Tentatively looking higher - Market Analysis for Mar 5th, 2015

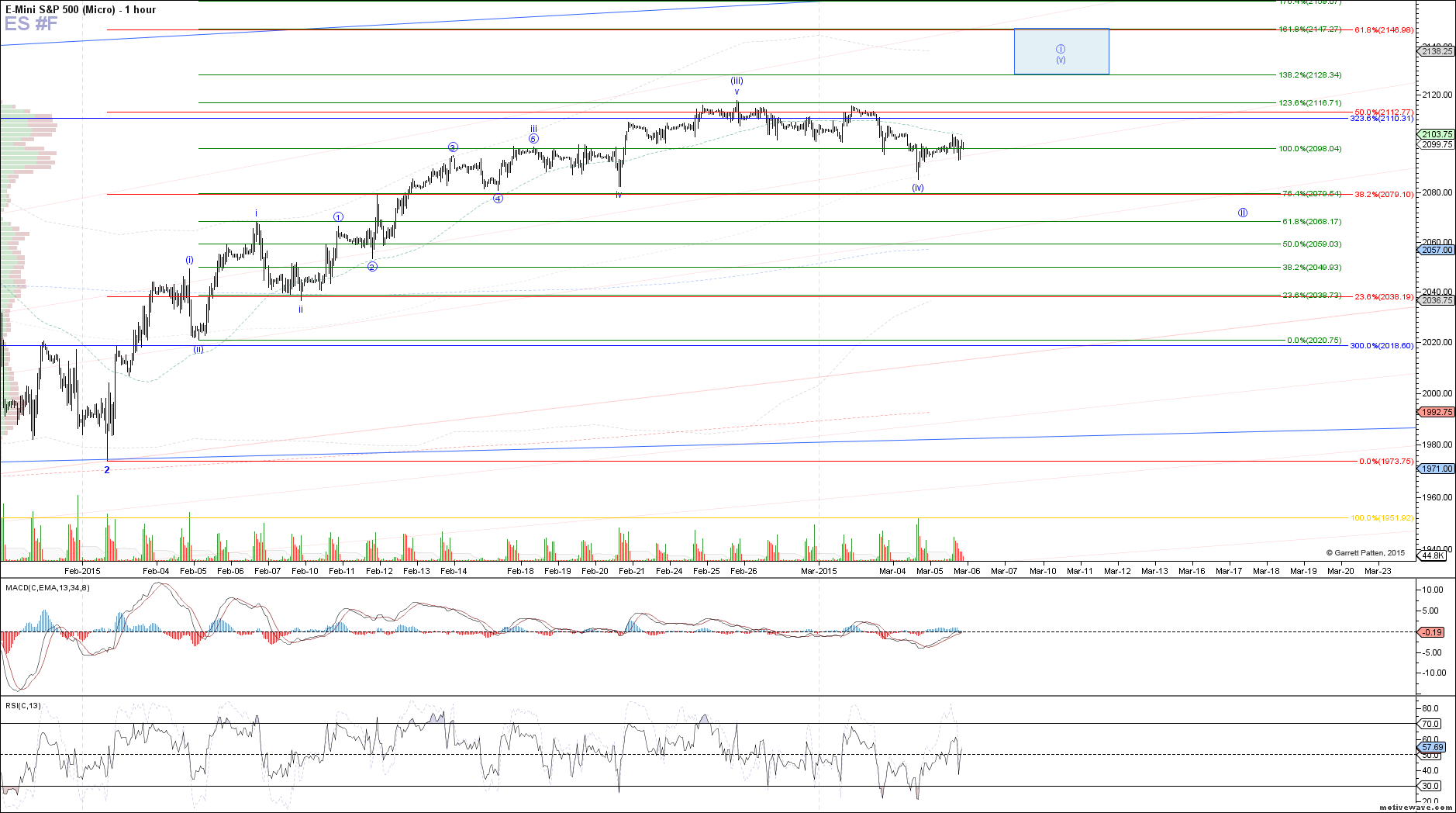

The ES stayed mostly range bound today, seeking out a new high pre-market after the impulse up off of yesterday's low, but then retracing in a corrective fashion after the open. As long as price is above 2092.50, my expectation will be that we have started wave (v) of i in Avi's count, targeting 2128 - 2147 from here. Below 2092.50 and probabilities increase that we will see a new low below the one made yesterday, with 2079.50 as the next support below for an alt wave (iv) in red.

The subwave structure off yesterday's low is not entirely clear yet, since it can be interpreted as the start of some sort of diagonal, or as a wave i with an expanded combo wave ii. Therefore, focusing on support and resistance in this region will yield the best results. 2108 - 2010 is the next minor resistance above which if cleared should further confirm that wave (v) towards the blue target box above is underway.