Bearish below today's high

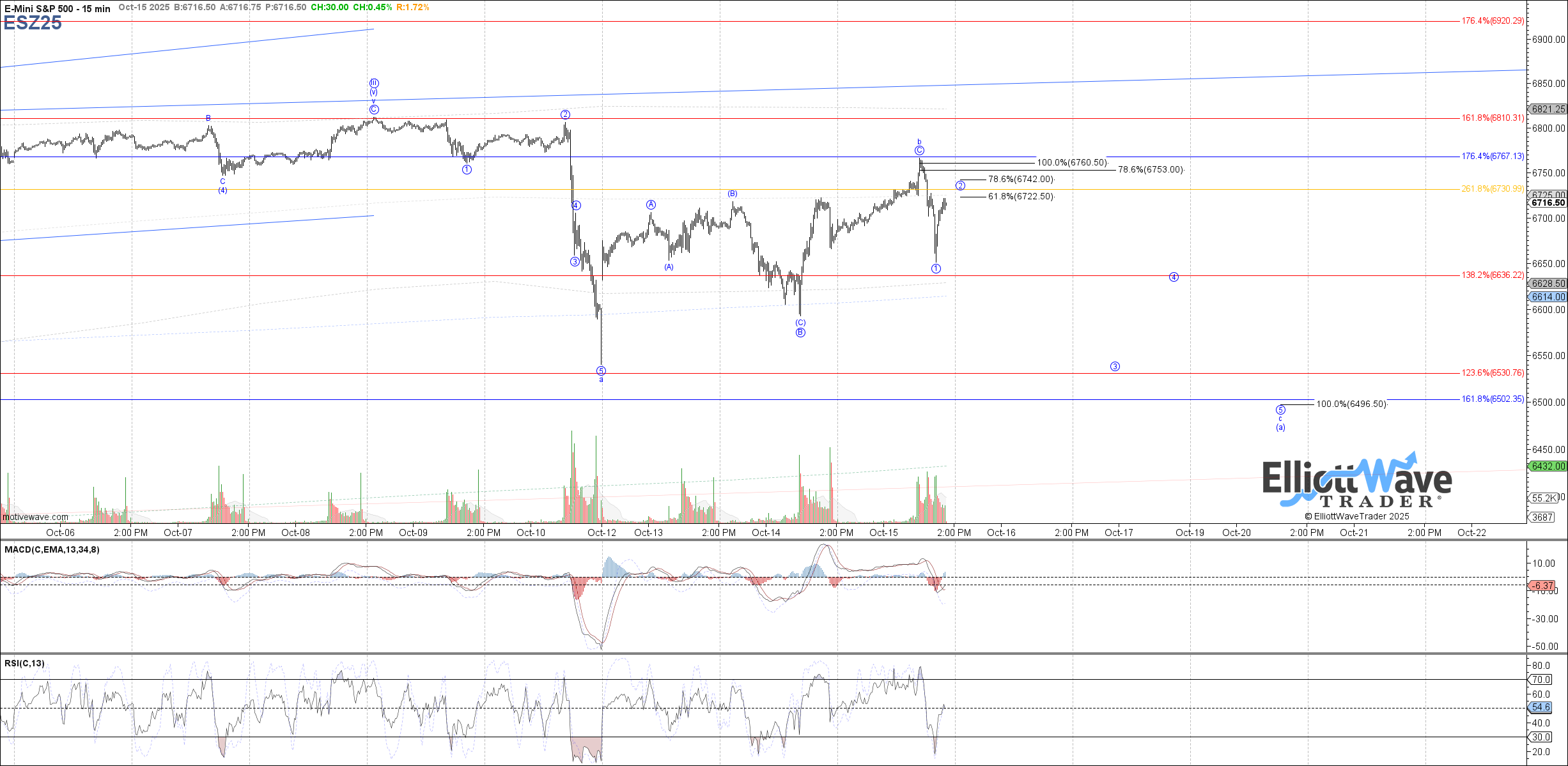

Futures drifted higher following yesterday's close, resulting in the cash chart gapping higher at the open and exceeding yesterday's high. Price continued initially higher following the open to reach the measured move fib target cited in yesterday's EOD update at 6760.50. From there price reversed sharply back down, continuing to cooperate with the expectations laid out for a b-wave bounce off of Friday's low.

Therefore, as long as price is now holding below today's high, then the assumption is that a b-wave bounce off of Friday's low has completed, and price is starting a c-wave down from today's high. Based on that expectation, the afternoon low should have completed wave 1 of c, and this is now the wave 2 of c bounce. Price has already reached the .618 retrace at 6722.50 as ideal resistance to hold, otherwise the .786 retrace at 6742 is the next fib resistance above.

However, conditions for this downside setup could be more favorable, since the decline off of the high made this morning was only 3 waves. Therefore, it limits the c-wave to a diagonal structure, which is less reliable than an impulse. The other concern is that the bounce off of the afternoon low isn't as clearly corrective as ideal, and is even possible to count as a potential 5 waves up. Therefore, a break below today's low is now what would really confirm the bearish setup and a c-wave lower that should be heading back below last Friday's low. Any break back above today's high invalidates the c-wave down starting and opens the door to more bullish options.