Market Analysis for Jan 13th, 2019

ES - Review of last week and looking ahead to this week

I have not posted a weekend update in the main room for couple of weeks so nothing to review today here.

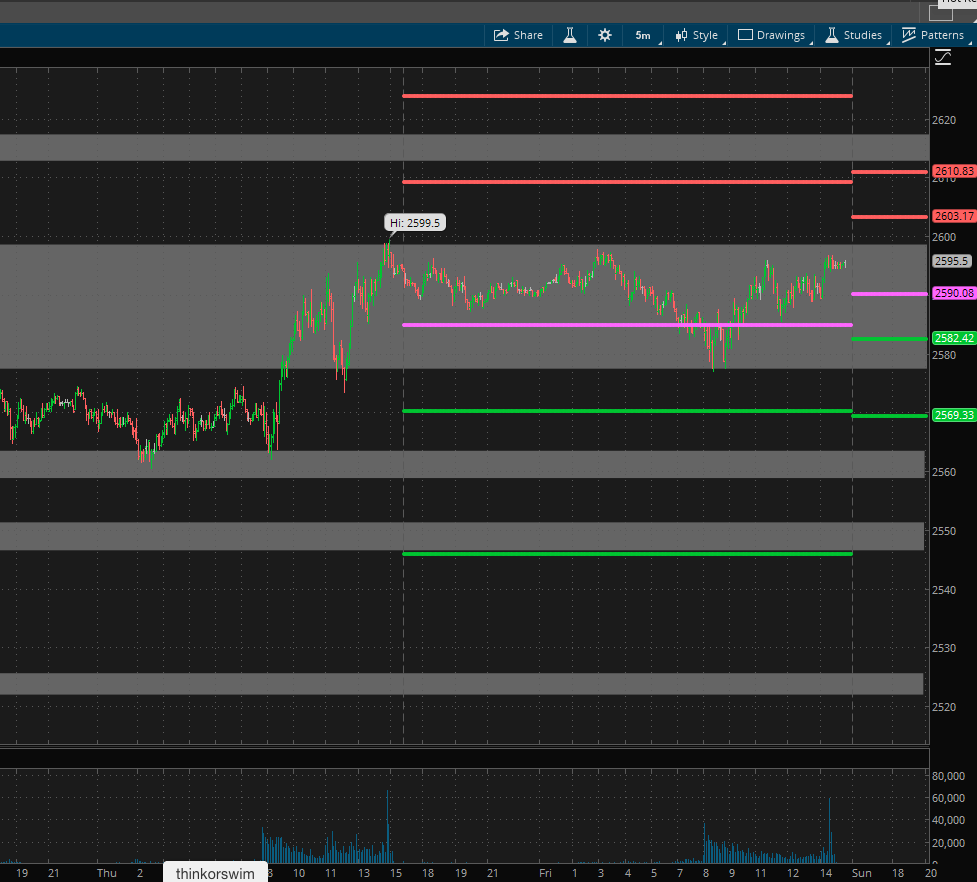

I was looking for the 2580-2600 resistance area to be tagged and the market to turn lower from there. We got there and have been trading in that zone over the past 2-3 days. To me, right now, it is looking more like we are building energy to break though the 2600 resistance area, to target first 2620 and then the 2640s. 2640 is one spot which can create a reaction/move lower but if we make it though that then 2680 area should be the next target.

