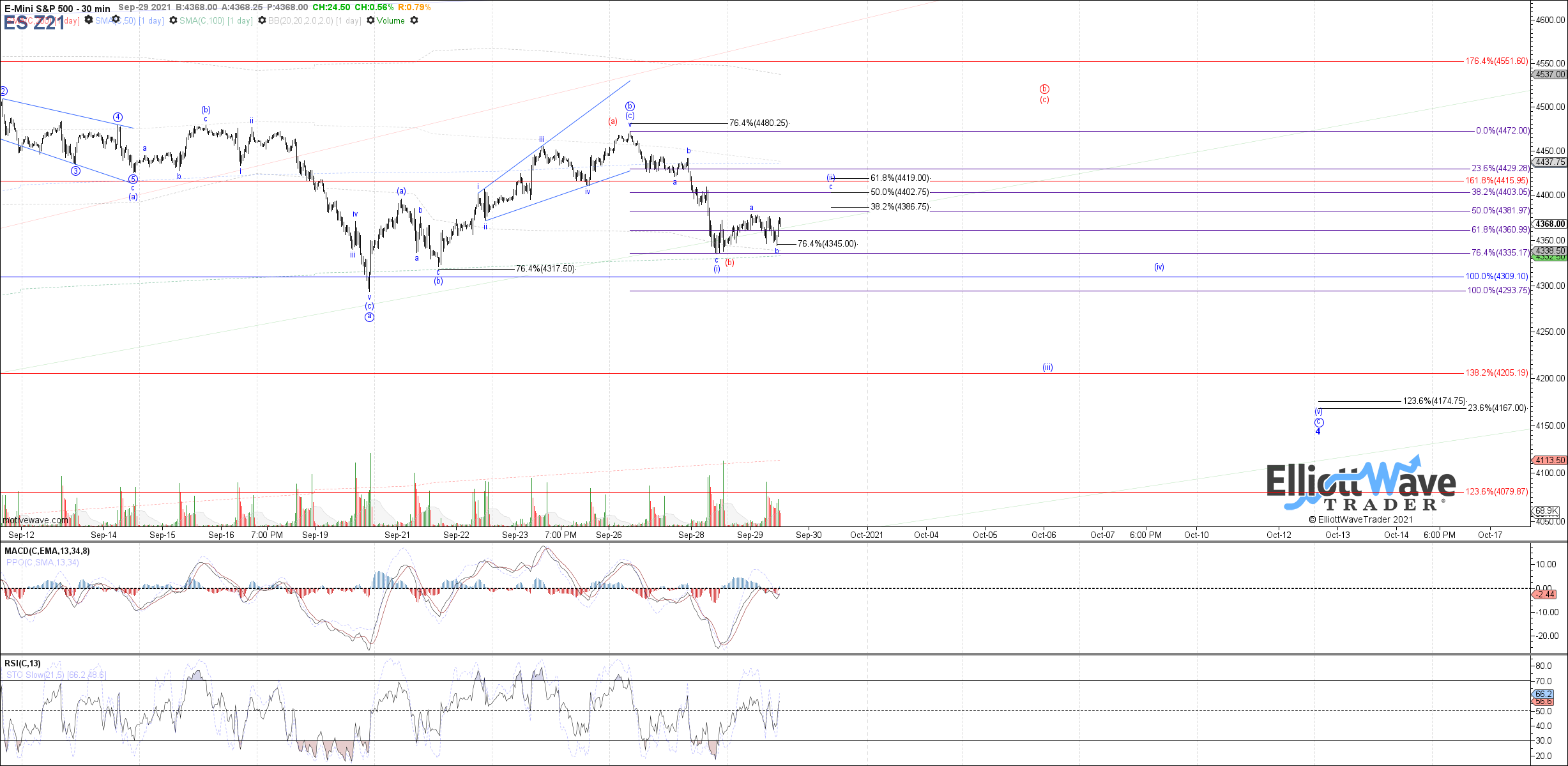

Working on wave (ii) of c

The market is attempting to close positive today, supportive of yesterday's low completing wave (i) of c within the blue count. Under that assumption, more near-term upside is expected as wave (ii) of c, with 4386.75 - 4419 still as the overall target range between the .382 - .618 retrace. Given the size of waves a and b within the start to wave (ii), it looks more likely that the upper end of that range between 4402.75 - 4419 will be reached before wave (ii) completes.

Regarding alternatives, back below today's low opens the door to price attempting more near-term downside in a larger wave (i) with ~4320 as the next possible support. Above 4419 would not invalidate the blue wave (ii) but would also open the door to the near-term bullish potential in red as a wider flat b-wave filling out that can revisit or slightly exceed Sunday's high.