Where Fundamentals Meet Technicals

Once per week in Stock Waves, I publish a piece called “Where Fundamentals Meet Technicals” that takes a look at various stocks or asset classes where my fundamental analysis aligns with the technical analysis from my partners Zac and Garrett, either bearishly or bullishly.

Occasionally, like this one, I publish one of them publicly as well.

As someone who is 95% fundamental-focused with a long-term view, I’m willing to buy an investment that I think is underpriced, and let it play out for years, which is a rather tax-advantaged strategy but requires considerable patience.

It does, however, help to have a price confirmation, momentum indicators, and other positive technicals on your side as well, so that you don’t waste a ton of opportunity cost waiting for something to play out when there’s bullish action going on elsewhere.

Investors all have different time horizons and investment processes, and I view technical analysis as a risk-management tool. Sometimes my fundamental analysis points in one direction, while the technical analysis points elsewhere, and other times, they intersect and point in the same direction. Those intersections are what I highlight in this weekly series for people that like both.

This issue of “Where Fundamentals Meet Technicals” looks at several stocks that I’ve been covering for a while to see their progress fundamentally and technically.

Adobe

Adobe (ADBE), as a 38-year old company, is not exactly some new hot stock that Generation Z kids are recommending to each other on TikTok in this recent bubble of retail enthusiasm.

And yet, it is a high-flying software company that over the past several years changed into a software-as-a-service subscription model that boosted growth and customer retention. From a combination of product development, targeted acquisitions, and the natural technological direction of cloud computing and SaaS, they’re becoming a more diversified and faster-growing company as they’ve aged, rather than slowing down.

They have more cash-equivalents than debt, very reliable free cash flow, and thus an “A” credit rating.

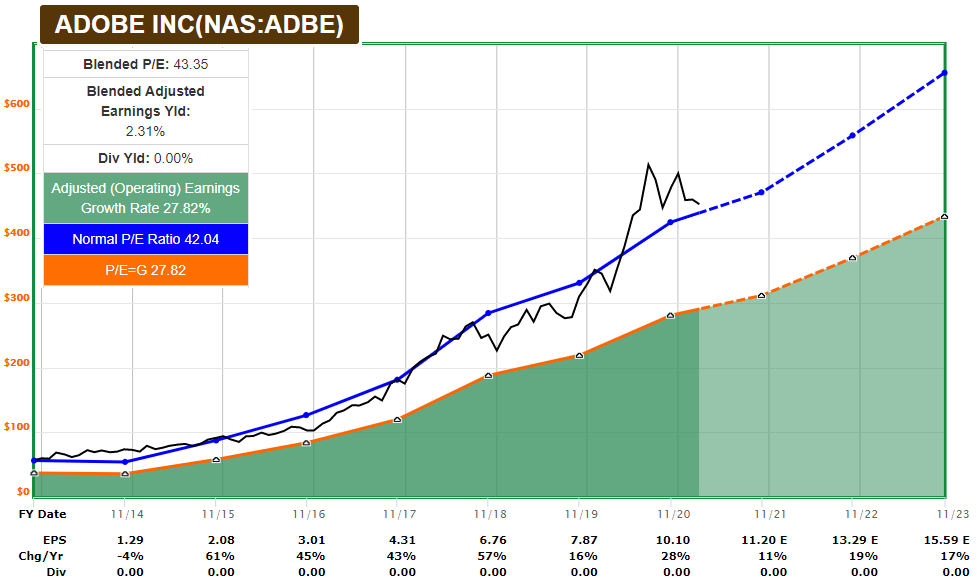

The big question, however, is valuation. Adobe is rarely cheap. I was long Adobe starting in January 2019, but sold it in mid-2020 when growth/tech stocks were all the rage and its valuation became concerning.

After a multi-month correction and continued underlying growth since then, however, Adobe came back down to the top end of my fair value range. It’s still not cheap, and I’d prefer to see it a bit lower, but the 3-5 year prospects do look reasonable from this level.

