World Markets Weekend: Wave Counts for DAX, STOXX, FTSE & More

EUROPE/AMERICAS

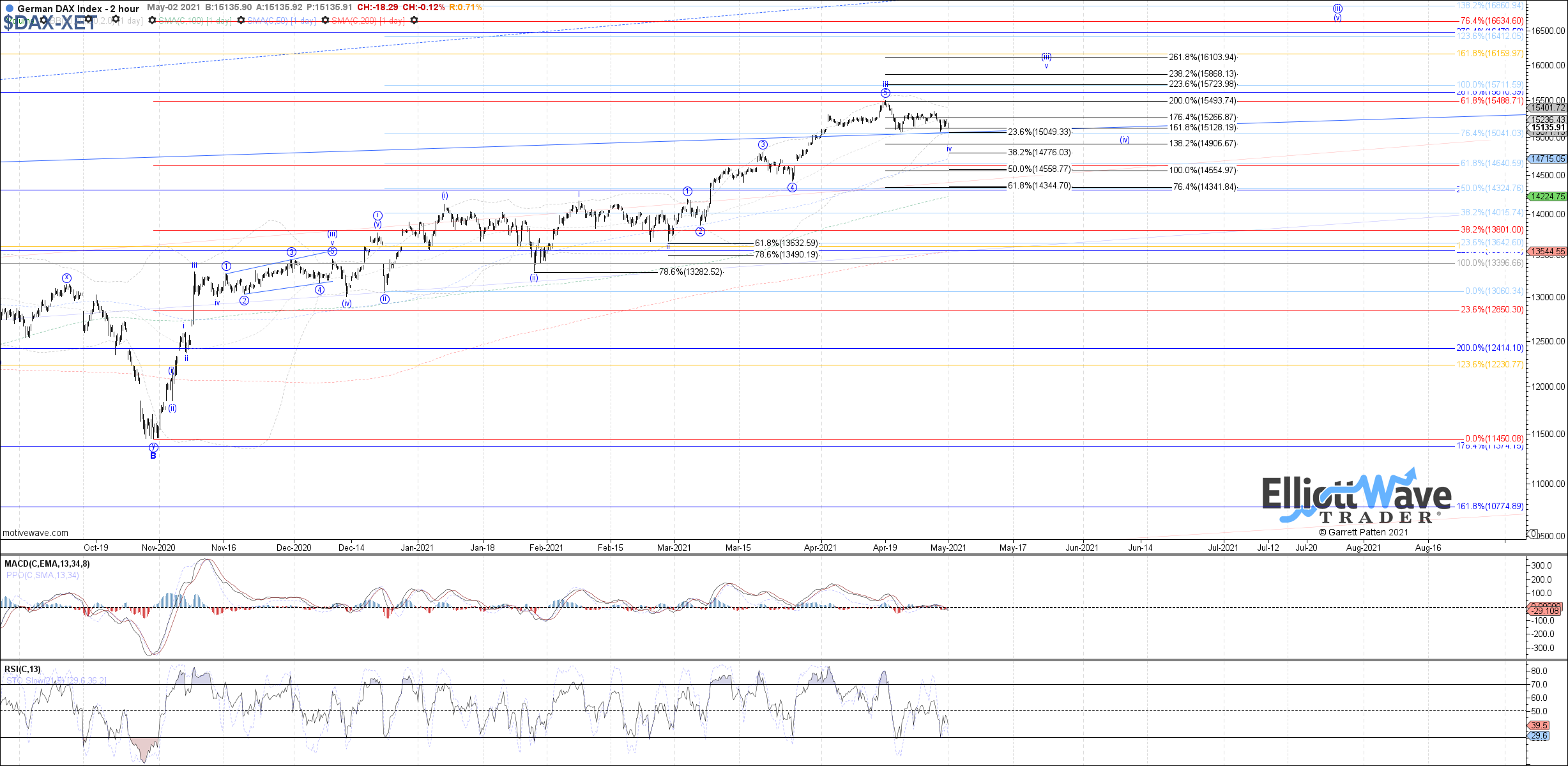

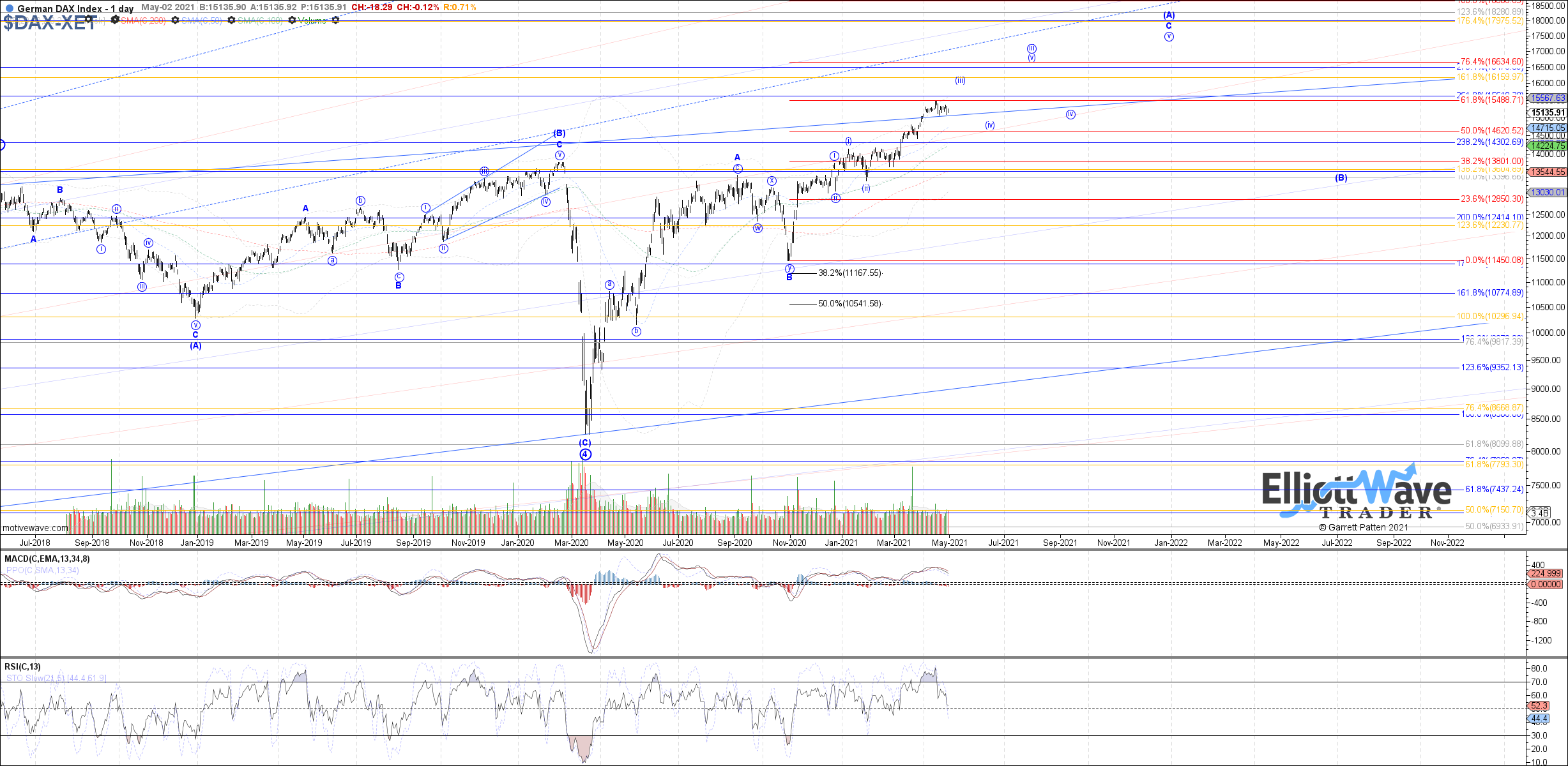

DAX: The DAX consolidated sideways last week, ultimately holding above the prior week’s low. Therefore, still technically possible that wave iv of (iii) has already completed and price is ready to head higher in wave v of (iii), but the lack of follow through last week makes that assumption questionable. Instead, a bit more near-term downside in wave iv may be needed, with ~14900 as the next main fib support below if price does undercut the recent April lows.

