite the change on the smaller scale, the larger bullish picture remained and allowed for some fine tuning of additional interim targets and increased potential that this chart was moving in the heart of a third wave. We tend to zoom in more near important levels to highlight support and resistance levels for our subscribers vs just staying at one level.

On August 20th with price hitting resistance a formal update was issued. The Charts of the Day video after the close noted supports levels that need to hold for structure to maintain an impulsive structure vs the risk that the chart could still be a diagonal and Zac even discussed some potential strategies he was considering to manage risk given the stance of the chart.

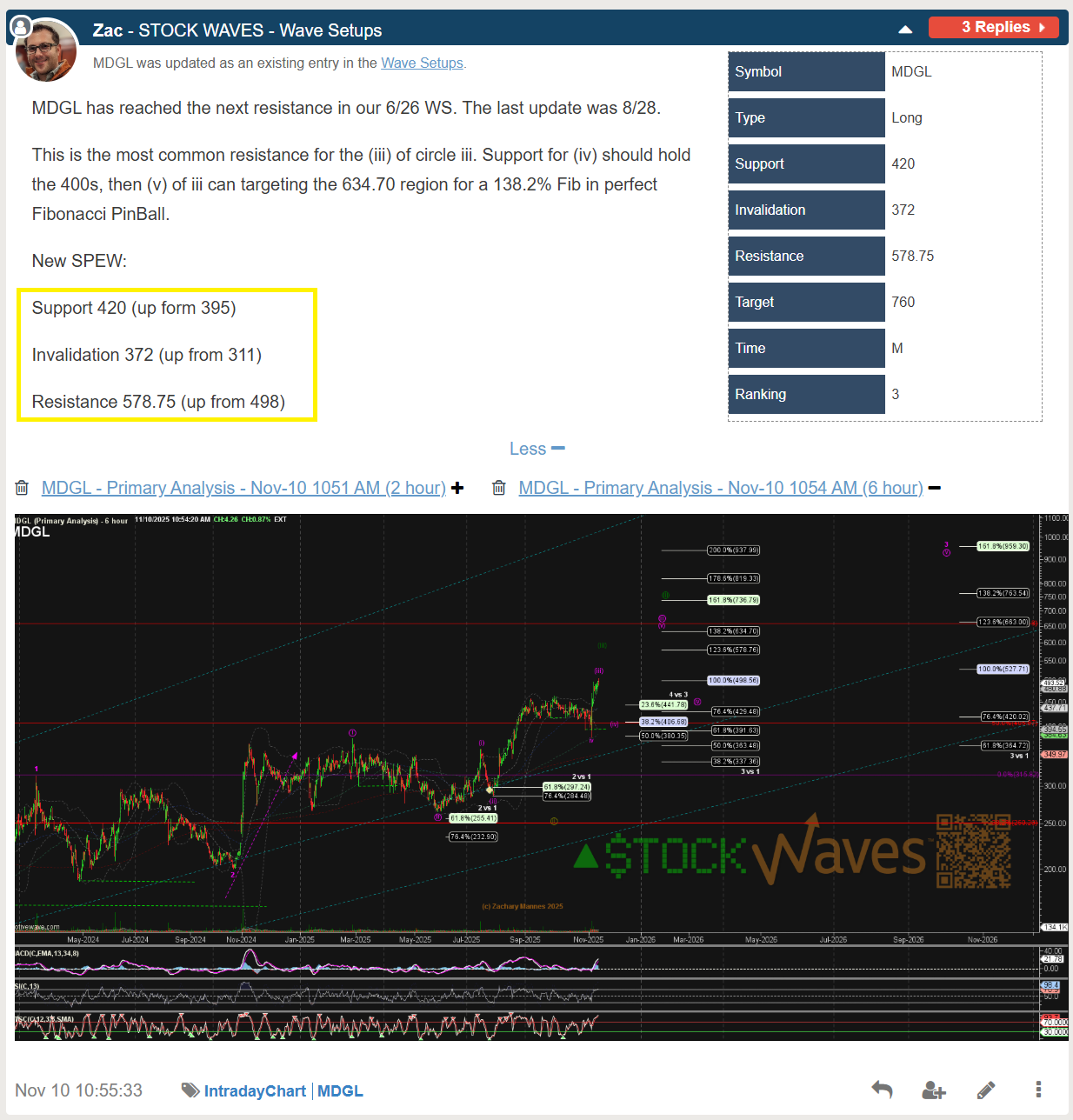

After reaching a local high in September, the next couple of months had a period of high level consolidation increasing our confidence that price was going continue higher. At Elliott Wave Trader, we use a combination of fibonacci supports and Elliott Wave structure observations to allow our analysts to select high probability price supports based on the pattern they observe taking shape on charts. Corrective structures are often overlapping and move countertrend while motive waves move much more directly and make progress higher (or lower) with the larger picture trend direction. Our education section, videos and analysts help subscribers by teaching Elliott Wave Theory and its practical application every day on our site.

