Eyes on the Prize

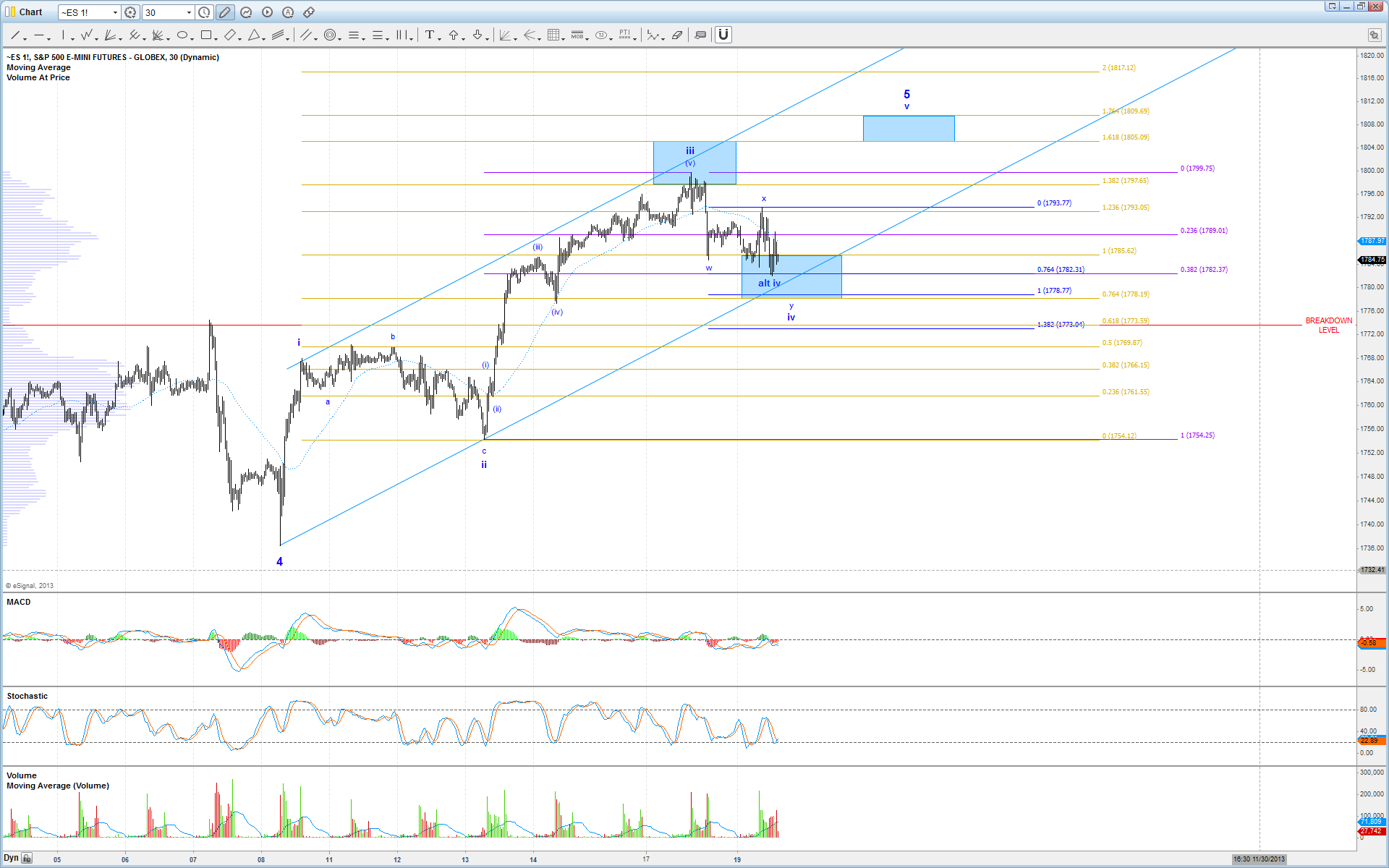

Today's price action in ES filled out more of our expected wave iv of 5. The low of the day was made right at the .764 extension of the a-wave and the .382 retrace of wave iii of 5. Based on this fib significance, the potential for the bottom of wave iv of 5 already in place exists, even though price did not quite reach our ideal 1778 target. However, because that low was made in what can only reasonably counted as 3 waves, this potential is not highly reliable.

Therefore, do not be surprised to see another trip back down after hours tonight or early tomorrow morning in order for price to tag the 1778 target in a more complex WXY pattern in order to complete wave iv of 5. Assuming that support holds, that low should still lead to a wave v of 5 back to new highs which would complete the overall pattern off the October low. Again, the sweet spot for that high is between 1804 - 1810, however anywhere in the 1801 - 1824 range is acceptable.

If our ideal scenario plays out and a new high in wave v of 5 is seen into the target area, aggressive traders can look for a short entry that should result in a move back to at least the low 1700's. More conservative traders should wait for an initial 5 waves down off the high, and then short the corrective retrace.