How to Trade Out a 4th Wave

Initially posted as a Swing Alert (Mar 4, 2013 12:50:01)

I wanted to take a moment and address a concern that many have about how to trade out of a 4th wave, especially in the case where it is unclear as to whether the 4th wave has actually been completed. KGBgirl and I went through this discussion months ago, and we came to a conclusion that seems to make sense for the conservative traders, especially since the aggressive traders will do what they will anyway.

So, ideally, the safest way to trade a 5th wave when there are questions about the completion of the 4th wave is to wait for the break out. Now, that does not mean you buy the break out, as those who have been here long enough know my feelings about buying a break out. I only suggest buys at Fib support levels.

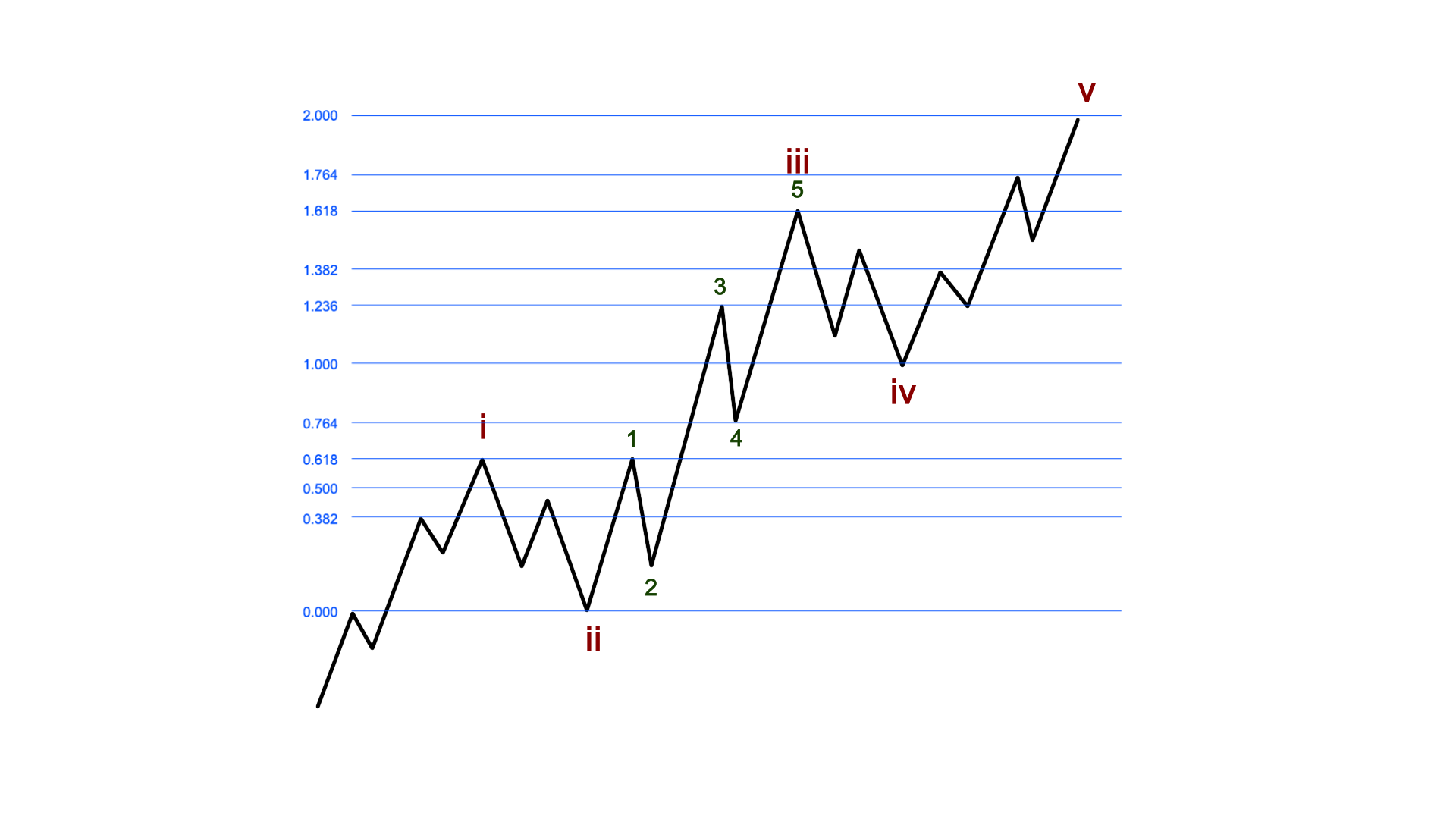

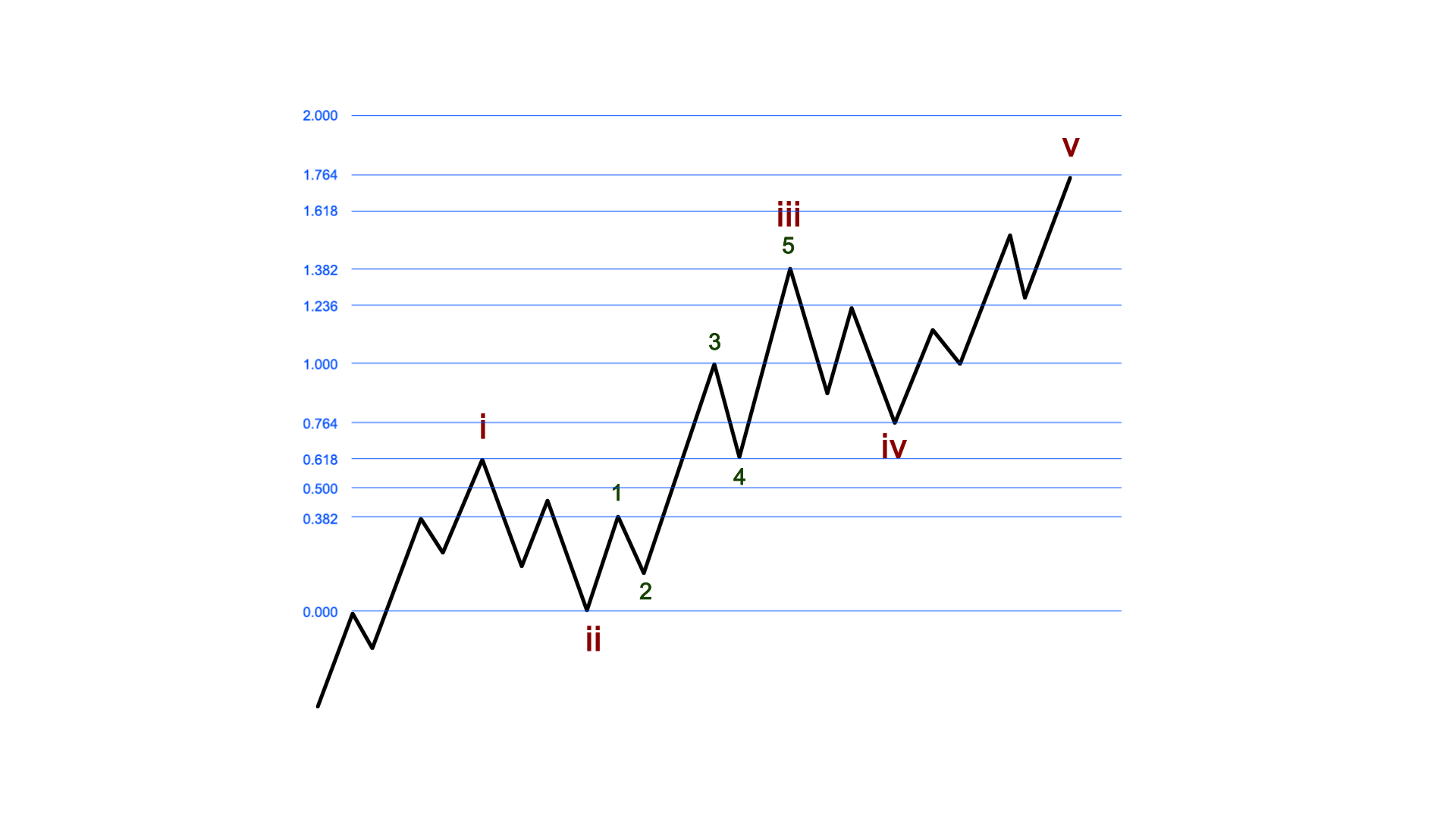

What I mean is that a break out from a 4th wave usually becomes most apparent when the market takes out resistance in wave iii of (3) of the 5th wave. And since we know that the target for such a wave is usually the 1.00 or 1.236 extension, then our expectation is that wave iv of (3) will pullback to the .764 or .618 extension in a corrective pullback.

So, in my opinion, that would be the safest place to buy for the more conservative traders with you ultimate target being the 1.764 extension, and potentially the 2.00 extension. But, remember, you will be within a 5th wave, and it may not reach the full 2.00 extension, so you may want to take your ball home early, and just pocket what you made with less risk, as the market would be at a point of impending reversal.

As for those more nimble, you can always exit at the 1.382 or 1.618 extension to complete wave 5 of (iii) and then buy again after the wave (iv) pulls back to the 1.00 extension for the run to the 1.764 extension. This gives you two trades within that final 5th (v) wave in a much safer manner.