2 Preferred Stocks To Own For Your Retirement, Yields Up To 7%

In navigating today's volatile market conditions marked by rising interest rates and economic uncertainties, investors seek stability and reliable income streams. At High Dividend Investing, we recommend allocating at least 40% to fixed-income securities, including preferred stocks and baby bonds. These instruments offer fixed yields, ensuring consistent income with lower volatility than common stock. Preferred stocks, which combine stock and bond characteristics, often have higher current yields and showcase resilience during mild recessions, exemplified by their continued dividend payouts despite cuts or suspensions. This is why I am loading up on as many quality preferreds as I can while the sale lasts.

While these securities provide income stability, they aren't devoid of risks, with susceptibility to interest rate fluctuations and issuer-specific challenges. Diversification across assets and periodic evaluation are critical requirements for a healthy income stream. This article explores the appeal of preferred stocks and fixed-income securities within a dynamic investment landscape, emphasizing their role in constructing portfolios that weather market fluctuations and secure steady returns.

Preferred Securities Basics

- Dividends vs. Interest Payments: Preferred securities pay dividends, not interest. This dividend payment is not guaranteed and can be skipped by the issuer without triggering a default. Taxation on preferred dividends often resembles taxation on common stock dividends, and can be attractive in comparison with interest income.

- Attractive Coupon Structures: Preferred securities can have various rate structures including fixed, floating, or fixed-to-floating rate dividends. Floating rate structures offer less interest rate risk compared to fixed-rate securities.

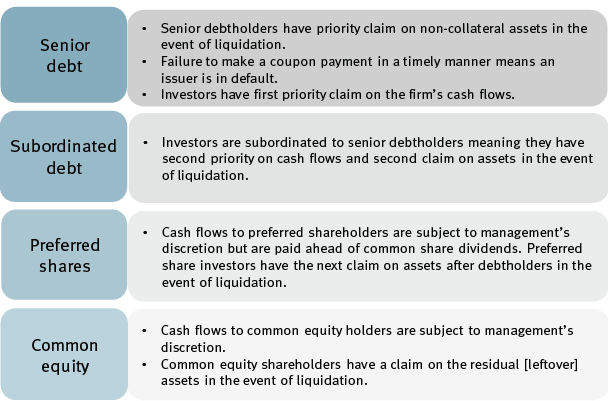

- Ranked Higher In The Capital Structure: Preferred securities rank higher than common equity but lower than senior debt. In case of an issuer's default, holders of preferred securities are paid after bondholders but before common stockholders. Cumulative preferred dividends must be paid before any dividends are distributed to common shareholders.

RBC

- Cumulative vs. Non-Cumulative: Companies in the financial sector often issue non-cumulative preferreds, where missed dividends are not accrued and not mandatory to make current before common stock dividends. This is often perceived as a psychological safety net for preferred shareholders. On the other hand, companies from other sectors typically issue cumulative preferreds, allowing missed dividends to accumulate and be paid in full when payments are resumed.

- Maturity Terms: Preferred securities can have terminal maturities where they are redeemed by the issuing company at a set date for par value. These tend to be less volatile and less sensitive to interest rate changes, especially if the maturity date is approaching in the near term. Conversely, perpetual preferreds have no fixed maturity date and can be called by the issuer after a specified call date, but the issuer is not mandated to redeem them. These perpetual preferreds are more sensitive to interest rate fluctuations and might change their dividend terms after the call date depending on the prospectus.

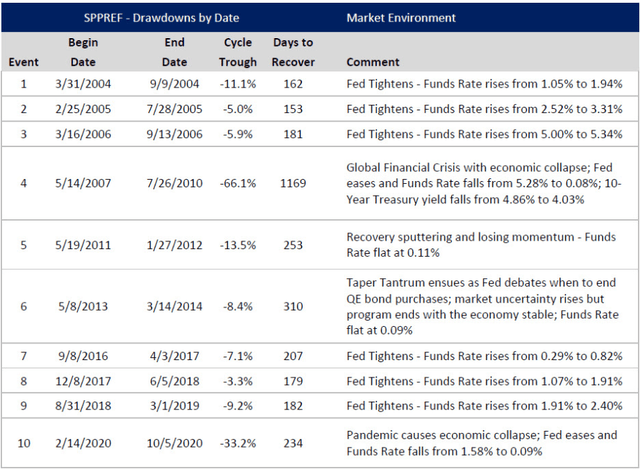

Price Volatility

Preferred securities display unique characteristics, being less tethered to daily market sentiment but sensitive to interest rate shifts. Their fixed dividends make them vulnerable to price drops during rate hikes, followed by recoveries when rates decrease as long as the issuer is in good standing. A review of the 20-year history of preferred stock performance tells us that the monetary policy effects on preferred stock prices are temporary, and only on the surface. We see volatility, but as an income investor, volatility is your friend. Source

