Range bound day - Market Analysis for Sep 23rd, 2015

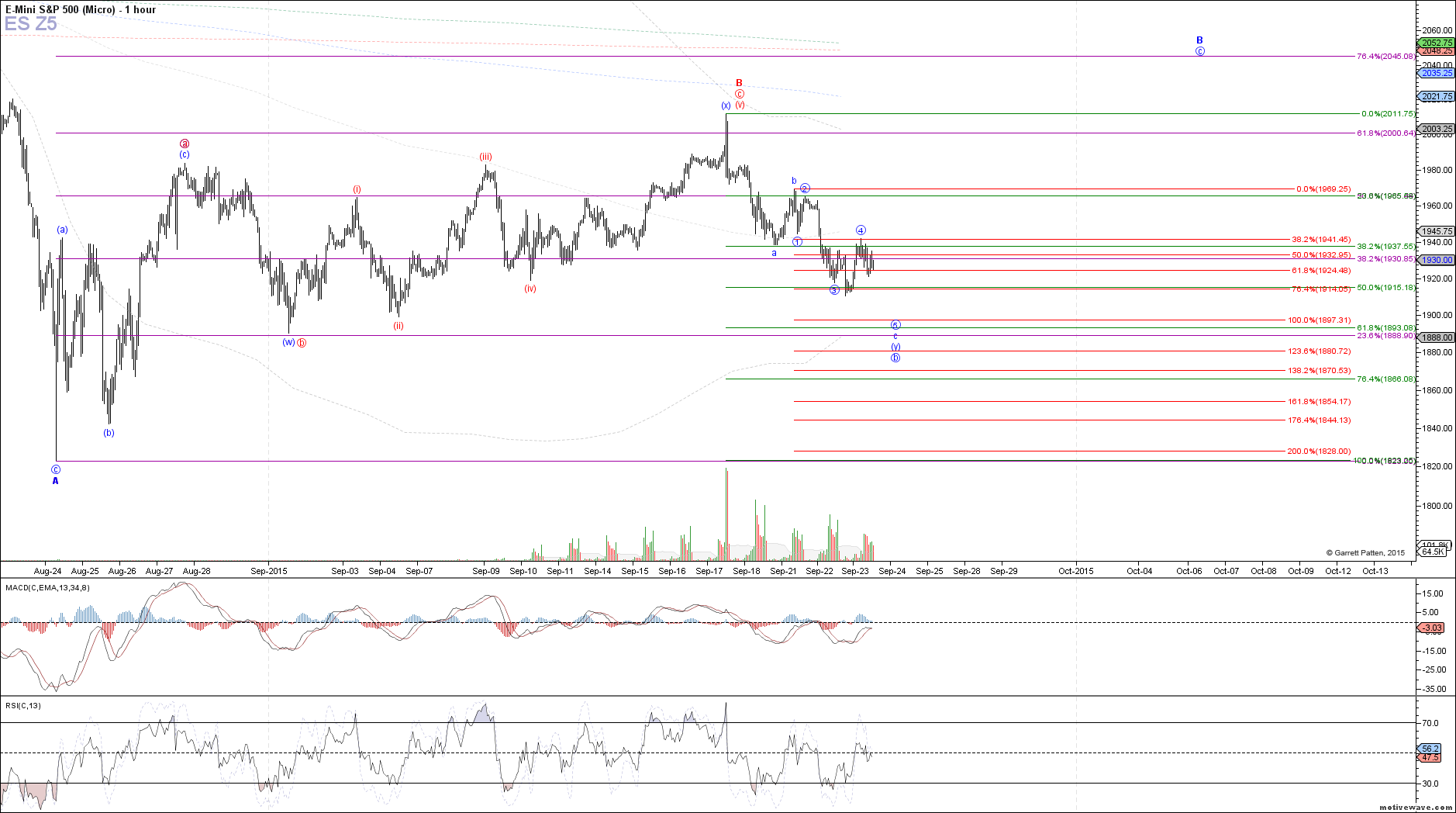

Today's market moves were relatively tame compared to recent volatility, leaving us with the same potential counts that we addressed this morning. At the moment, I am leaning toward one more low needed in this c-wave down off Monday's high, targeting roughly 1900 ES. However, price needs to break below the noon low today at 1920.75 ES in order place probabilities firmly in favor of that path. Until then, it is still possible that the c-wave down off Monday's high bottomed already on the spike down last night.