Here’s the F.A.S.T. Graph:

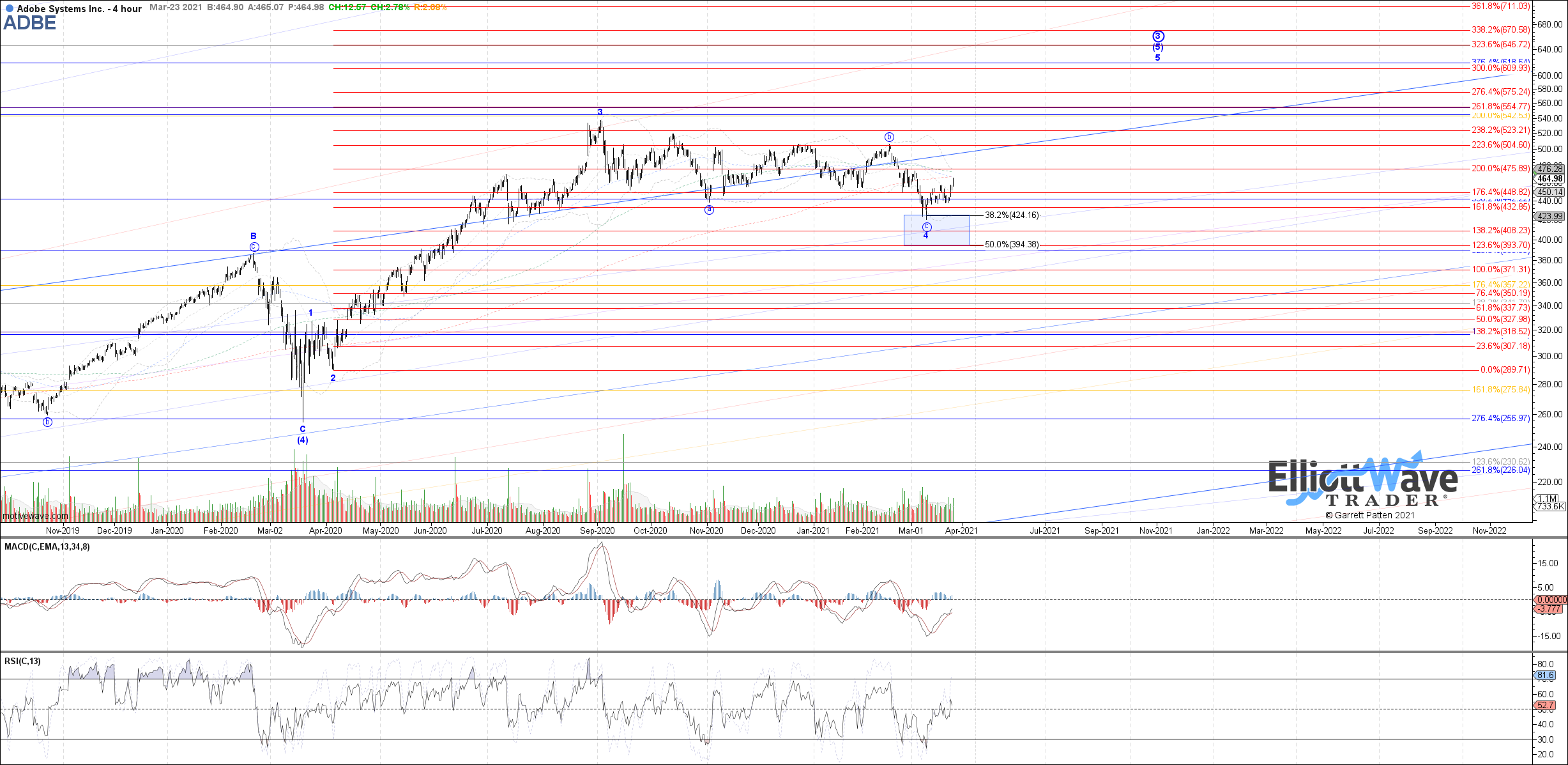

Garrett, who focuses on the technicals rather than the valuation, sees a good probability for a local bottom in place and new highs ahead:

I started recommending this one a week ago in Stock Waves. The stock just had a bullish daily MACD crossover on the daily chart, and it’ll be interesting to see if this trend stays in place to form a bullish weekly MACD crossover.

Overall, I am constructive towards Adobe, would prefer to buy it a bit cheaper, but am willing to buy an initial tranche at current levels along with selling cash-secured puts to get paid to wait to potentially buy it at cheaper levels.

