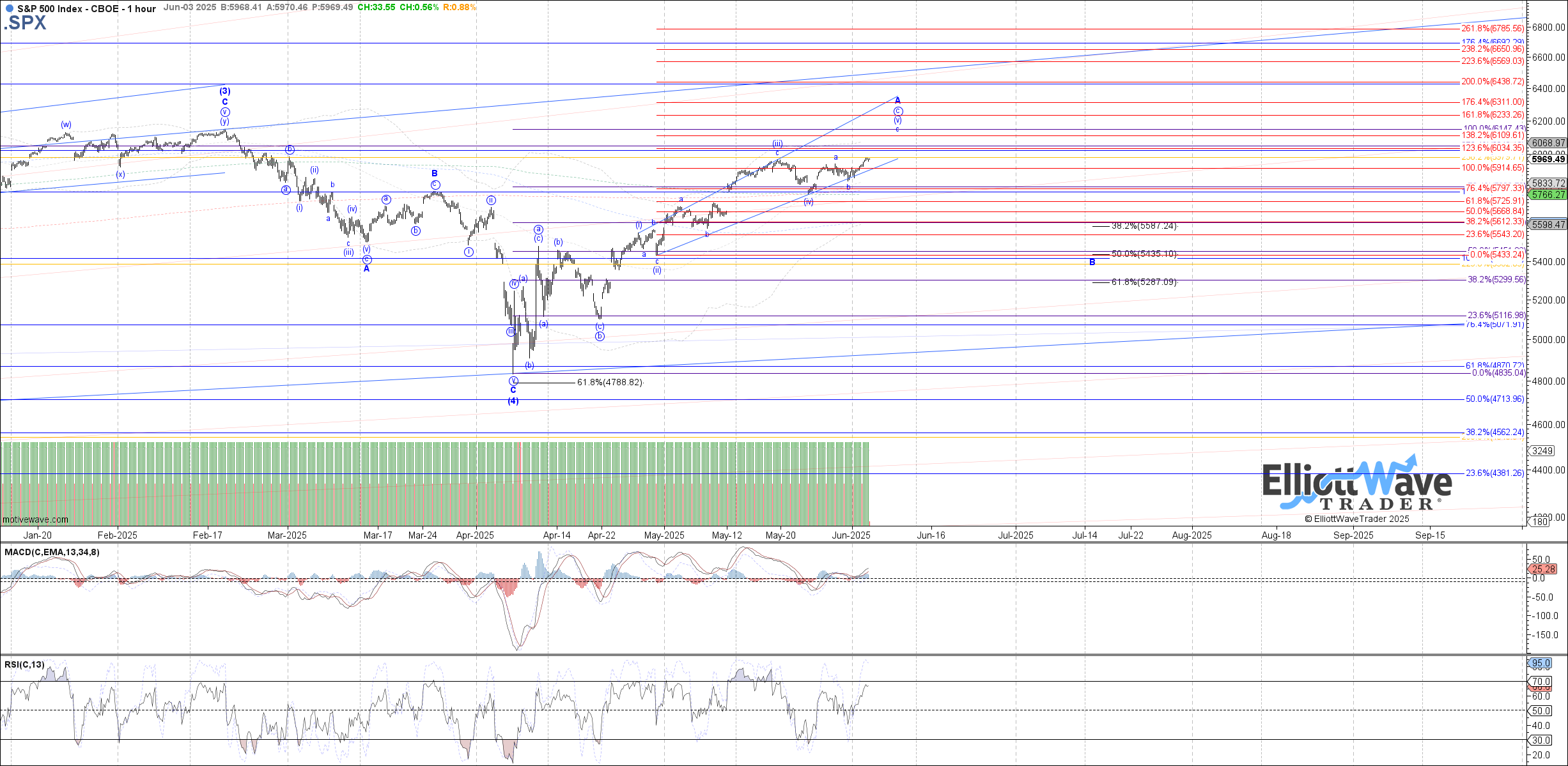

Continuation of the bullish path

Futures drifted lower following yesterday's close, pulling back from the 5948.50 - 5971.25 ES fib resistance cited in yesterday's EOD update. However, price found support at the overnight low where it should have as wave (4) of a potential leading diagonal off of Friday's low. Price has since been trending higher following the open this morning, making a higher high compared to yesterday's high which satisfies expectations for a potential 5 waves up from Friday's low.

If price has completed 5 waves up from Friday's low as wave 1 of c, then a near-term pullback as wave 2 of c should follow with 5938.25 - 5905.50 ES as retrace support and the target range for wave 2. Otherwise, if price continues to extend immediately higher from here instead, especially a direct breakout above last week's high, it would suggest that price is already further along in wave c of (v) and more nested off of Friday's low. In that case 6100 would be the minimum target expected to be reached before wave c of (v) completes and price attempts a larger top.