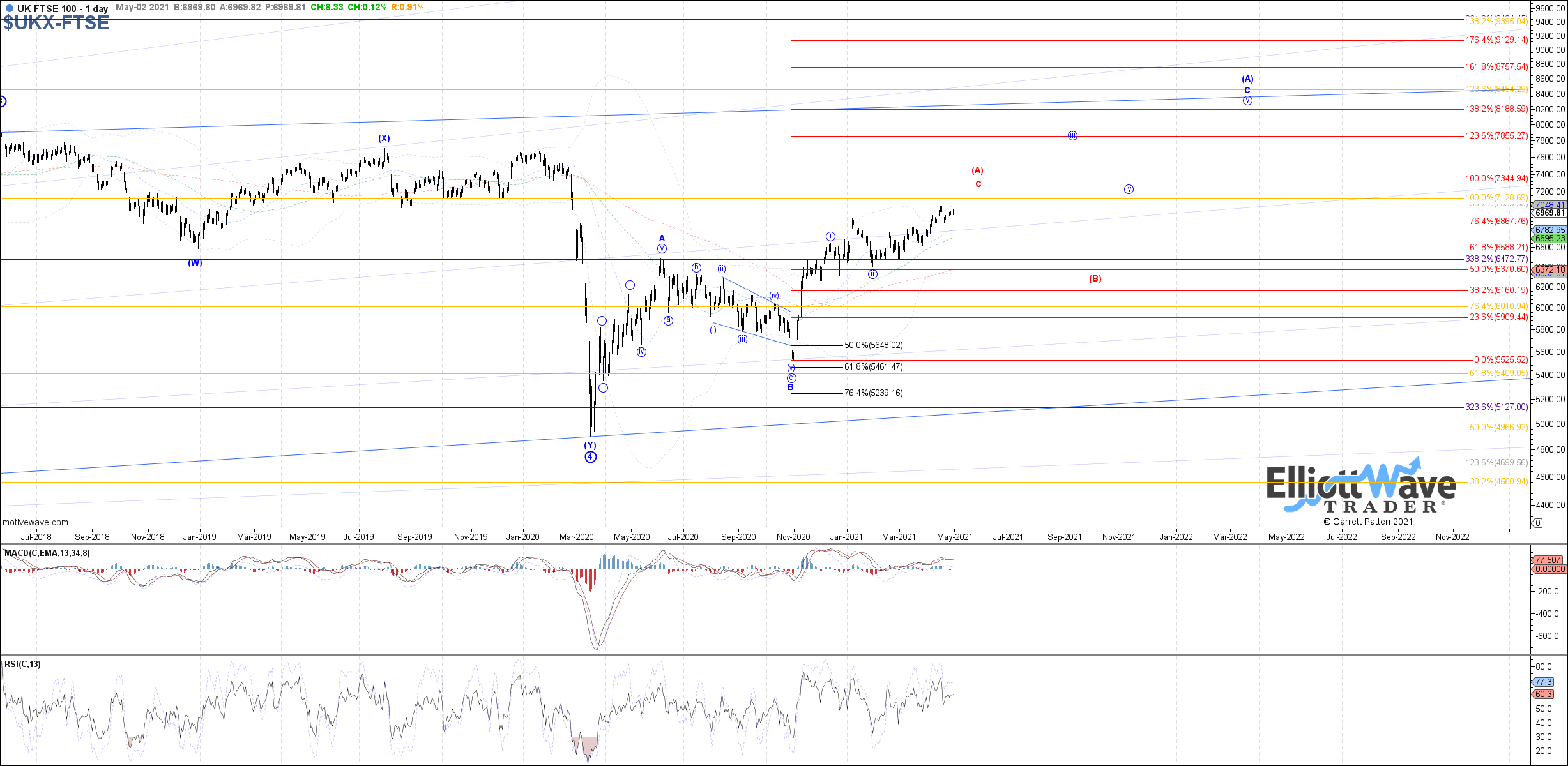

FTSE: The FTSE continued higher last week, exceeding the .618 retrace as resistance cited but so far still holding below the prior April high. Therefore, a wider flat as wave (iv) remains a possibility, but with slightly reduced odds than if the .618 retrace had held. A break below 6925 would start improving those odds again, with 6840 as a potential target for wave c of (iv). Otherwise, the alternative is another extension in wave (iii) that can take price past the April high before reattempting wave (iv) again.