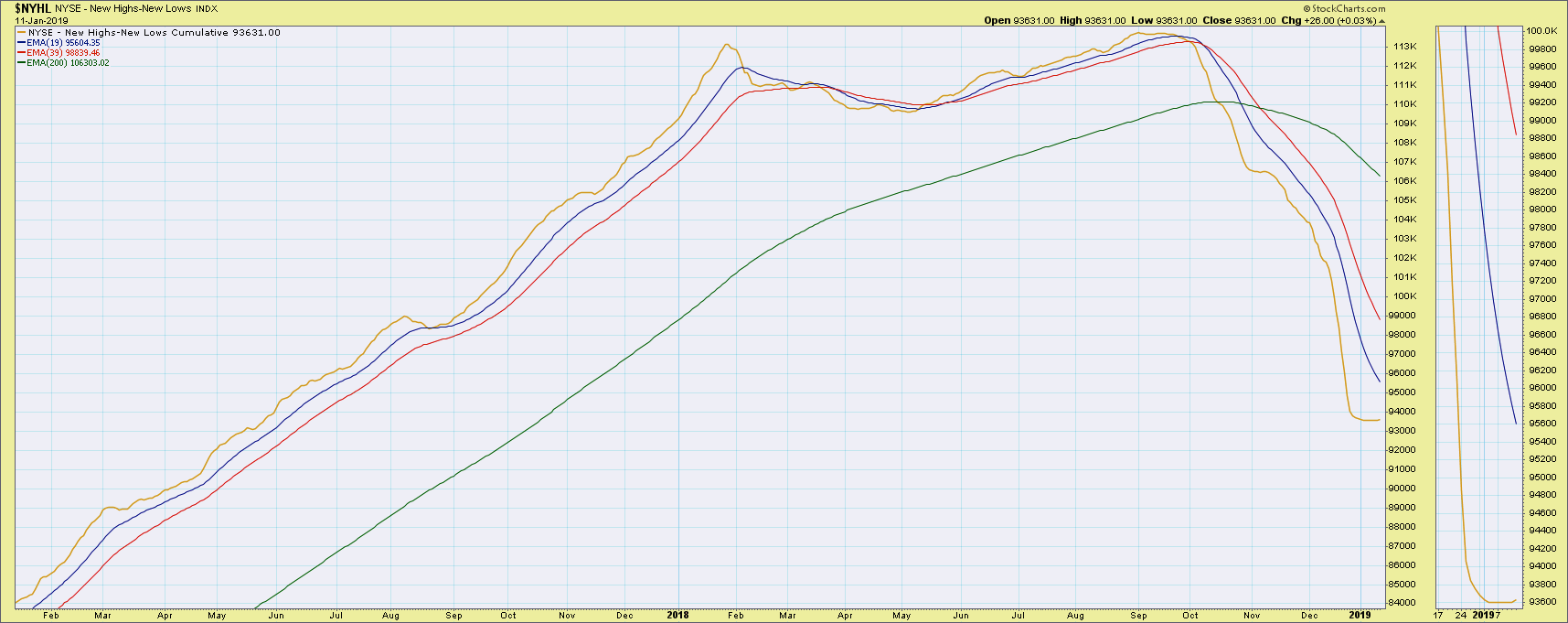

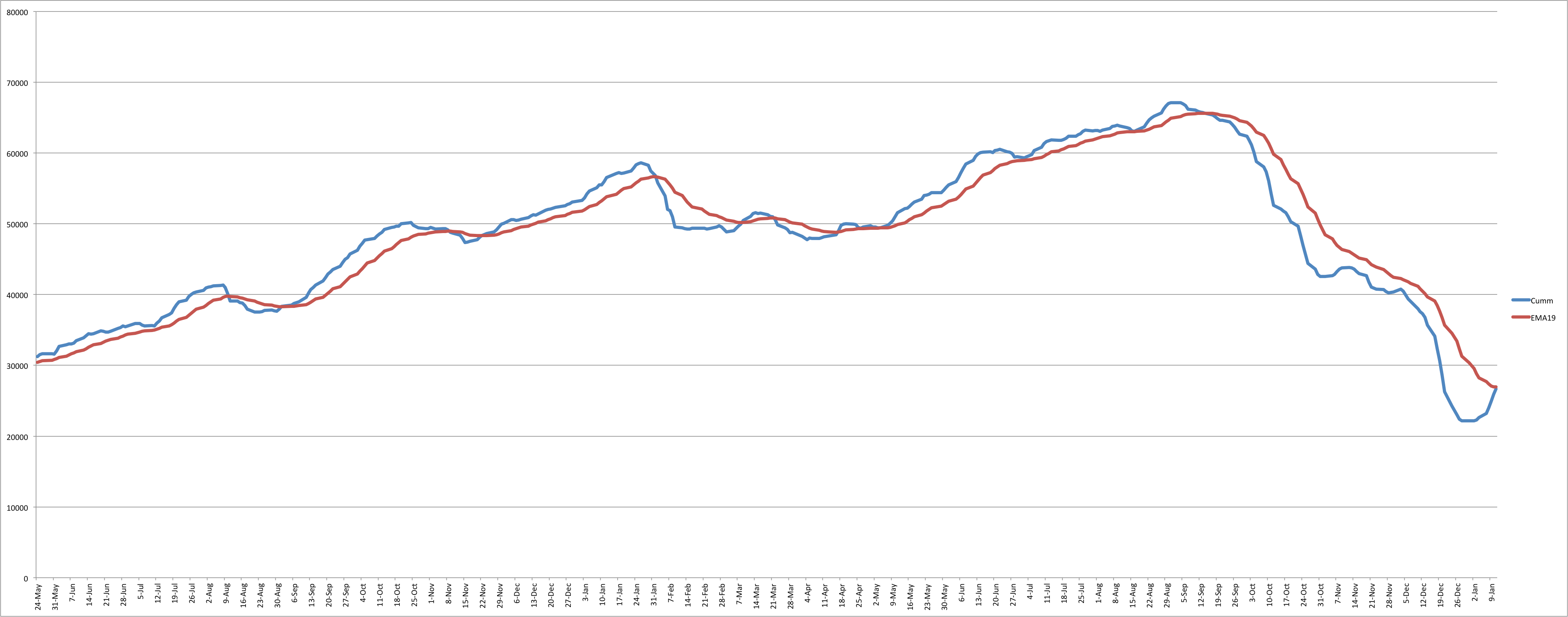

I have been posting the NYHL and the NYHL1M setup occasionally here as well and the NYHL1M is getting very close to a buy signal. The latest charts are posted below. Now, to be clear the original NYHL setup is nowhere near a buy - still a solid sell and will be a while before it can get to a buy. The NYHL1M setup which is a more sensitive version that I built is what is showing a possible buy very soon… likely early this week. On backtests both have been pretty good so I am inclined to take this trade. Even if it turns out to be a dud, I expect it will give a fairly quick and harmless exit. Recent example is the one in March where it gave a buy around the 7th and a sell/exit around the 22nd.. Was almost a breakeven exit. So even if this buy is wrong, it should get us out without too much of damage.

With the NYHL1M setup close to giving us a buy, it is tough for me to remain bearish here especially if we can break through 2600-2605 area decisively. Since it is a mechanical system, it makes sense to take the trade and then exit/go short if it goes to a sell later on.

ES Pivots - Daily pivot is at 2590. Resistance R1 is at 2603 and R2 is at 2611. Support S1 is at 2582 and S2 is at 2569. Gray zone areas - we are in resistance in this 2580-2600 area, second area is at 2613-17 and then at 2636-43. On the downside, we have support at 2563-59, then 2551-46 and below this at 2525-22.

All the best to your trading week ahead..