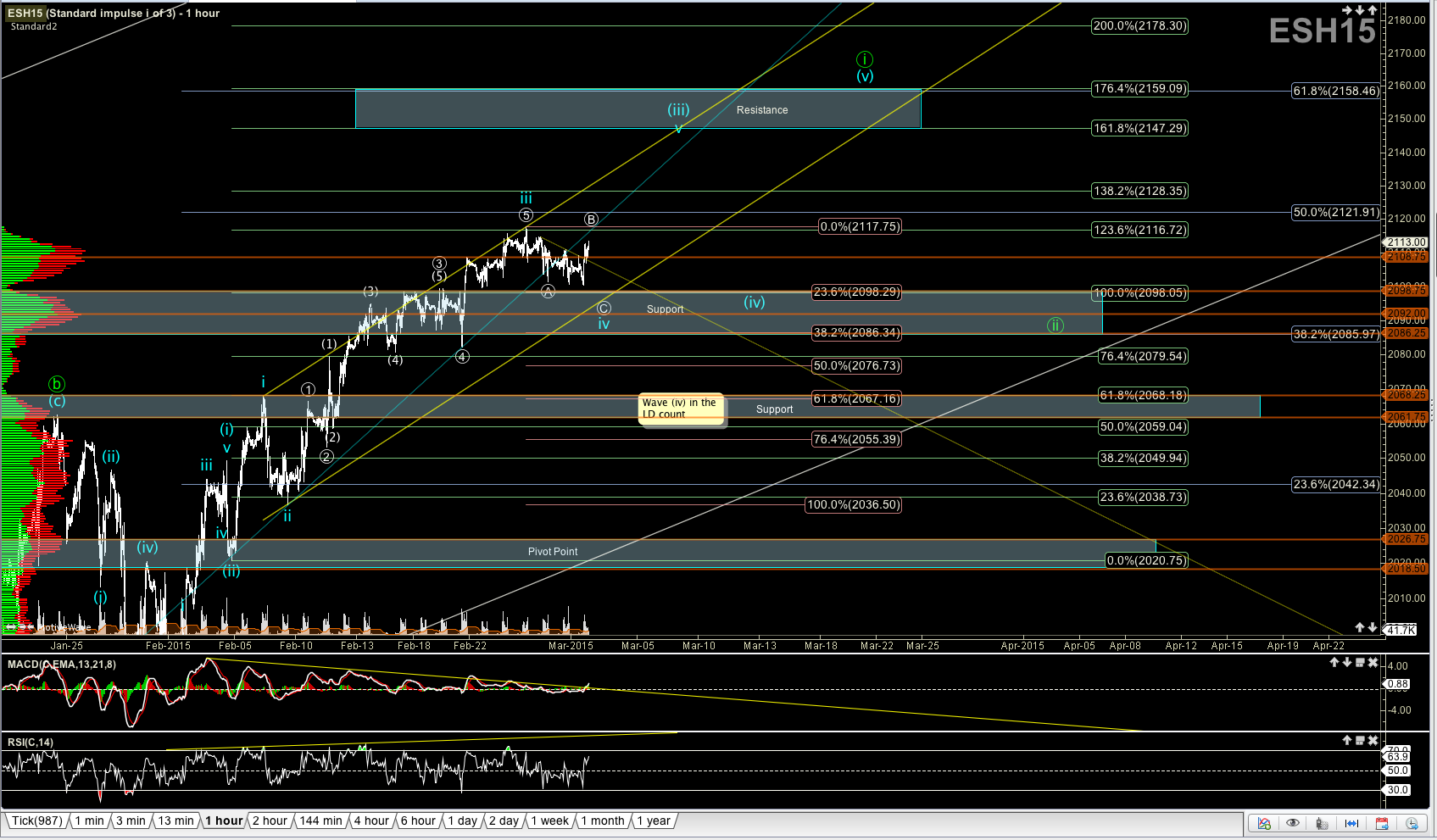

Wave iv potentially completed

With todays 5 wave move up from the LOD, and then 3 waves back down it seems likely that wave iv of (iii) is completed, and ES is moving up to 2128-2147 in v of (iii). On the smaller timeframes the standard projections are pointing to 2128 for wave v of (iii), however on the larger timeframe since iii of (iii) hit the 1.236 extension, v of (iii) should hit the 1.618 extension at 2147. From the 2128-2147 region ES should pull back toward 2100-2080 in wave (iv).

On the micro level ES should remain over 2105 now in v of (iii) and rally up to 2119.25 for iii of 3 on the micro level (3 min chart), then hold over 2114.50 at all times if its going to extend up to 2128. It looks like its possible (3) of 3 has started already, but if price breaks below 2108.75, but holds above 2105 its possible wave 2 is going to be an expanded flat.

Alternatively if price fails to break out over 2117.75 its always possible ES is still in wave iv of (iii) as a more complex wave iv (either a flat or a triangle) but as long as price holds over 2105 the immediate setup is for higher.

Support - 2105, 2100/2098, 2093/91, 2085, 2080 and 2068-2060.

Resistance - 2117.75, 2128, 2147, 2158