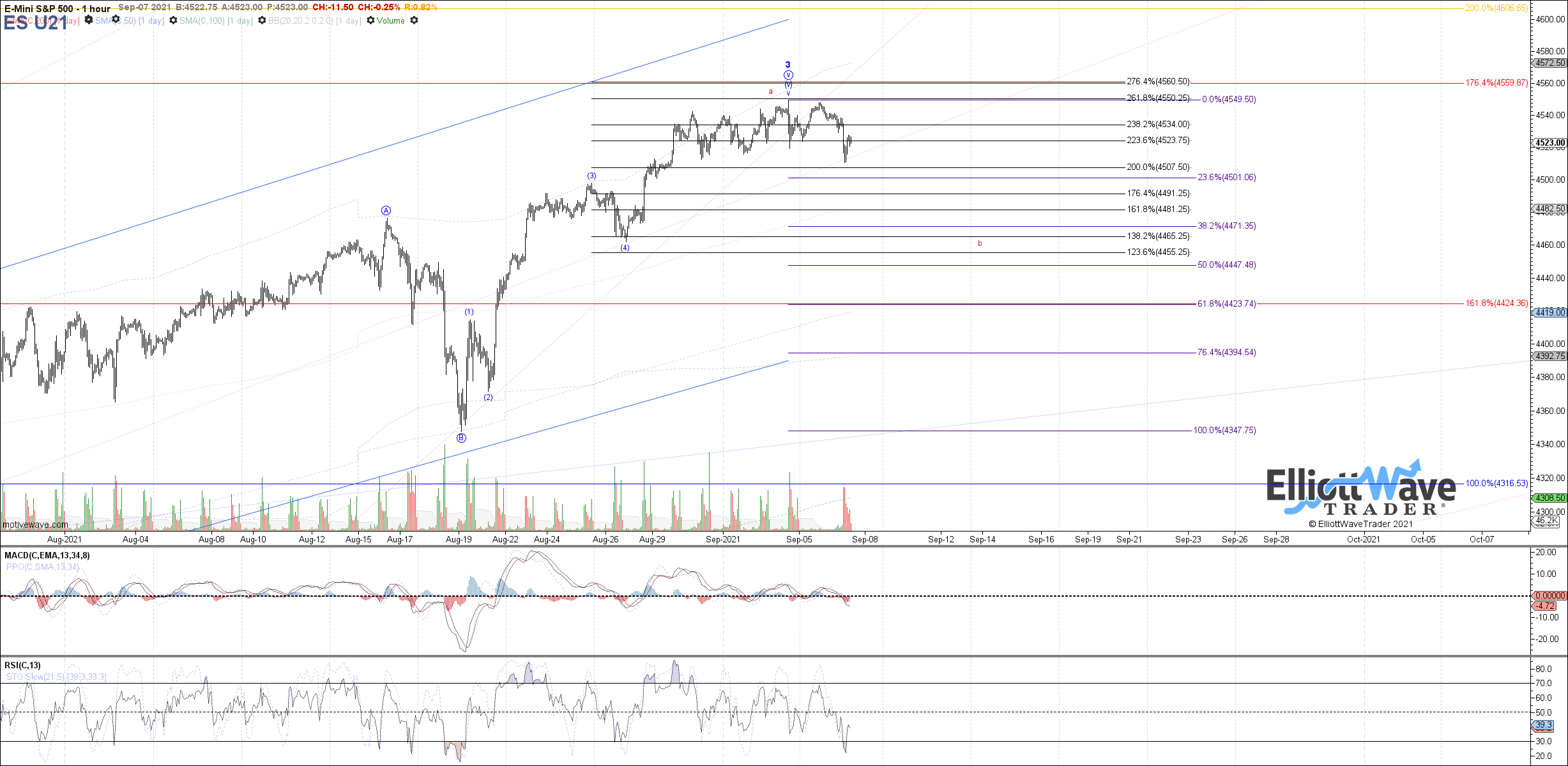

Attempting a Local Top

The market continued to slide following the open, making a new low on the month this morning. Therefore, price has provided the initial indication of a local top potentially forming, following what still looks like a very reasonable 5 waves up from the August low complete into last week's high.

If the 5 waves up is the start to another setup for further extension higher, then a corrective pullback as a b-wave or wave ii has room to retrace back to the standard .382 - .618 support between 4471.25 - 4423.75. A break below there is needed to otherwise open the door to a more significant top in place and larger degree correction looming.

To assume anything more immediately bullish from here, at the very least I would want to see a micro 5 up from the low made this morning. That would require price exceeding the afternoon high at 4527.75 which would allow for a micro leading diagonal up.