Enterprise Products Partners LP

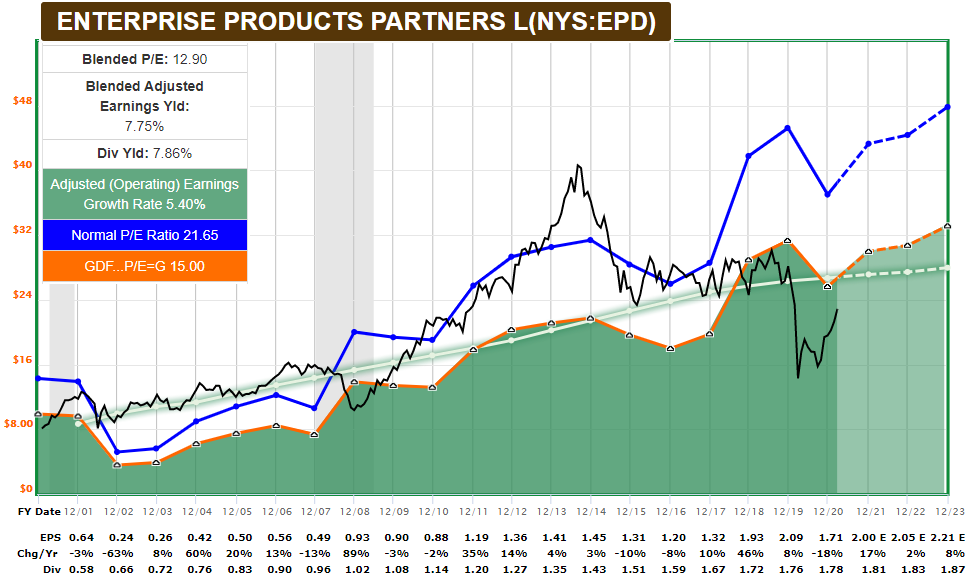

On the other end of the spectrum, we have Enterprise Products Partners LP (EPD). This is a large slow-growing energy transportation company. They are one of the most diversified businesses in the space, with natural gas, natural gas liquids, oil, and petrochemical infrastructure.

Their distributable cash flow continued to cover their distribution in 2020, and overall they are at attractive valuations. Even as the world moves towards electric vehicles, there are not a ton of substitutes for what EPD focuses on transporting, which are the various derivatives of natural gas that we all interact with multiple times per day. Even this monitor and keyboard I’m typing on have petrochemical origins.

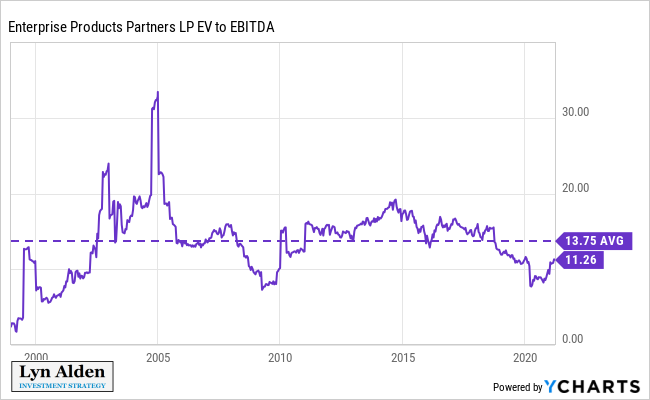

Although the units have had somewhat of a run-up, EPD remains at cheaper-than-average price levels relative to fundamentals:

Chart Source: F.A.S.T. Graphs

Folks on Robinhood aren’t exactly buying a lot of investments that send a K-1 form every year like EPD does. It’s out-of-favor, which leaves an undervalued investment for those that appreciate its continued long-term potential and solid management.

