Hedging a diversified Portfolio

This is something that was requested about the best way to hedge a diversified portfolio with long term puts. I'm attaching two charts from the Gamma Optimizer, yes the G.O can do hedge analysis, for more information please watch this video: https://youtu.be/o5c0TTBfBGE

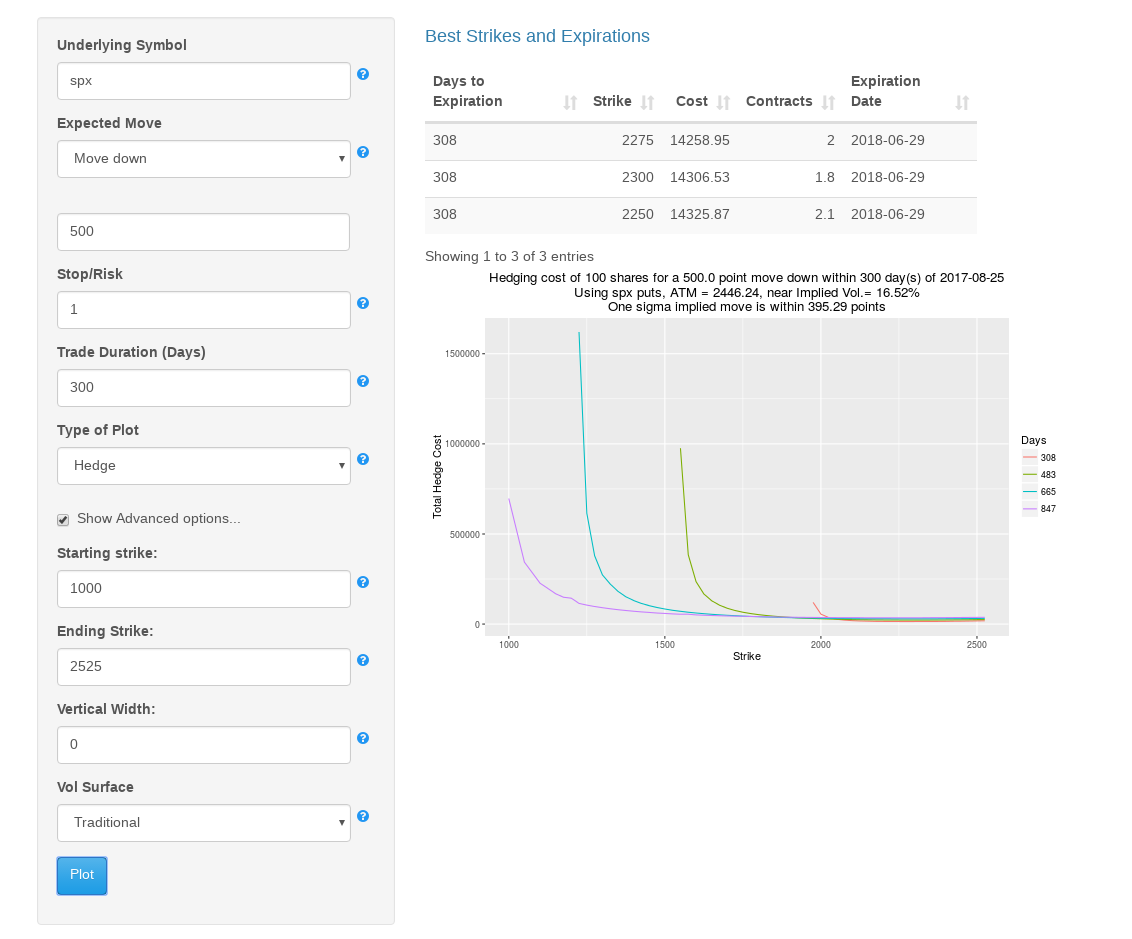

Now the original request was to come up with a hedge that was set and forget (1 year or more). So in the analysis I'm simulating a 500 point drop in SPX (about 20% catastrophic crash) in 300 days (so we can get 2018 options at all here). The result is in the first chart as you can see the optimizer is recommending 2 contracts of 2275 puts expiring Jun29-2018 with a total cost of $14,258.95 to cover what should be a loss of $50,000 in the portfolio, as you can see that is a very expensive hedge here (almost 30% of the total unhedged portfolio loss).