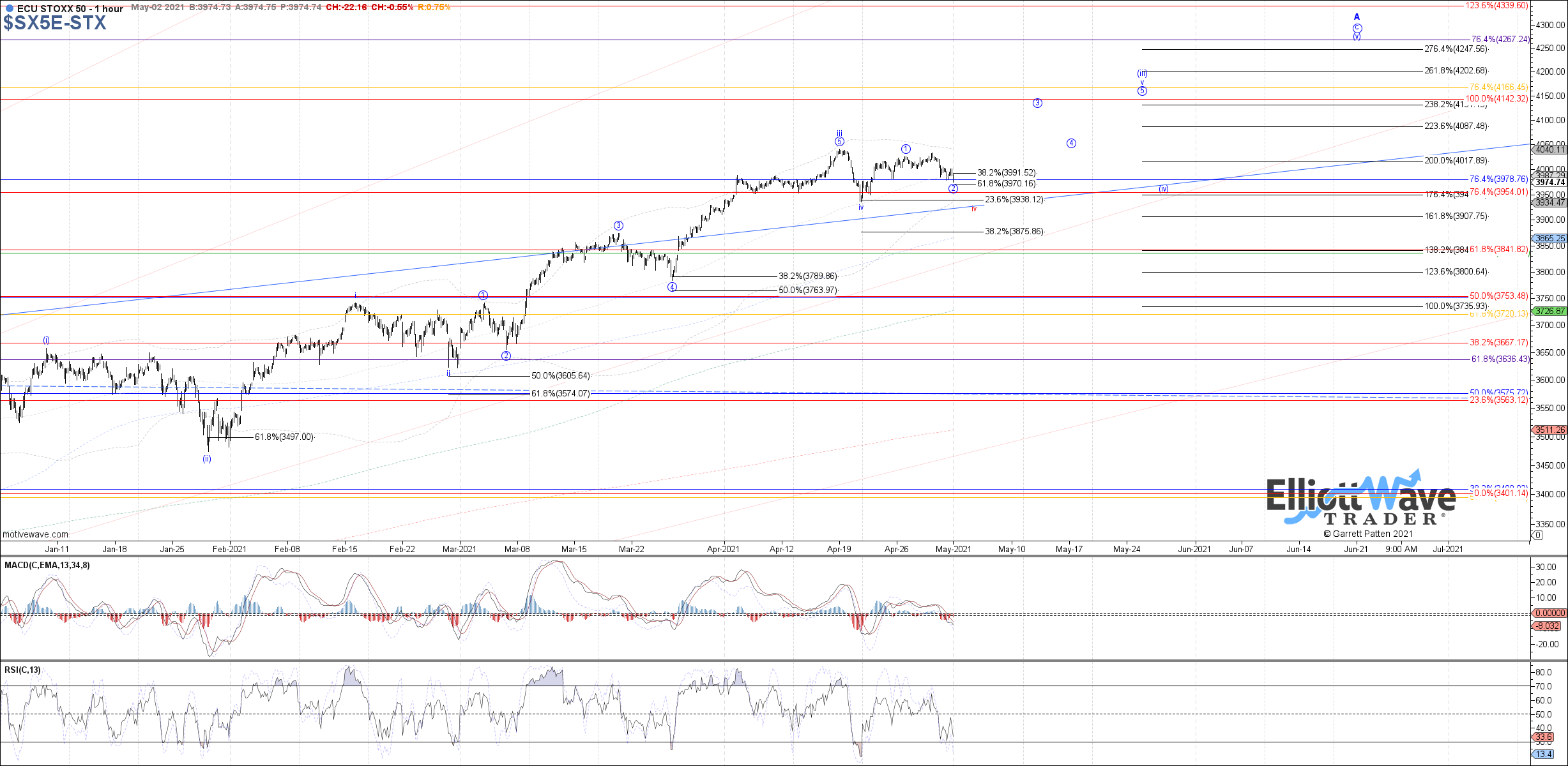

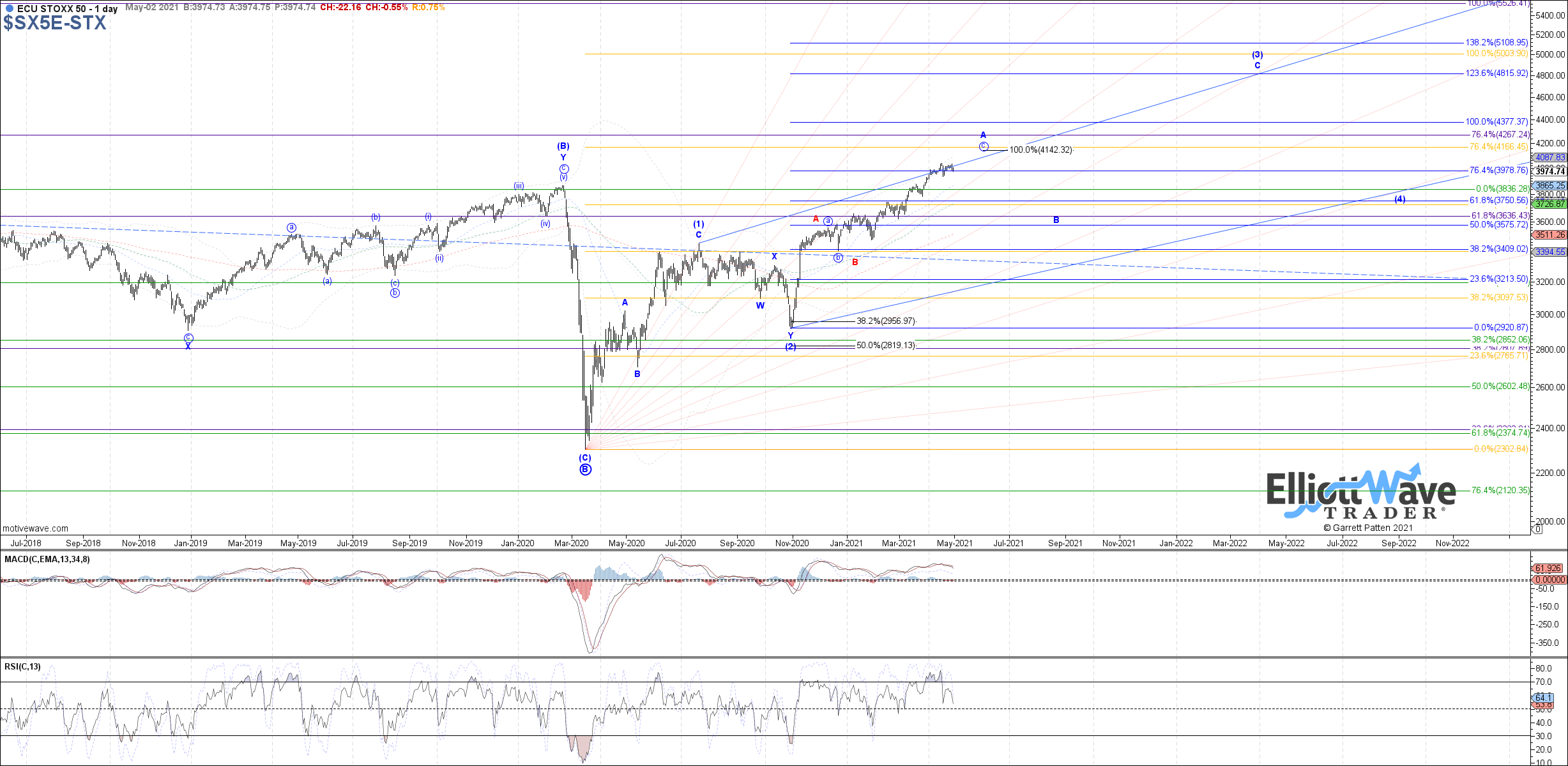

STOXX: The STOXX also consolidated sideways last week, eventually entering into the target support cited for wave 2 of a possible 1-2 start to wave v of (iii). If price manages to hold 3970 as support and turns back up above last week’s high, we can assume wave 3 of v is filling out 4100 – 4125 as a potential target. Otherwise, the 1-2 start to wave v remains valid as long as price is above 3935, but the closer price reaches toward that level the more likely a wider flat wave iv becomes.