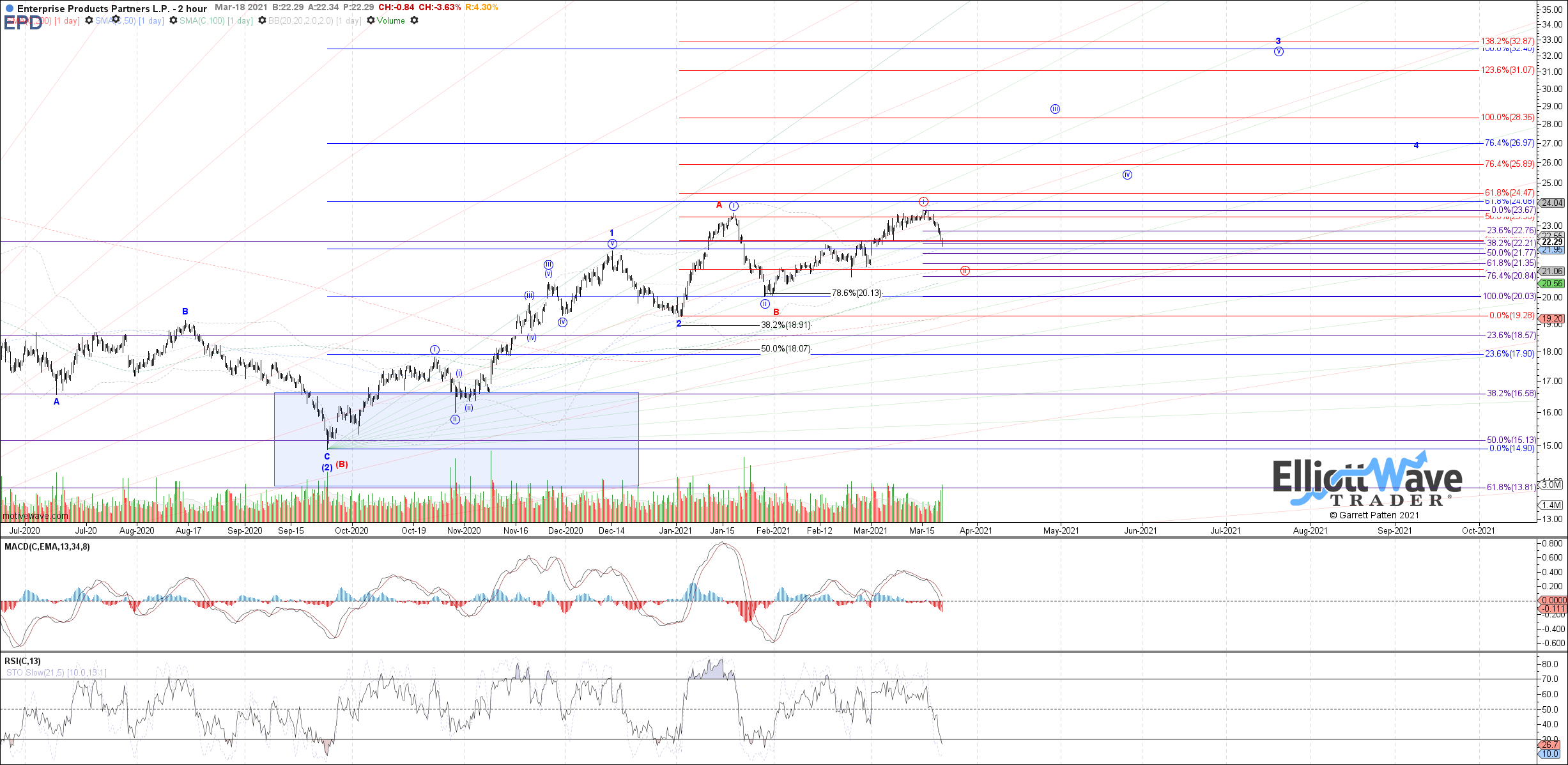

From a technical perspective, it has been experiencing a correction over the past week, which let off some steam from the recent bull period. Garrett remains favorable going forward when the next uptrend begins:

Importantly, EPD doesn’t need a ton of capital appreciation to provide great returns, so there is a rather low hurdle to step over for the investment to be a successful one. With a covered distribution yield of 8% (along with a recent mild increase, continuing their long stretch of consistent increases), any price that is flat-to-up over the long run is good for total returns.

Amazon

For people that haven’t been following it closely, it may surprise people that Amazon (AMZN) stock has been in an 8-month mild correction.

Amazon has always been difficult to value in terms of GAAP earnings, and in my view that remains one of its weaknesses. A 25-year-old company with a 13-figure market capitalization should probably have straightforward earnings by this point.