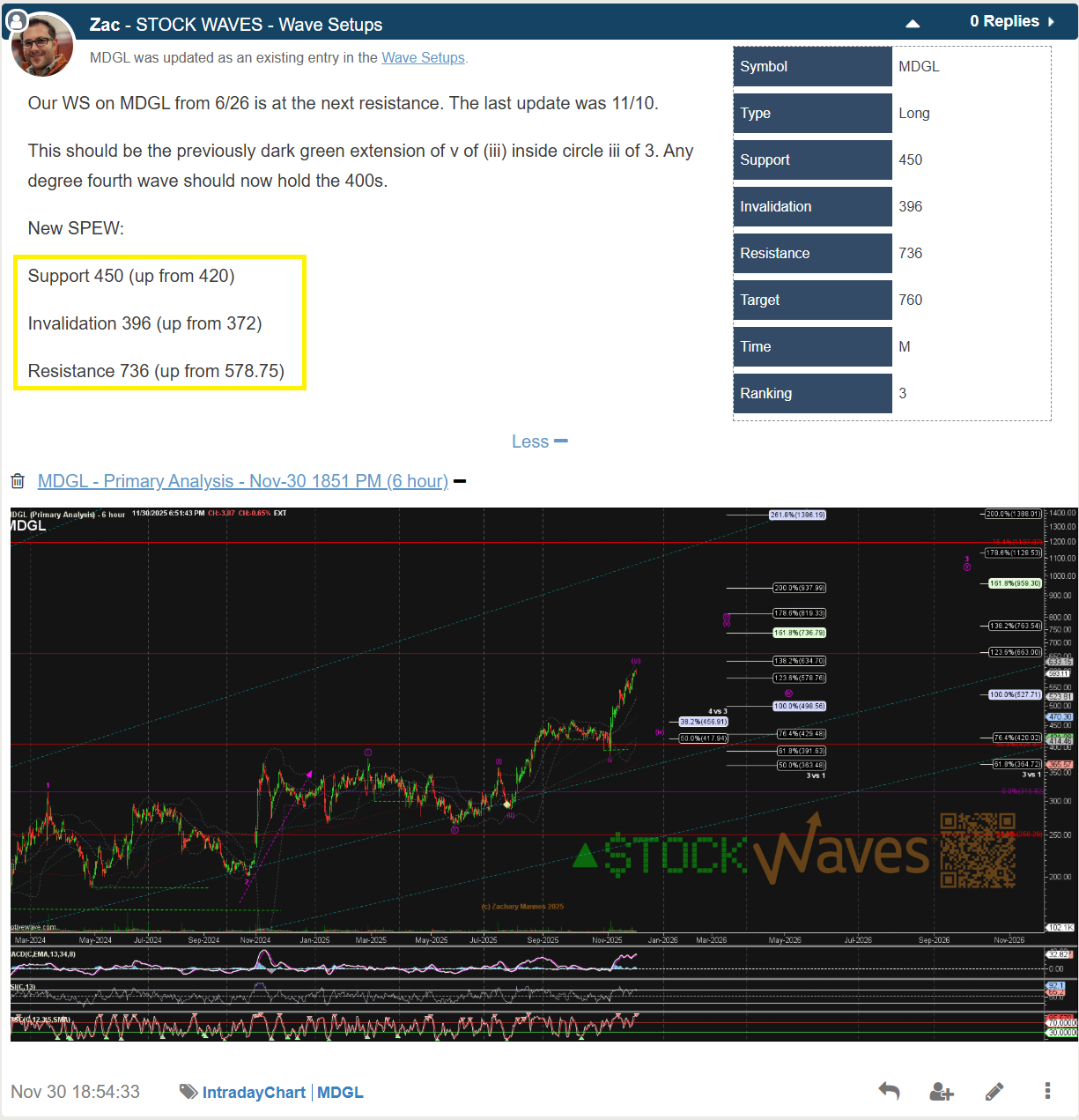

Our latest formal Wave Setup updates came on November 10th and 30th after price hit another resistance level and then proceeded to extend slightly further as indicated by Zac’s green count on the chart from November 10th.

While some analysts might shy away from diagonal structures, I would consider them a Stock Waves specialization within the Elliott Wave Theory universe. To the uninitiated they can be VERY difficult to navigate but for our members there have been additional opportunities to trade around a core holding to improve their returns when favorable risk/ reward setups presented themselves.

We will continue to track the path of MDGL in progress to our larger picture targets.