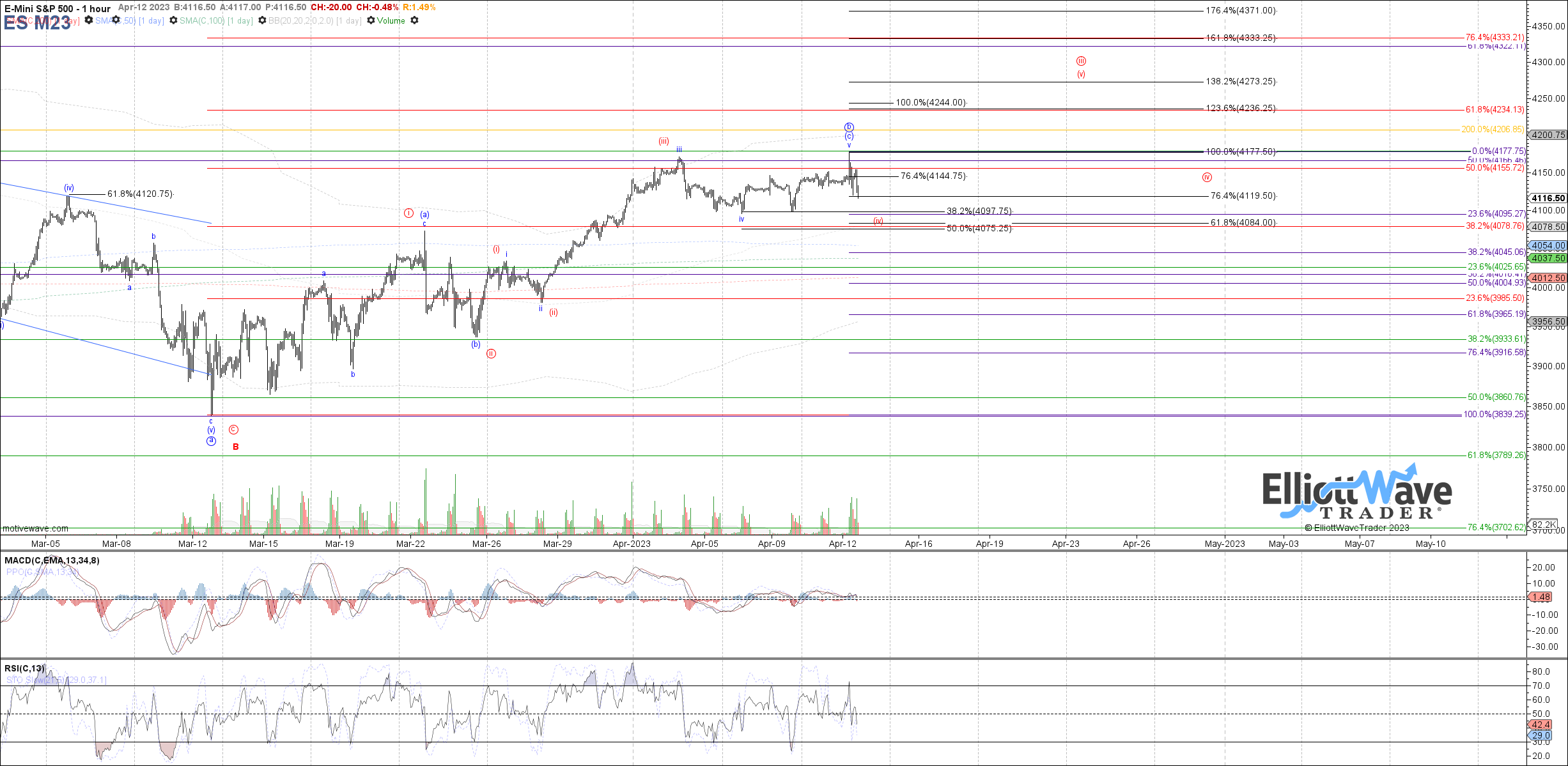

Likely heading back to retest last week's low

After the initial spike higher pre-market off the CPI print, price quickly rolled back over into the RTH open and continued down to briefly undercut the .618 retrace that was cited as support for a 4th wave during the pre-market video. However, price managed to recover back above that support going into the afternoon session, rallying from there until the FED minutes was released at 2 PM. That catalyst sent price back down again, ultimately leading to a poke back below the morning low and therefore making the expectation for any immediate trip back to new highs from here much more questionable.

The break of the morning low has instead opened the door to a top in place to the potential abc structure off the March low shown in blue, which would suggest at least a corrective pullback to take price to standard retracement support of the rally off the March low between 4045 - 3965 if correct.

However, there remains the possibility of the more immediately bullish option of an impulse off the March low shown in red, just forcing a wider corrective flat for the wave (iv) of iii that can retest the fib support range between 4098 - 4075 before attempting to turn back up again. Therefore, a break below 4075 is ultimately needed to confirm that the abc up in blue has topped, and price is going to head back down to at least test retrace support between 4045 - 3965.