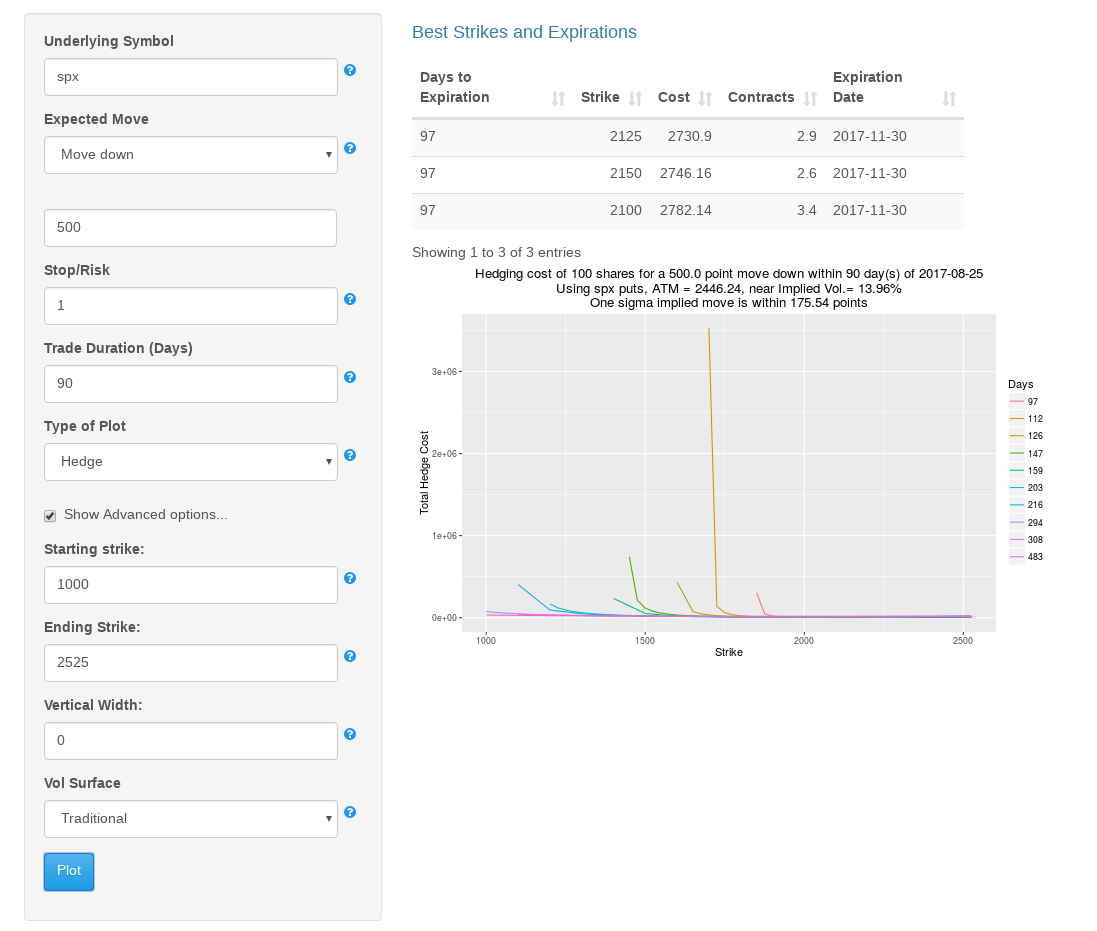

The second chart is the same simulation but with a 90 day window instead (the one used by most funds and big portfolios). You can see that the optimizer recommends now 3 puts at 2125 for Nov 30 with a total cost of 2,730 (to cover an unhedged portfolio loss of 50,000) if you do a systematic trade every quarter it could add up to $10K on the annual hedge, which beats the 300 day one.

So as you can see it is much better to hedge every 90 days than having a long term hedging position here. Now if you intend to use the G.O to design a hedge like that please don't forget to use the Stochastic volatility options because the 500 point move is big enough to cause a massive spike in volatility. If you run the simulation that way the hedging costs will be reduced dramatically but the quarterly hedge will always beat the annual one.