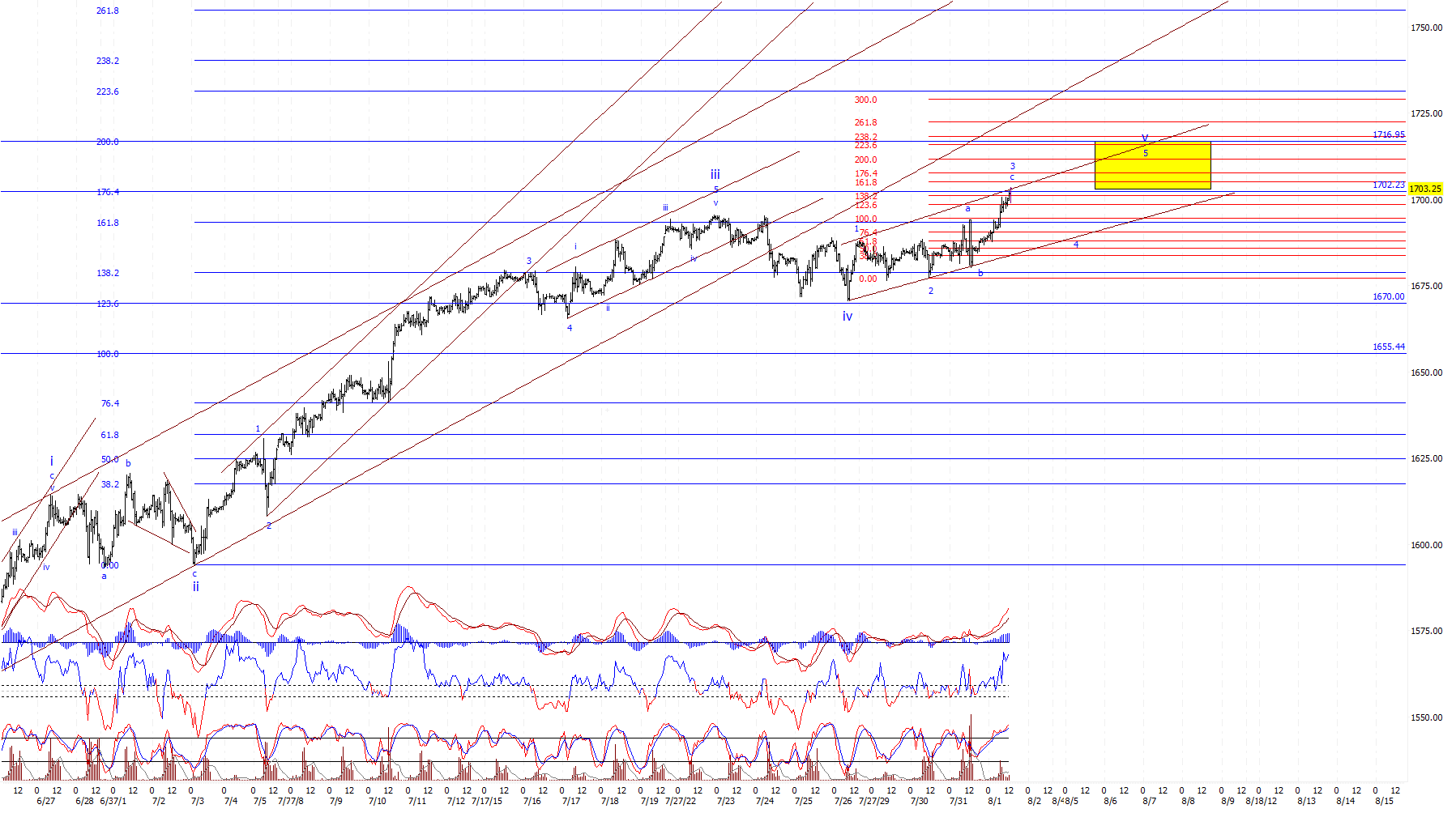

Wave 5 - Market Analysis for Aug 1st, 2013

While it is clear that we are in a 5th wave, the exact structure that it is forming is somewhat questionable. There are 2 viable options at this point: the ending diagonal, which has already been discussed, and a standard impulse, which relies on one of the ugliest wave 2s I have seen in awhile. The end result is just about the same, both seem to be reaching for the upper teens of 1700. The difference will be how deep wave iv within this 5th wave will come. Immediate support under the standard impulse count, as illustrated on the 15 min chart, is at 1698. Below that, the next fib is 1694. This is the region of support that needs to hold in order to maintain the standard impulse count. A break below there would confirm the ending diagonal, and could reach as far as the lower trend line of the trend channel. If support does hold, the next target above will be 1708.75, and would complete wave iii of this 5th wave.