The grind continues - Market Analysis for Jan 11th, 2018

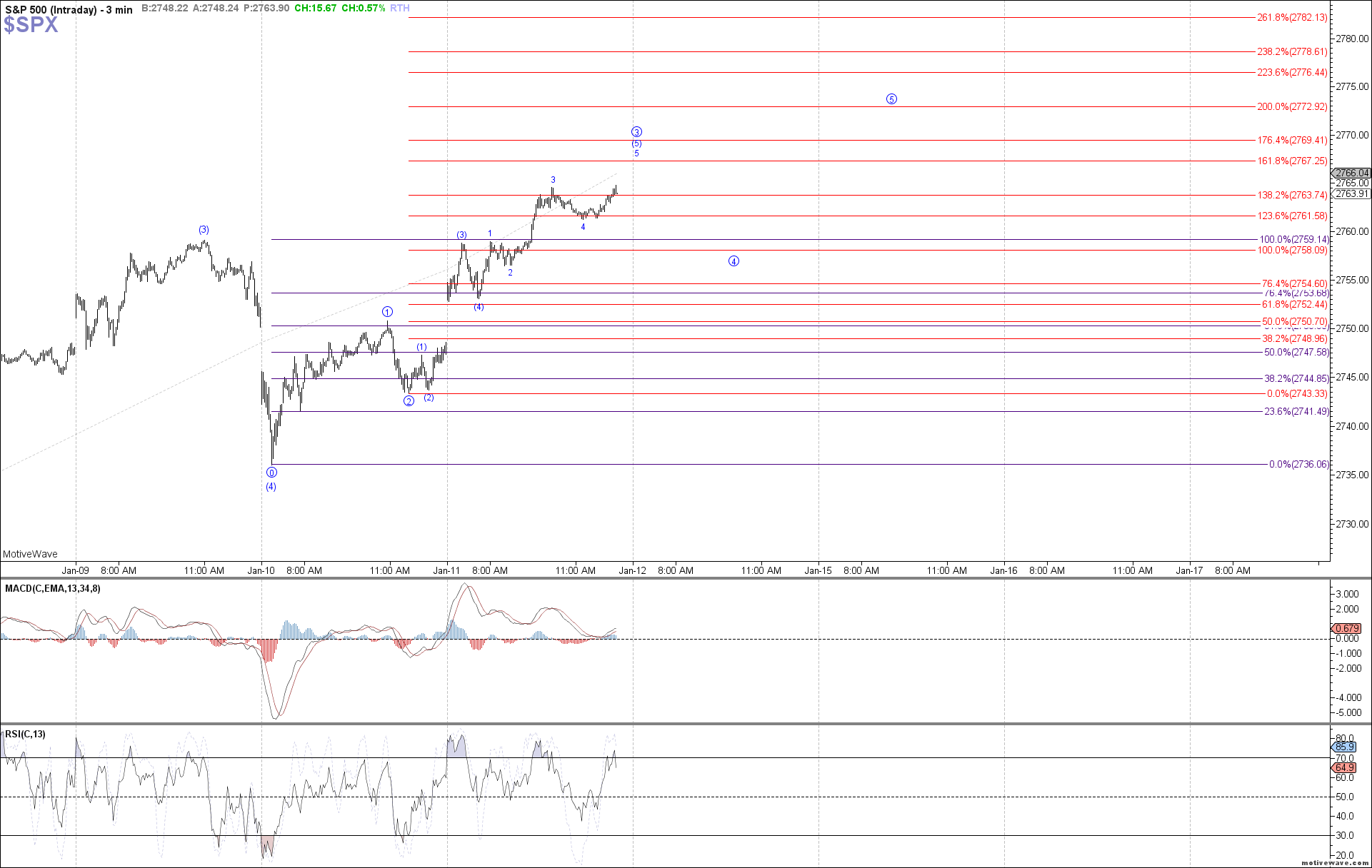

The market continued up today, taking yet another opportunity to extend higher and breaking out to new high. A move back below Wednesday's low at 2736 SPX will now be needed before assuming any meaningful downside at this time. Otherwise, the move up off that low looks incomplete so far, still needing at least another 4th and 5th wave before completing.

Today's move should have fulfilled the majority of wave 3 in this most recent impulse, with one more push toward 2767.25 SPX possible before turning back down in wave 4. Once the 4th wave consolidation does begin, 2758 - 2755 SPX will be the support region below to watch, which if holds will setup another move higher as wave 5 into ~2773 before the next potential top.

Below 2755 SPX would be a warning sign that the structure may be morphing into an ending diagonal instead of a standard impulse (which is how ES counts best). Either way, we still have no larger implications of a top yet and therefore no setup to short.