The S&P500 Will Exceed 3000

Several years ago, we set our target for the S&P500 between 2537-2611. While it may not seem like such a stretch of the imagination right now, consider that the market was in the 1800 region at the time we set this target, and most market participants were awaiting the certain market crash just around the corner. In fact, we maintained our strong conviction for this rally to 2500+ no matter who won the election in 2016. And, the fact that Trump won and we still rallied, despite most expectations to the contrary, supports our larger degree perspective.

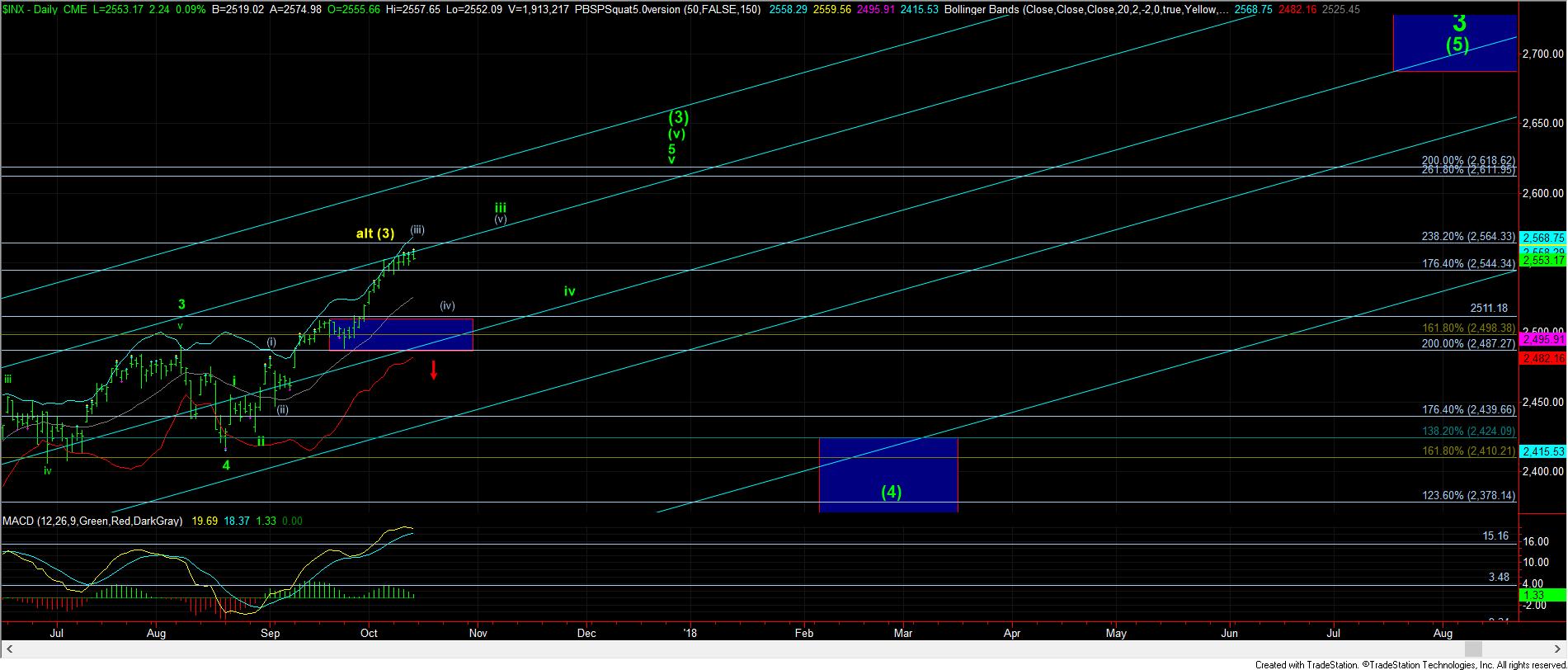

But, now, we are in what we consider a “topping” zone. While the market can still push higher by another 50 points or so, I think we will be starting a multi-month pullback as we move into 2018. So, my expectation remains that we are completing the final segments of wave (3), as you can see in the charts below. And, as long as we remain over the 2511SPX support region on the next pullback, the market will likely try to push up to our next long-term target in the 2611SPX region.

I have also attached my long-term chart on the S&P500 below. And, for those that recognize it, you will know it has been quite an excellent road map for the US stock market. In fact, while many were calling for the “crash” back in early 2016, this chart was pointing straight up towards the 2500+ region.

Ultimately, this chart suggests that we will not likely see a 15%+ correction in the market until we complete waves (4) and (5). But, even after a 15%+ correction, which seems to be setting up for 2019 (just in time for our next Presidential election), the market will likely be heading higher into the early 2020’s, and will likely eclipse the 3000 region no matter who is elected President in 2020.

So, while I see a lot of frustration by market participants due to how extended this market has become, if one embraces the fact that we are still in a long-term bull market, and will likely remain in a long term bull market for another 5 or so years, then most of your focus should remain on the long side of the market rather than looking for that ever elusive “crash” spoken about and expected almost daily in the financial blogs.