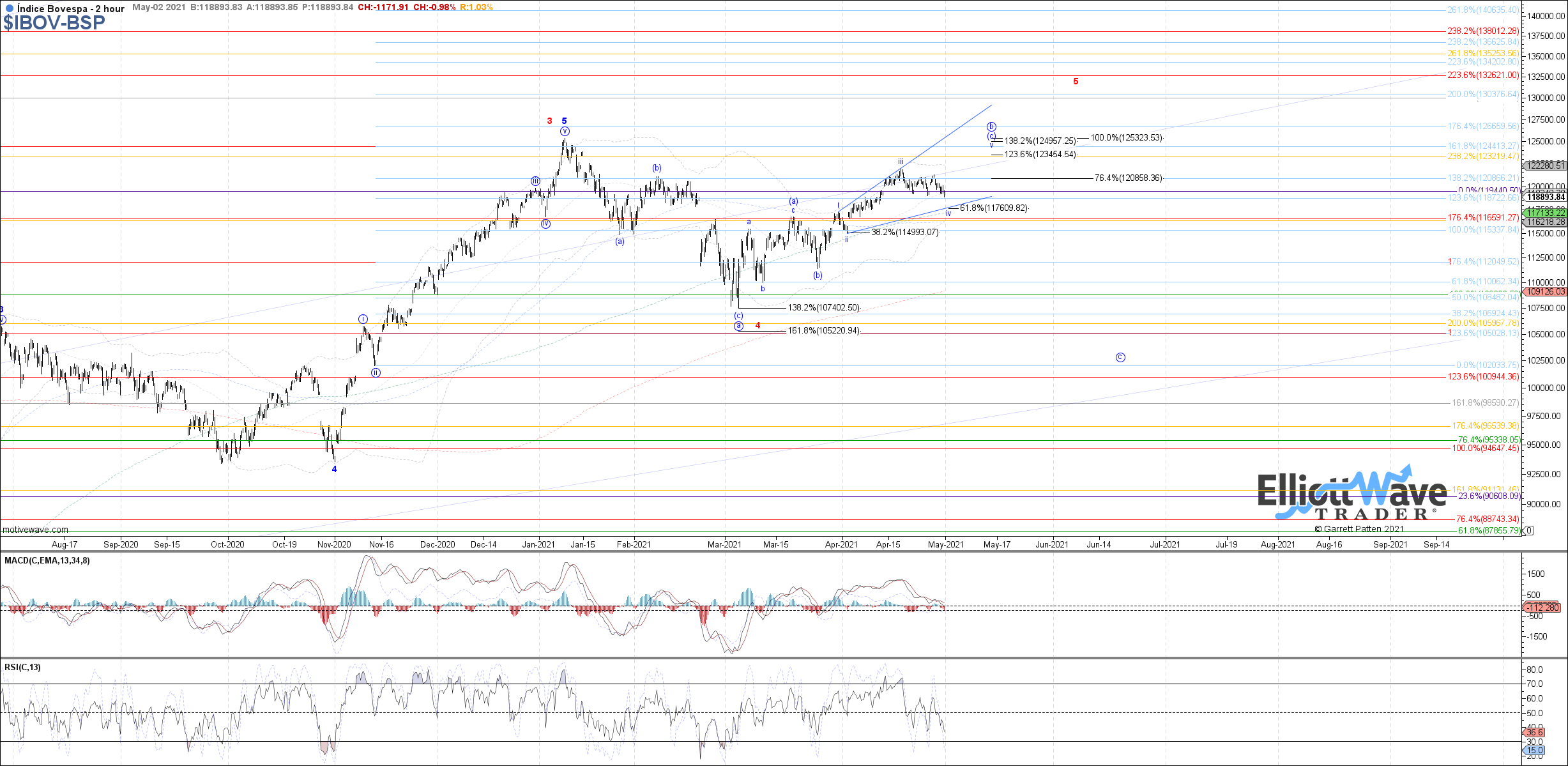

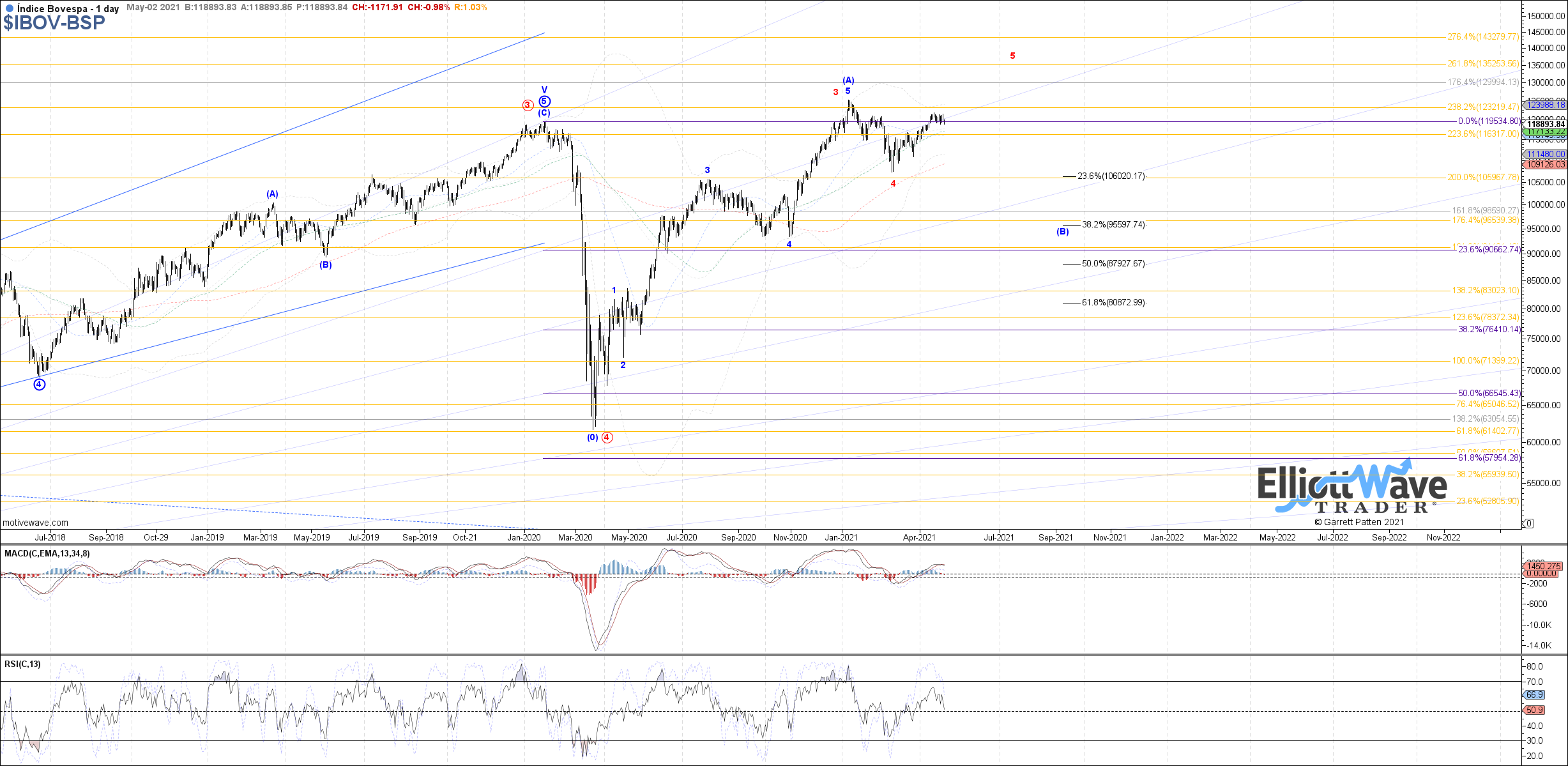

IBOV: The Bovespa consolidated sideways last week, acting like price is still working on wave iv of (c). If so, there remains room for a bit more near-term downside if needed, with 117610 still as main support below that is ideal to hold in order to turn price back up in wave v of (c) next. Any break above last week’s high now would suggest that wave v of (c) is already underway.

