Market Indecisive Today - Market Analysis for Apr 16th, 2020

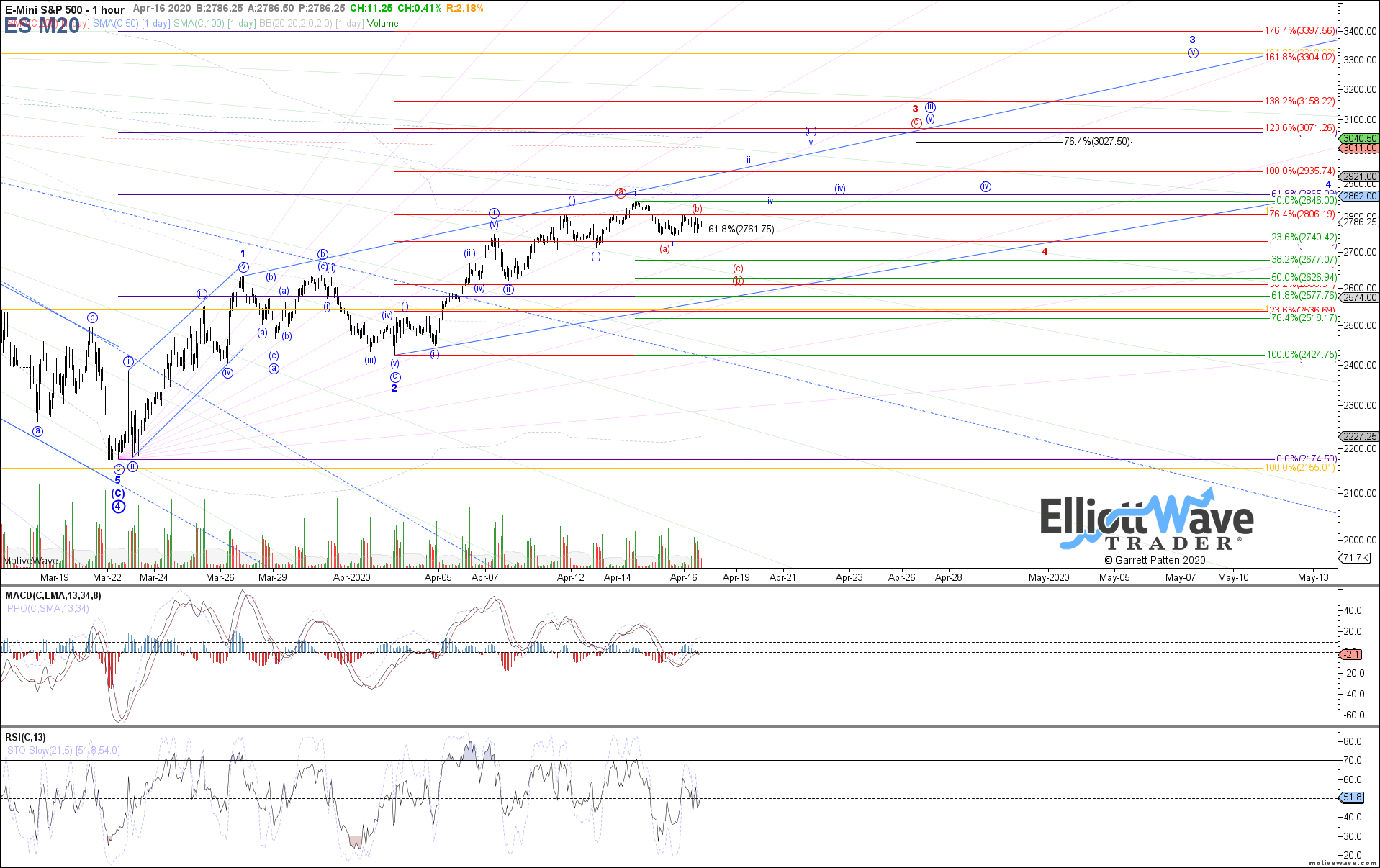

The market traded in a tight range today, overall maintaining within the prior trading day's range. Therefore, it has not made a decisive decision yet between the impulsive blue count or the red leading diagonal count off the March low.

However, the red path does seem to have the advantage at the moment, but until price takes out the overnight low at 2746 and more importantly Monday's low at 2711 the blue path still technically has a fighting chance. It is even possible that we chop around in this range longer as red wave (b) of b before rolling over.

Otherwise, a break back above the .618 retrace at 2808 is needed in order to strongly consider the blue count making a comeback and attempting a direct breakout toward a new high on the month from here.

If downside follow through in the red path is seen, then 2677 remains the ideal minimum target to reach before completing wave (c) of b, but I will initially be watching for the measured move target relative to the size of wave (a) based on where wave (b) completes.

Overall, I maintain my larger degree bullish outlook with a bottom in place at the March low, with the two paths simply being a variation of how we fill out 5 waves up from that low.