Corrective bounce - Market Analysis for Aug 3rd, 2016

The market traded modestly higher today, following the suggested setup from the alert sent out this morning for a bounce.

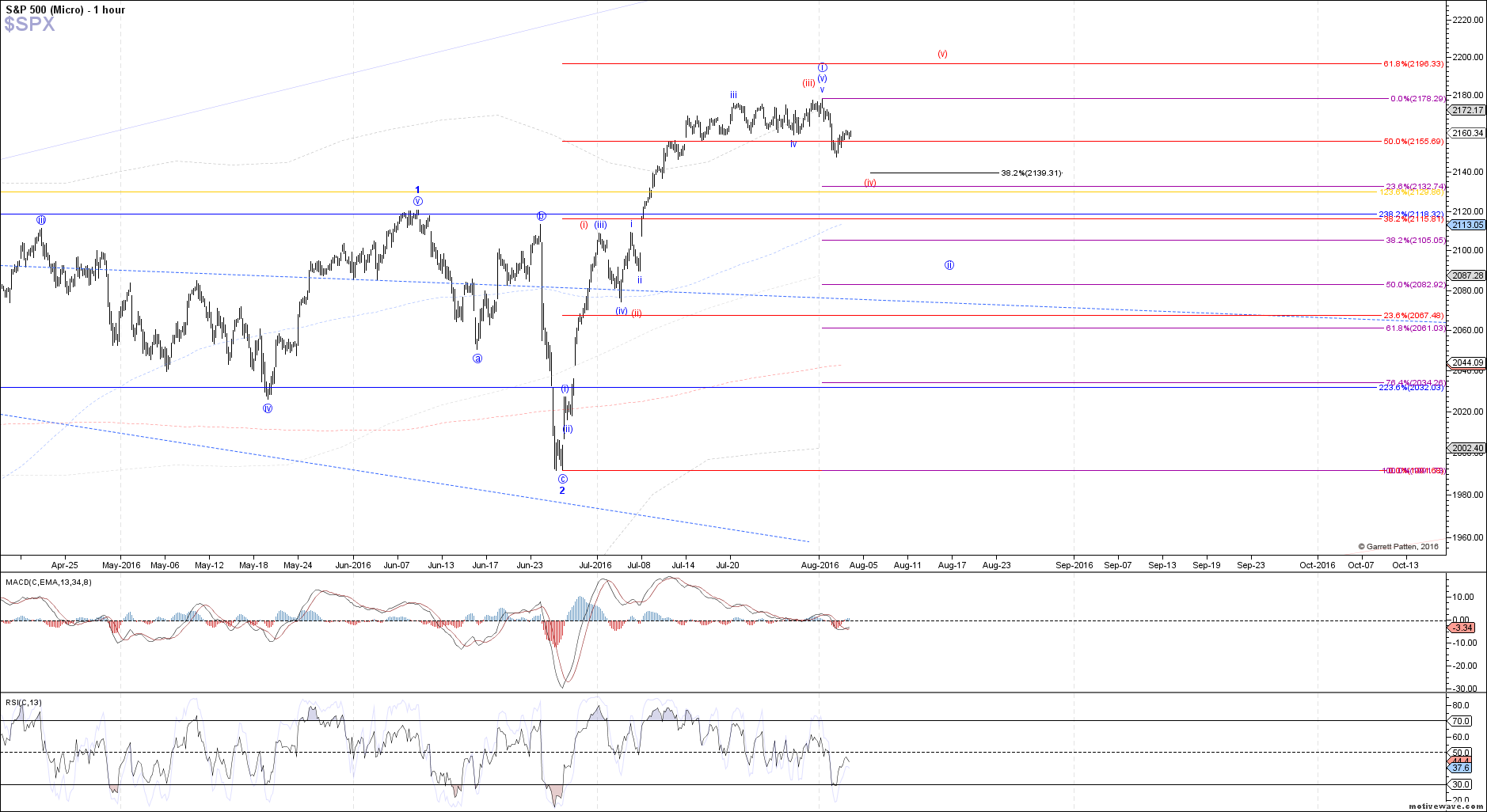

So far this bounce has showed us signs of being corrective, so unless it morphs into something impulsive looking or breaks above the .618 retrace at 2166.50 SPX, it will likely be followed by another leg down in either red wave (iv) or the start of blue wave ii. Assuming we do see another move lower, 2139 SPX remains ideal support for the red count, below which we can start to assume that price is in the larger blue wave ii already targeting 2105 - 2061 SPX.

Near-term we can still see a little bit higher into the 2163 - 2166 SPX resistance cited this morning though, but a break below today's low at 2152.50 SPX should confirm another local top in place.