Consolidation day - Market Analysis for Sep 19th, 2018

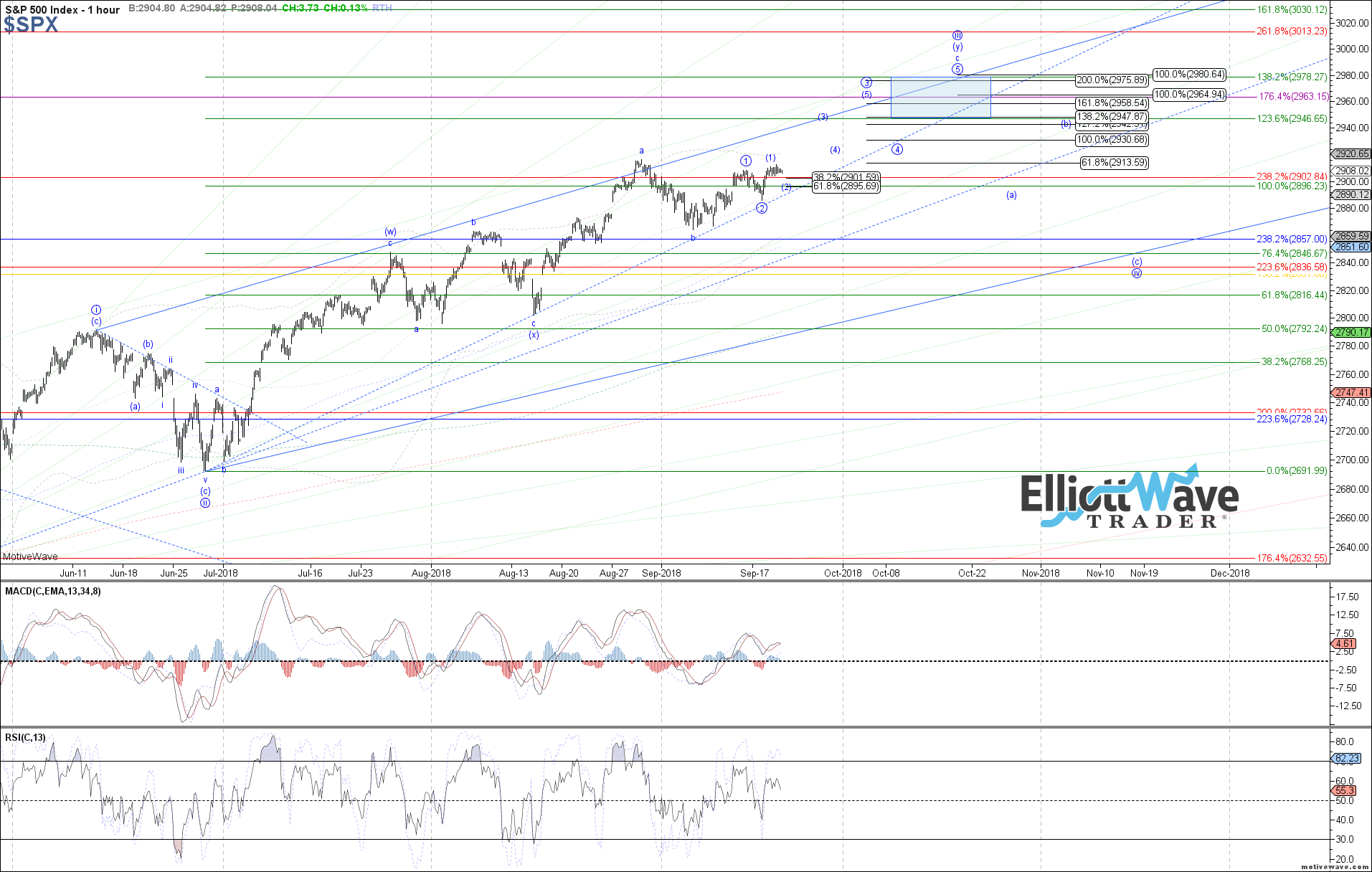

The market was flat as a pancake today, consolidating sideways and digesting yesterday's move higher. Therefore, my thoughts from this morning remain pretty much the same. There remains no reason to assume that this consolidation is anything but corrective, likely setting up further upside into the end of the month.

If corrective, then ideal micro support to hold is 2901 - 2895 SPX, as the .382 to .618 retrace of the latest move up into yesterday's high. If we are dealing with a standard impulse for wave c of (y) shown on my chart, then a consolidation here can be considered as wave (2) of 3 before turning back up in wave (3) of 3 and heading toward 2942 SPX next.

The alternative is that wave c of (y) takes shape as an ending diagonal instead of a standard impulse, in which case 2942 SPX would be the target for all of 3 of c instead. In either case, further upside remains expected as long as Monday's low at 2886 SPX holds.