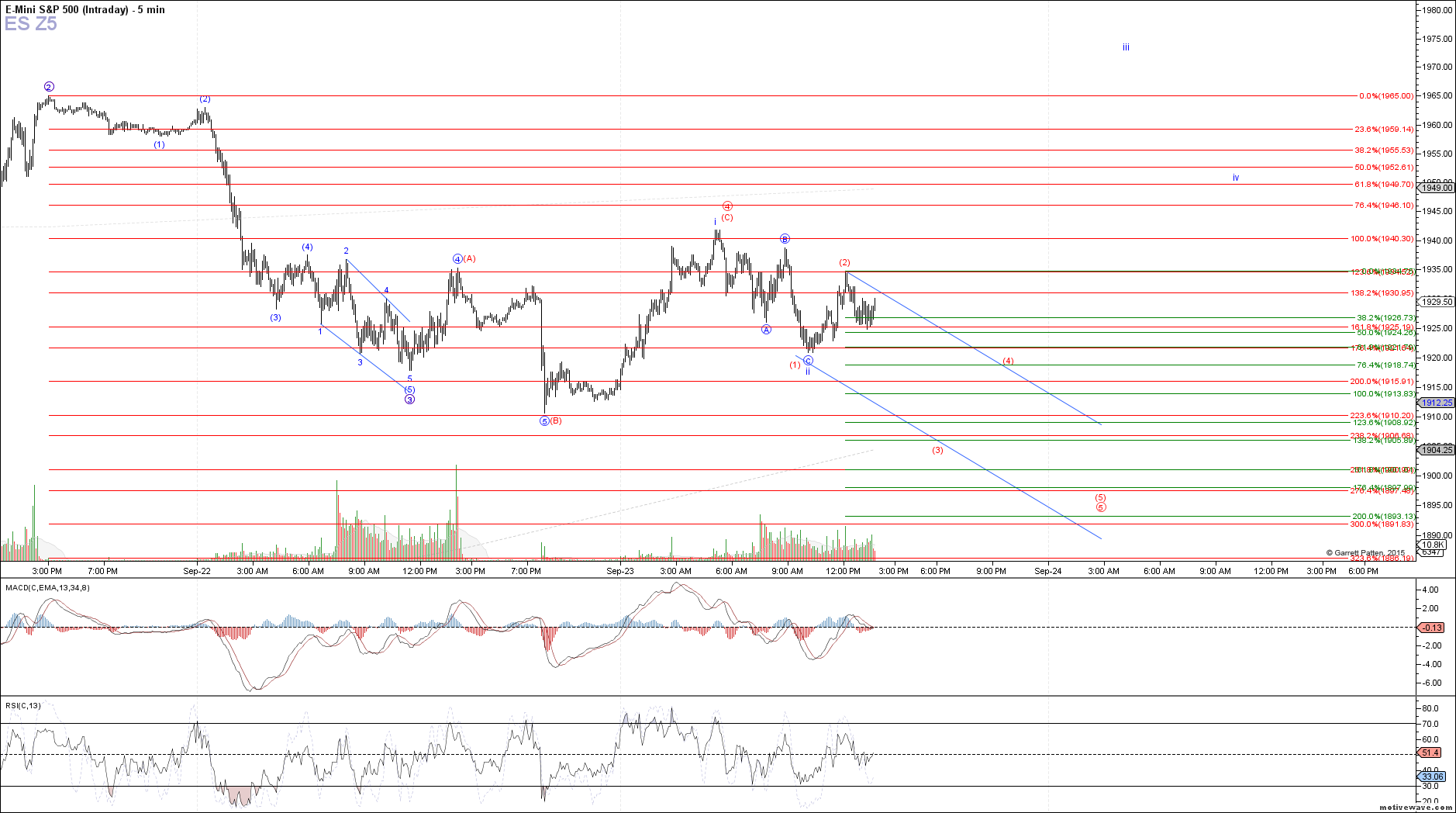

The attached 5 minute chart shows a more detailed view of these potential counts, with the red labels leading to 1900 ES and the blue labels suggesting a bottom already in place. Wave 5 in the red count would likely be as an ending diagonal, with price currently in (3) of the ending diagonal with an ideal target of 1909 - 1906 ES before bouncing in wave (4). As noted, price needs to take out the noon low at 1920.75 ES to place probabilities firmly in favor of that path. If we instead see a rally back above the 2 pm high at 1934.75, it would make the red count much less likely, and start to suggest that price is heading immediately higher in the blue count.