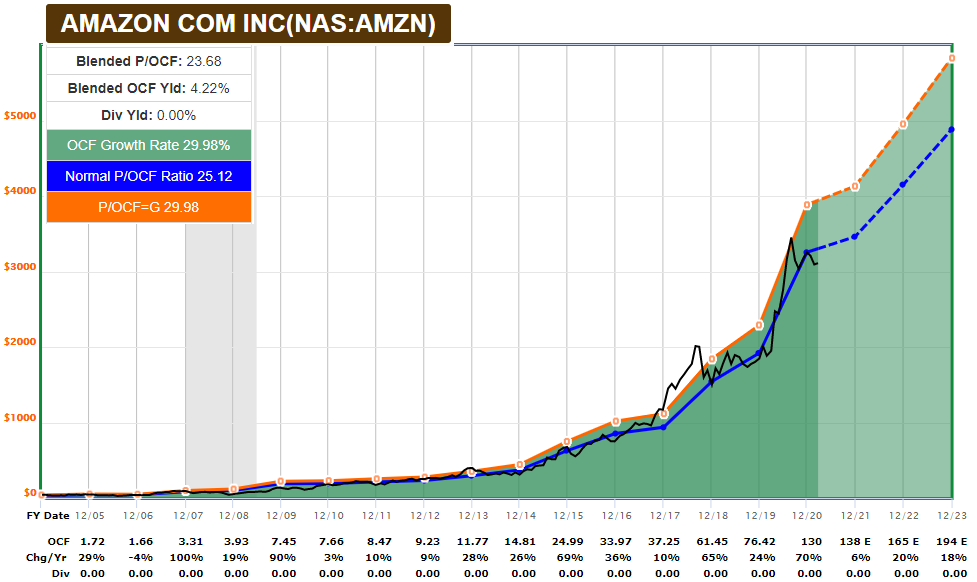

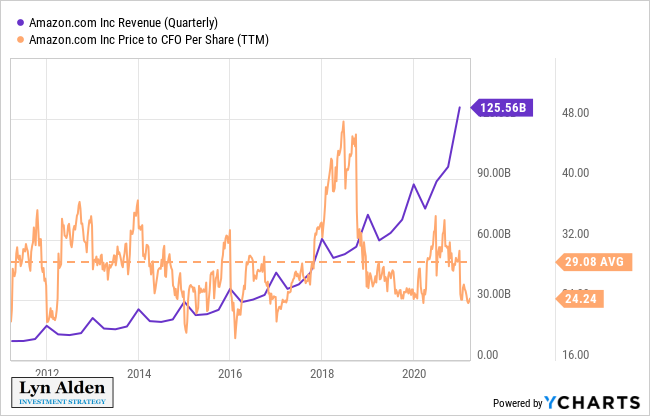

However, Amazon stock has instead closely followed another valuation metric: operating cash flow. For nearly two decades, the stock has closely hugged a 25x operating cash flow multiple. Whenever it went higher, it historically tended to consolidate or correct for a time. Whenever it went lower, it historically became a strong buy.

Lately, that would put it in the “buy” camp:

Chart Source: F.A.S.T. Graphs

Eventually, as Amazon matures and slows down, I would expect that figure to fall to 20x and eventually towards 15x. But with substantial growth expected by analysists over the next 2-3 years, Amazon still has upward pressure in terms of stock price appreciation.

Garrett, focusing on Fibonacci levels and other technical indicators within his process, sees Amazon reaching as high as $4k or more over the next year:

Will that occur? I have no idea.

However, I’m certainly paying attention when the valuation is below historical norms and technicals point up. Count me a mild buyer.

Cameco

Uranium is an under-owned commodity. It’s not one of the big ones like oil, copper, gold, or silver.

Although the western world has stagnated in terms of building nuclear power facilities, Asia, the Middle East, and other parts of the world continue to do so.

Uranium itself has been in a long bear market below all-time highs, but bottomed in late 2016 and since then has been in a persistent uptrend. And yet, it remains below the cost of most forms of production.

Chart Source: Trading Economics

One of the largest and lowest-cost uranium miners is Cameco (CCJ). Although uranium itself reached a price bottom back in late 2016, uranium miners including Cameco kept with a downtrend price trend after that, and didn’t bottom until March 2020. Since then, however, they have been in a very strong uptrend.

From a technical perspective, Zac expects that recent uptrend to continue:

Fundamentally, the long-term supply/demand forces of the uranium industry look very bullish. Primary production is not enough to meet existing utility annual demand, and the current price is insufficient to incentivize new mines coming online. However, there has been a long period of secondary supply that has met this difference, which came from previous periods of oversupply including for weapons turned into civilian power.

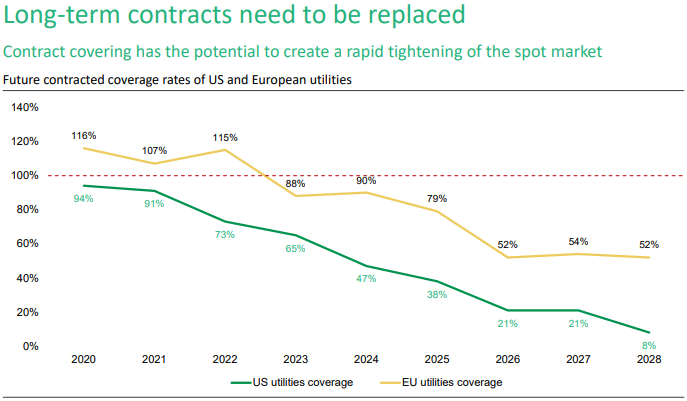

By most accounts, however, secondary supply is dwindling. Furthermore, utilities are low in terms of how many years’ worth of uranium they have contracted for, and thus are likely to begin a contracting cycle over the next several years. They’ll need to come to market to secure their long-term uranium supply to keep the lights on in their areas of service.

Chart Source: Yellow Cake PLC March 2021 Presentation

Uranium miners like Cameco are well-positioned as bullish investments over the next 3-5 years in my view, and are not strongly correlated with other asset classes.