Bulls still in control

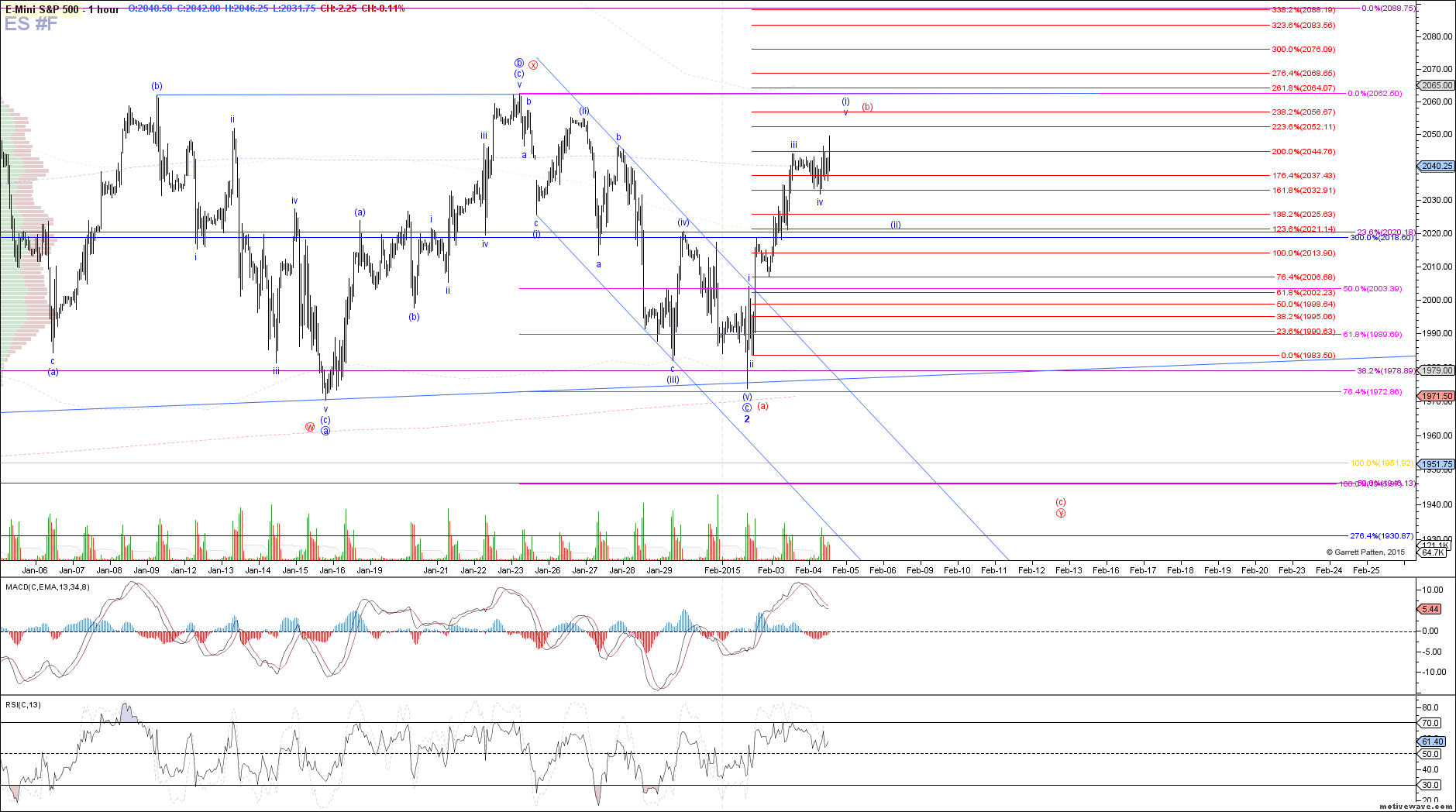

The ES spent all last night and the majority of today consolidating sideways near the local highs before breaking to the upside near the close. This price action counts best as a wave iv of (i) in our bullish blue count, not really changing much regarding expectations on the hourly chart aside from the small extension.

Assuming price is in blue wave v of (i) off the low made this morning, it appears to be tracing out as an ending diagonal, so although a small amount more of near-term upside is expected to take price to 2052 - 2057, it will likely be a choppy rise. Despite this extension, we are still expecting a corrective pullback in wave (ii) of the bullish count to follow soon after, setting up a much better entry for a swing long position using a stop below the low made earlier this week. Support for blue wave (ii) will depend on exactly where wave (i) tops.

However, if price starts to decline impulsively below retrace support, the bearish red count is still a valid concern, as wave (c) of a larger Y-wave that can take price to a new swing low. This scenario does not come into play until support starts breaking though, so until then focus should remain on the bullish blue count.