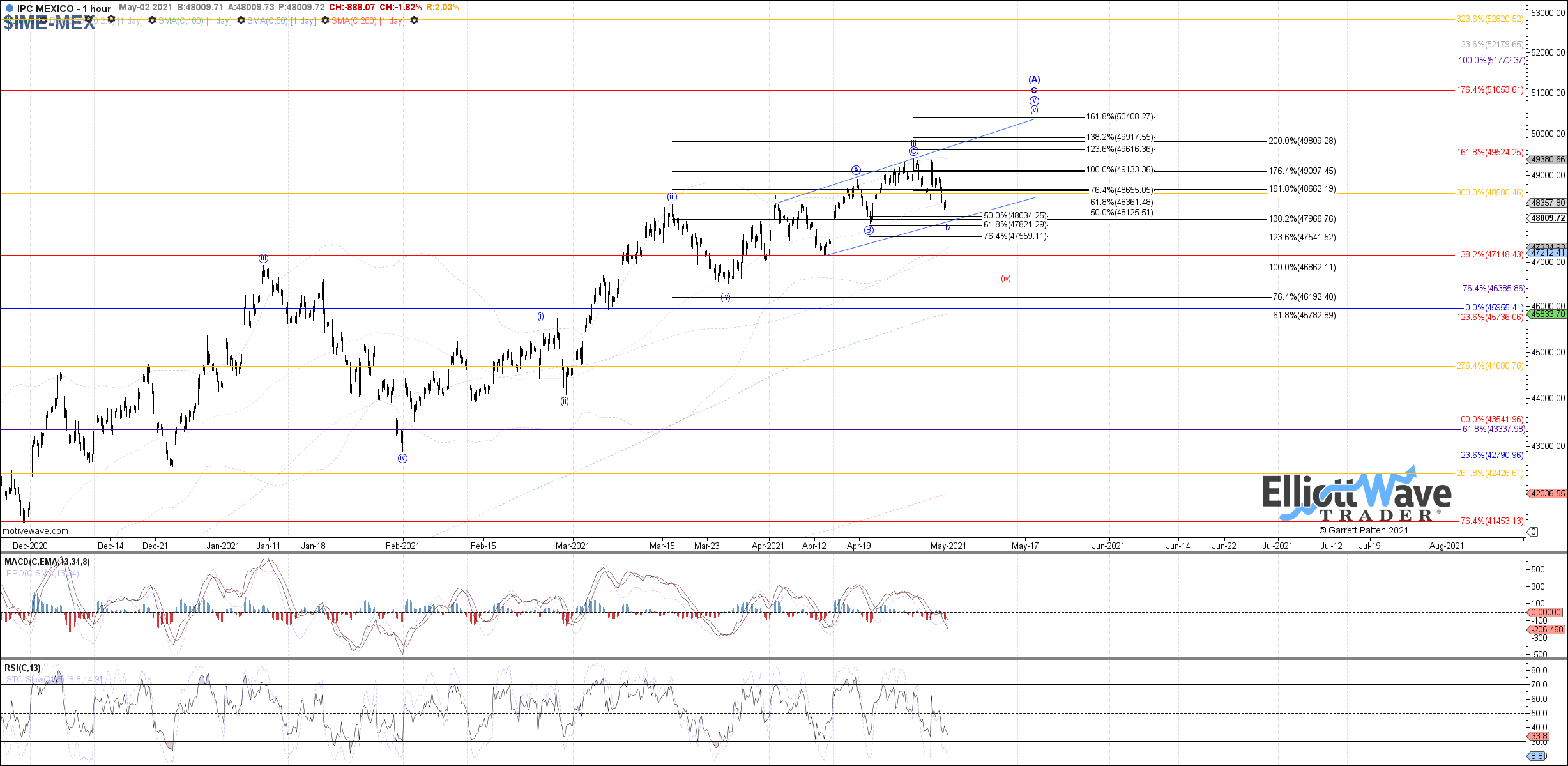

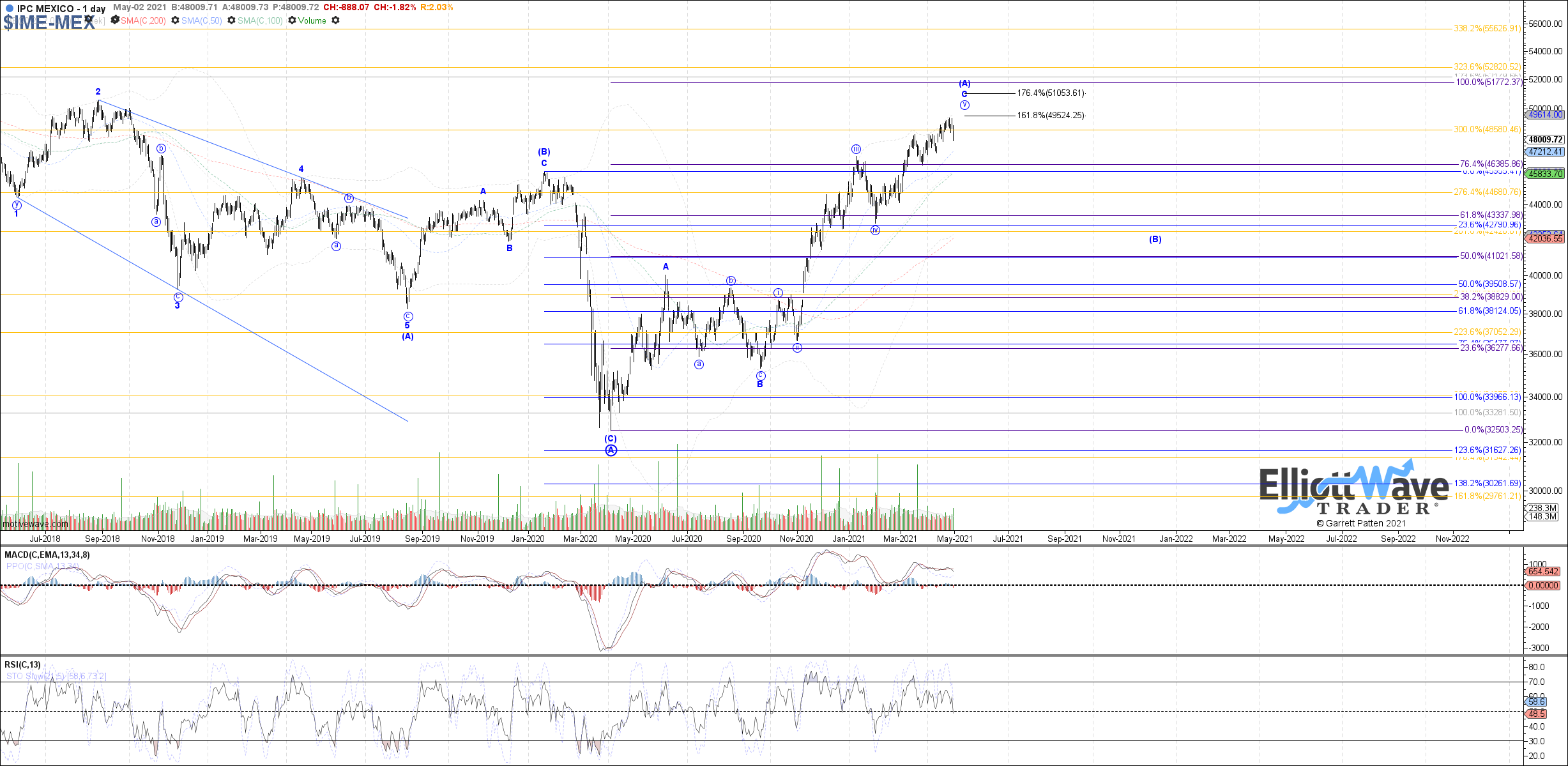

IPC: The IPC pulled back last week, looking like wave iv of (v) filling out. If so, price has already reached the target support cited for wave iv, so this would be the ideal spot for price to attempt to turn back up from as wave v of (v) next. Below 47850 is the first warning sign of weakness, but wave iv does not completely invalidate until a break below the wave ii low at 47145.