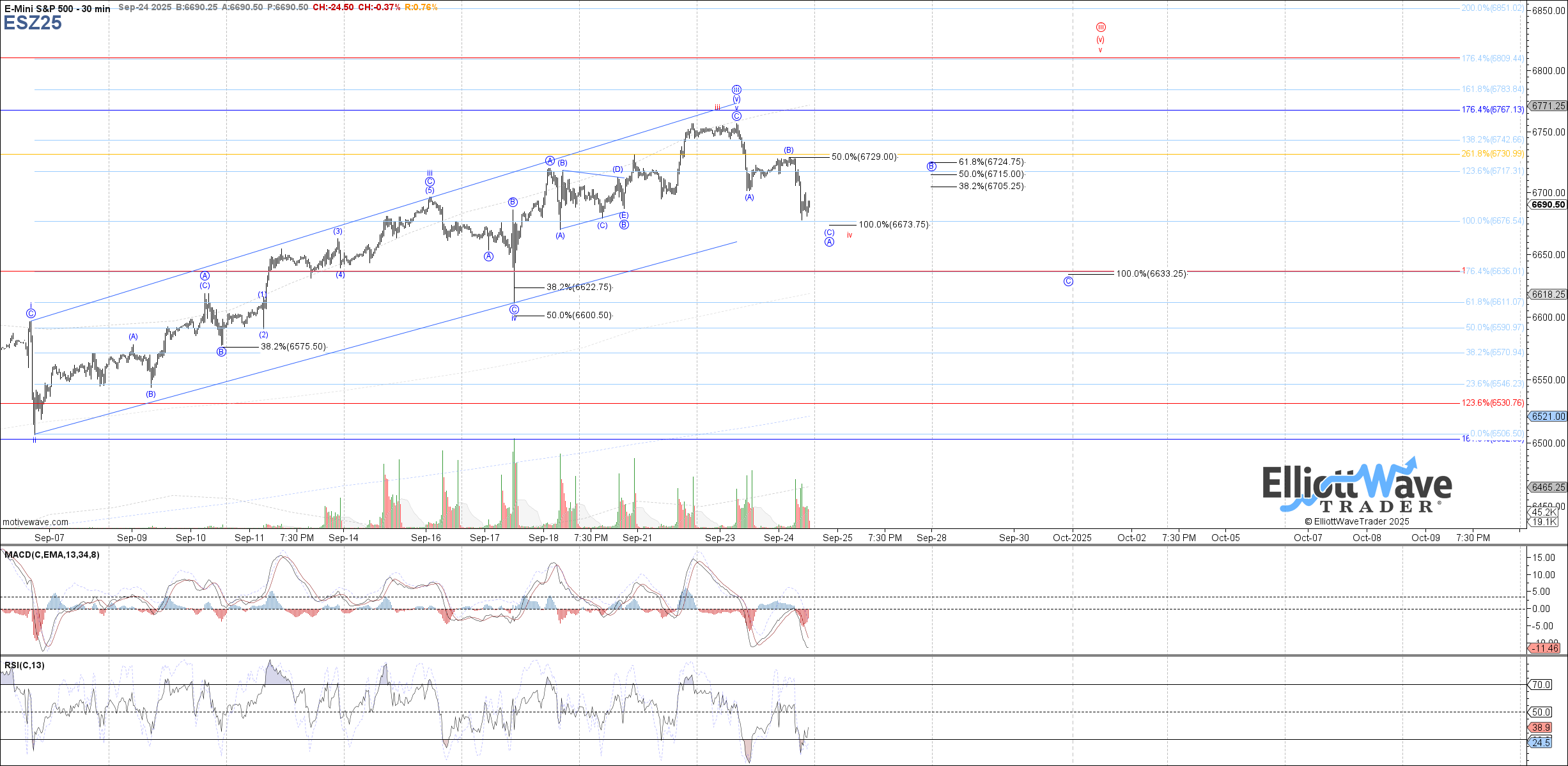

First downside target achieved

The market continued lower today, breaking below yesterday afternoon's low and coming close to reaching a measured move fib as the first target. When initial support broke yesterday, that was our clue that more downside could be seen today and to treat the bounce off of yesterday's low into the pre-market high this morning as corrective until proven otherwise.

By following expectations for at least another measured move lower (one more low is still ideal to actually hit the measured move fib at 6673.75), enough downside has been achieved to satisfy either a larger degree a-wave in the blue count, or a completed corrective pullback as the more bullish option in red.

Therefore, the nature of the next bounce will determine between those two potentials, but I will be giving benefit of doubt to the blue count unless the market suggests otherwise. The next bounce would have to produce either a clear 5 waves up from the low or exceed the .618 retrace to begin adopting the bullish red count.