Another Fed day, another whipsaw...

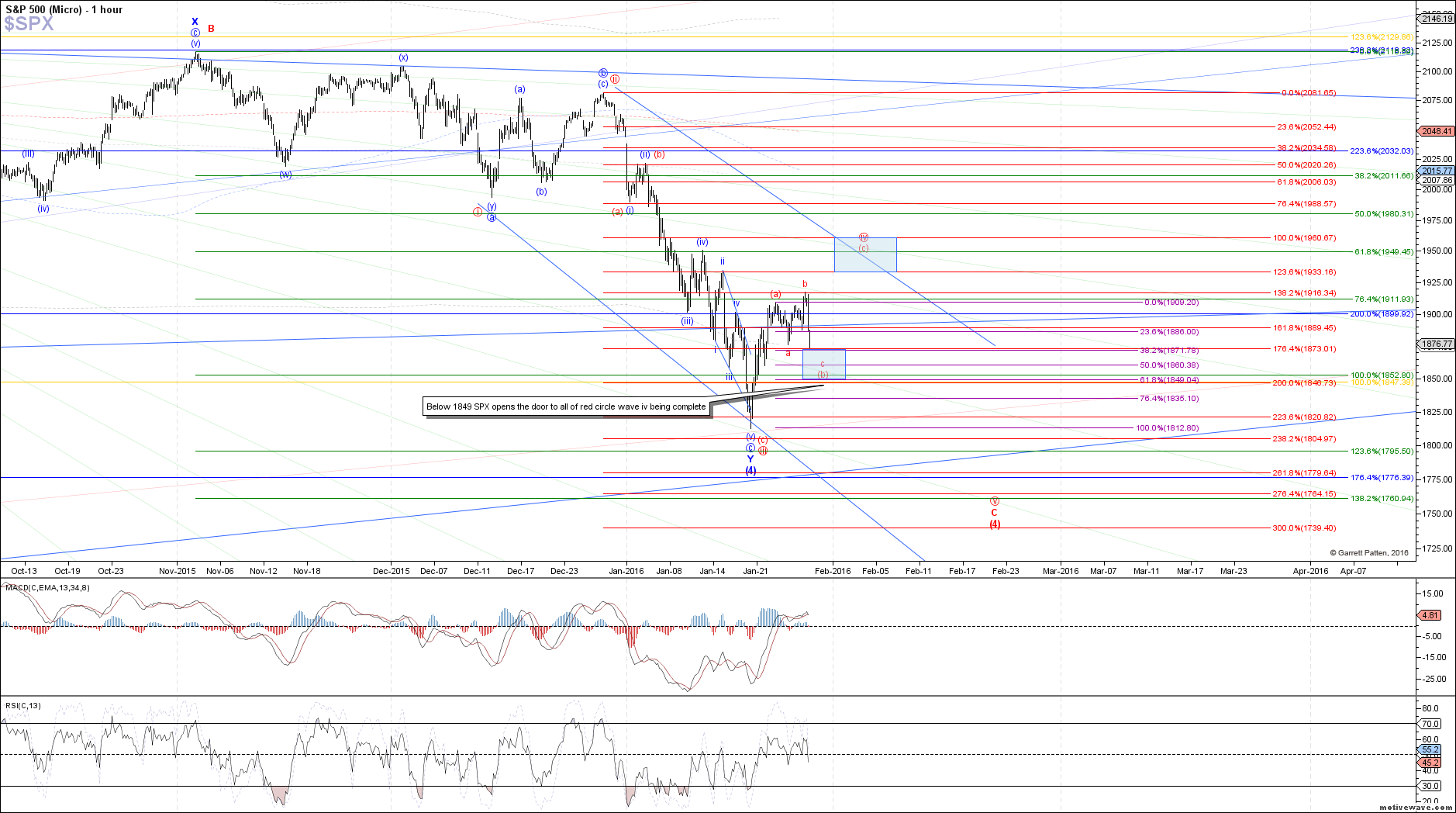

Today started off well with SPX following expectations, holding the .618 retrace at 1887.50 before turning back up to a new local high in what looked like wave iii of (c) in the red count.

However, once the FOMC announcement hit the tape, price reversed back down strongly, breaking below support cited in the wave alerts to warn us that follow through was not going to happen. With the decline continuing down below the prior low this morning at 1887.50, we are left with only a 3 wave structure off Monday's low into today's high.

This suggests that price is still in the (b)-wave of iv under the red count, now taking shape as an expanded flat. Under that assumption, price would be in wave c of (b), now targeting 1872 - 1849 SPX. We will have to watch the micro structure and technicals as price approaches the support region to assess if things look good for a long attempt to play the red (c)-wave higher to complete wave iv.

This is because if price breaks below 1849 SPX, it opens the door to all of circle wave iv in the red count having completed already, and price now on its way to a new swing low as red wave v of C.