Infracapfunds Website

Let us review an example. The iShares Preferred and Income Securities ETF (PFF) comprises 455 U.S. preferred securities. $10,000 invested in this diversified fund in 2008 is currently worth over $19,000. But in 2009, it saw a 54.4% decline in value before recovery. The fund’s resilience lies in consistent income, not in its price stability. PFF paid $14,227 in dividends (8.9% annual yield) over time, and we saw high priority for current income through market fluctuations. This is because several preferred issuers tend to make payments despite economic headwinds. So in 2009, having observed (or owning through) a 54.4% decline in principal value, would you be a buyer or a seller of PFF?

Opportunities Today

We can’t go back to 2009 to buy PFF, but thanks to the current restrictive monetary policy, there are many opportunities for investors. Interest rates won’t stay high forever, and we see preferreds at deep bargain prices and massive yield levels. These stocks provide high dividend yields and have a high likelihood of capital upside over time. Here are two picks to consider:

1. Huntington Bank Preferreds

Huntington Bancshares Inc. (HBAN) the 26th largest banking institution in the U.S., with a highly conservative investment portfolio, strong liquidity and capitalization levels. The bank maintains a growing common dividend at a modest payout ratio, and we like its deeply discounted preferreds:

- 4.50% Series H, Fixed-rate, Non-Cumulative Perpetual Preferred (HBANP)

- 5.70% Series I, Fixed-rate, Non-Cumulative Perpetual Preferred (HBANM)

- 6.875% Series J, Rate reset, Non-Cumulative Perpetual Preferred (HBANL)

HBANM offers a 7.2% current yield and up to 27% upside to par.

2. RPT Realty Preferred

As a result of generational sell-off in REITs, this sector is experiencing a massive consolidation, and we are seeing several M&A deals being announced every day. Grocery-anchored shopping center REIT Kimco (KIM) is acquiring RPT Realty (RPT), and RPT Realty’s 7.25% Series D Cumulative Convertible Perpetual Preferred Shares (RPT.PR.D) are being absorbed by the surviving company. This improves the income safety as KIM is a larger REIT with a better diversified portfolio and higher quality balance sheet.

KIM has two BBB- rated public preferreds that pay considerably lower yields in comparison. Placing RPT-D alongside them, we see an opportunity to lock in a healthy 7% yield to ride along for a modest capital upside towards yield parity..

Notable Risks/Issues With Preferred Securities

1. Capital upside is not reliable: Although we discuss many preferreds and say they yield x% and offer up to y% capital upside, the capital upside is not guaranteed. Their capital gains rely on fluctuating interest rates and issuer decisions around redemption.

2. Limited Growth Participation: If a company is prosperous, its common stock reflects the sentiment and can offer unlimited upside potential. Preferreds on the other hand don’t correlate closely with the growth potential of the issuer. They are primarily for income generation, and the better the market position of the issuer, the higher your income safety.

3. Low Liquidity: Most preferred securities are thinly traded, resulting in rapid changes to their stock prices. This can pose a challenge to investors (particularly those with a higher net worth) to build a meaningful position.

Conclusion

Amid rising interest rates, preferred securities offer high yields at deeply discounted price points. If individual securities are not your cup of tea, you could consider diversifying through funds like Virtus InfraCap U.S. Preferred Stock ETF (PFFA), Nuveen Preferred & Income Opportunities Fund (JPC), Cohen & Steers REIT & Preferred Income Fund (RNP), and Flaherty & Crumrine Dynamic Preferred and Income Fund (DFP).

At HDI, our preferred portfolio has +45 preferred securities from a wide range of industries, targeting a +9% overall yield. Many preferreds are trading for pennies on the dollar in today's markets, and the issuers are more than capable of maintaining preferred dividends regardless of the Fed’s near term rate policy decisions, even in the face of mild headwinds to the issuer’s operations from higher rates.