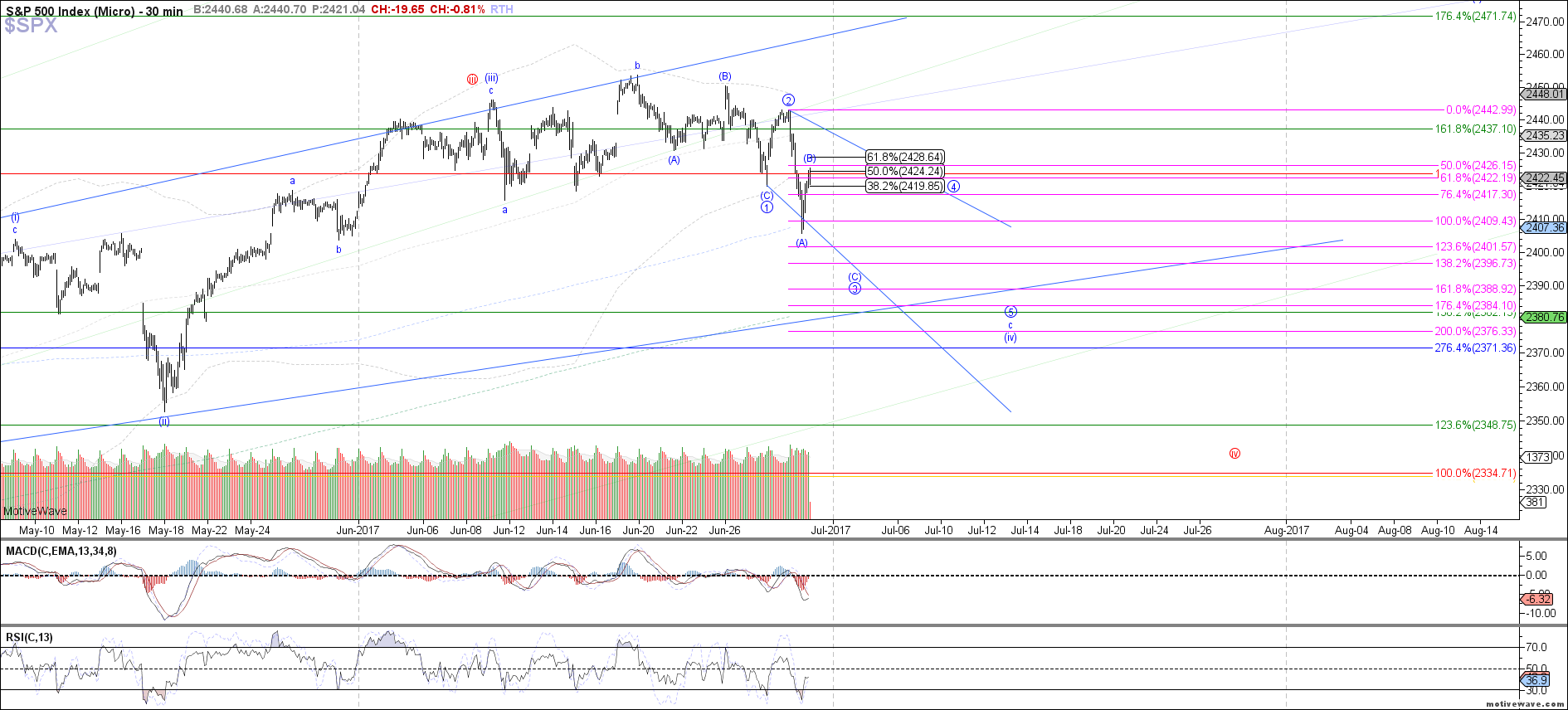

More downside can still be seen

The market dipped lower today, breaking support that should have held for wave iv of (iii) in the previous red count. Therefore, I believe that we have a setup for more near-term downside as price fills out the c-wave of (iv) under the blue count. Under that count, I would prefer that today's low completed wave (B) of circle 3, and we'll see another drop from here toward ~2397 SPX as wave (C) of circle 3 before bouncing again in circle 4.

However, as Zac presented in the trading room today, there is an alternative way of counting the blue ending diagonal c-wave, where today's low completed all of circle 3, and price is already bouncing in the circle 4. Under that scenario, it would allow for a little higher near-term into ~2435 SPX instead, but would otherwise stay below yesterday's high and still see one more low as the circle wave 5 before completing the blue c-wave and putting in another bottom.