FOMO Flipped to "Oh No!"

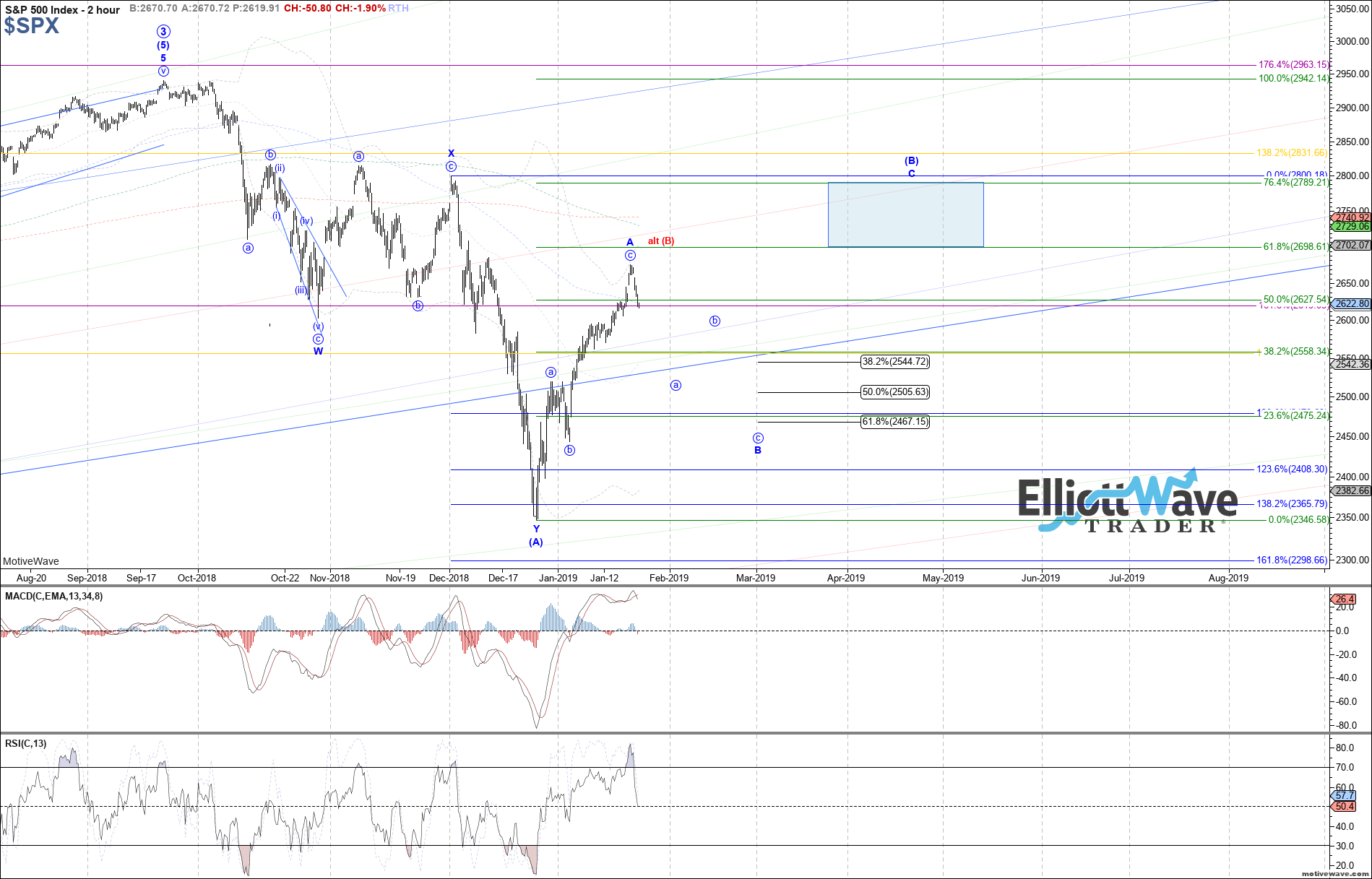

The market reversed strongly today, finally suggesting that a local top has been struck as blue wave A of (B) off the December low. If so, then price would now be correcting in wave B of (B), with an ideal target all the way back down at the .618 retrace of wave A, which is 2467 on the S&P 500.

In order to provide more confirmation that a near-term trend change has been established, and price is pulling back in the expected blue wave B of (B), a break below 2606 is required next. After that, we can more comfortably assume that at least the .382 retrace of wave A at 2545 will be reached before attempting to turn back up again. However, with the ideal target being the .618 retrace at 2467, then hopefully that would just be wave a of B.

Otherwise, if price fails to break below signal support from here, and instead makes a strong recovery, the .618 retrace at 2700 remains the next major resistance above.