One more low still likely

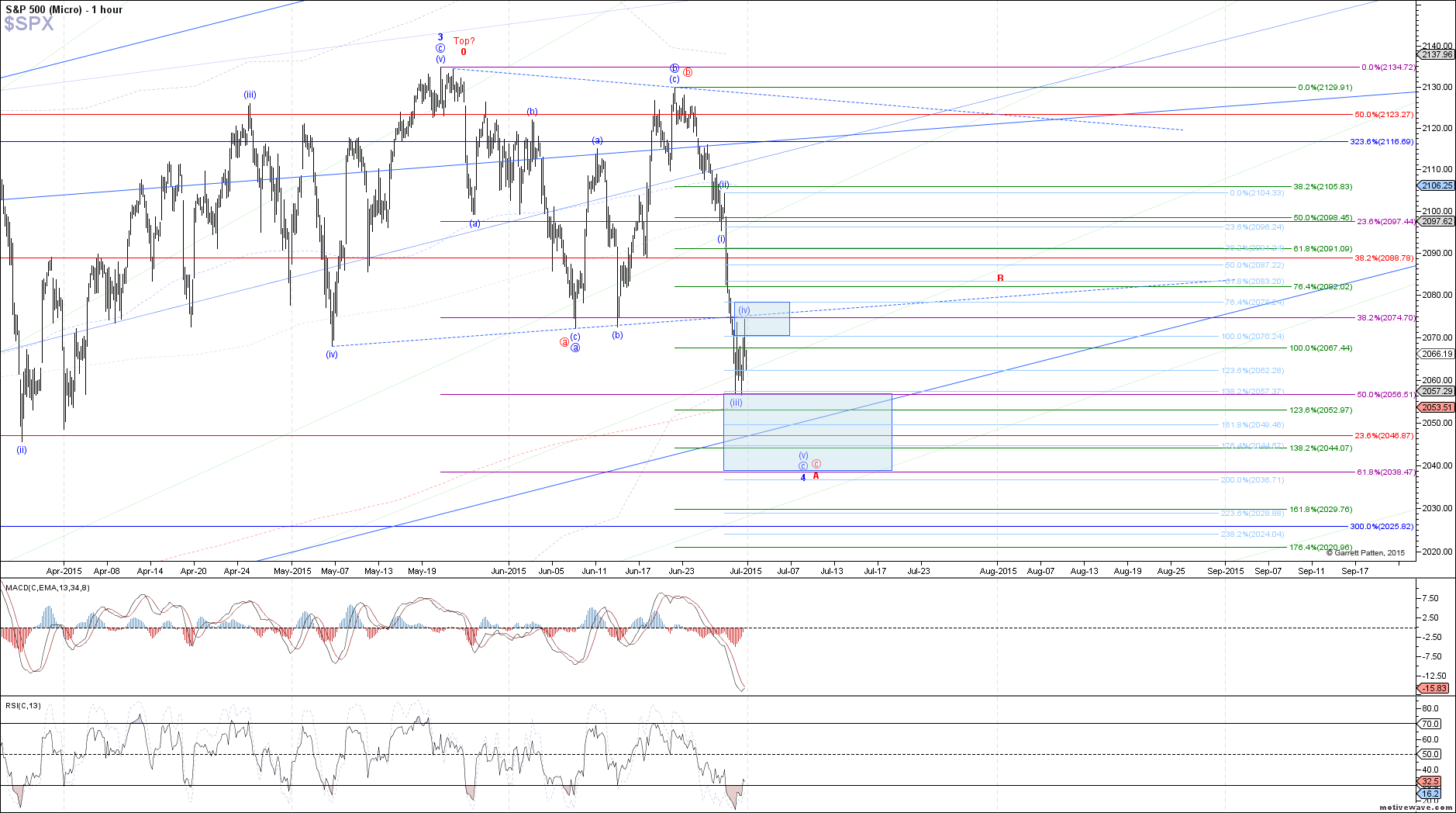

The market obliged with a corrective bounce today as hoped, filling out a very nice abc flat structure for wave (iv) in the c-wave off last week's high. In addition to staying below resistance for that wave (iv), probabilities are still supportive of one more low in this decline as wave (v) of c, with an ideal target of roughly 2044 SPX. At this point, it would take a sustained break above 2080 SPX for me to think something more immediately bullish is playing out.

Assuming price follows this path, we should see another 5 wave structure down off today's high into that target to complete wave (v), setting up a larger bounce next week and into early July. Both the potential counts, the blue allowing for one more swing high this year in primary wave 3, and the red with a top already in place for primary wave 3, remain valid. The difference between the two will depend on the nature of this next larger bounce after wave (v) completes.

If the bounce is clearly corrective, staying below retrace resistance (namely the .618 retrace of the decline off the May high), then the red count will have the upper hand, setting up another nasty drop into August that can take us back near the February low. Otherwise, if the bounce shows strength and possibly an impulsive structure, taking out retrace resistance, it would signal that there is still a shot at a new swing high this year in blue wave 5.