Local top confirmed - Market Analysis for Jan 16th, 2018

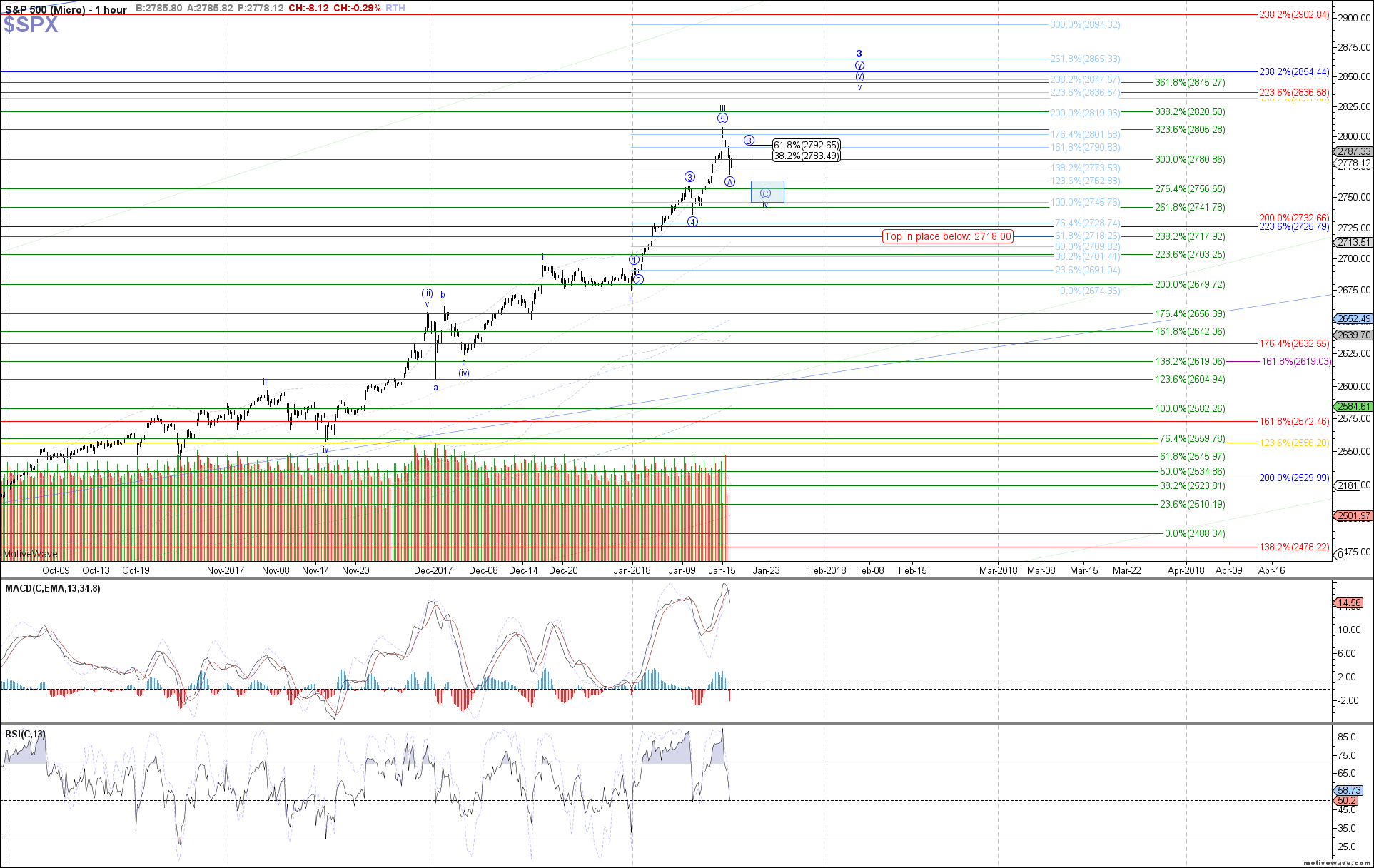

The market cooperated with expectations today by reversing shortly after the open, completing a 5th wave in the impulsive structure off last Wednesday's low. Zooming out, that impulse off Wednesday's low ideally counts as wave 5 of iii, with price now correcting in a higher degree 4th wave.

Under that assumption, today's decline should have completed the A-wave of iv, with price now starting a corrective bounce as wave B of iv. 2783.50 - 2793 SPX is the target resistance above if so, which should hold and turn price back down toward 2763 - 2746 SPX as wave C of iv next.

Otherwise, price would have to break impulsively back above 2793 SPX in order for me to assume that it is heading directly toward a new high as wave v of (v) already. Alternatively, a break below 2718 SPX is needed to confirm a larger top in place as all of minor degree wave 3, instead of needing one more high.