Silver Follow-Through Bodes Well For Bulls

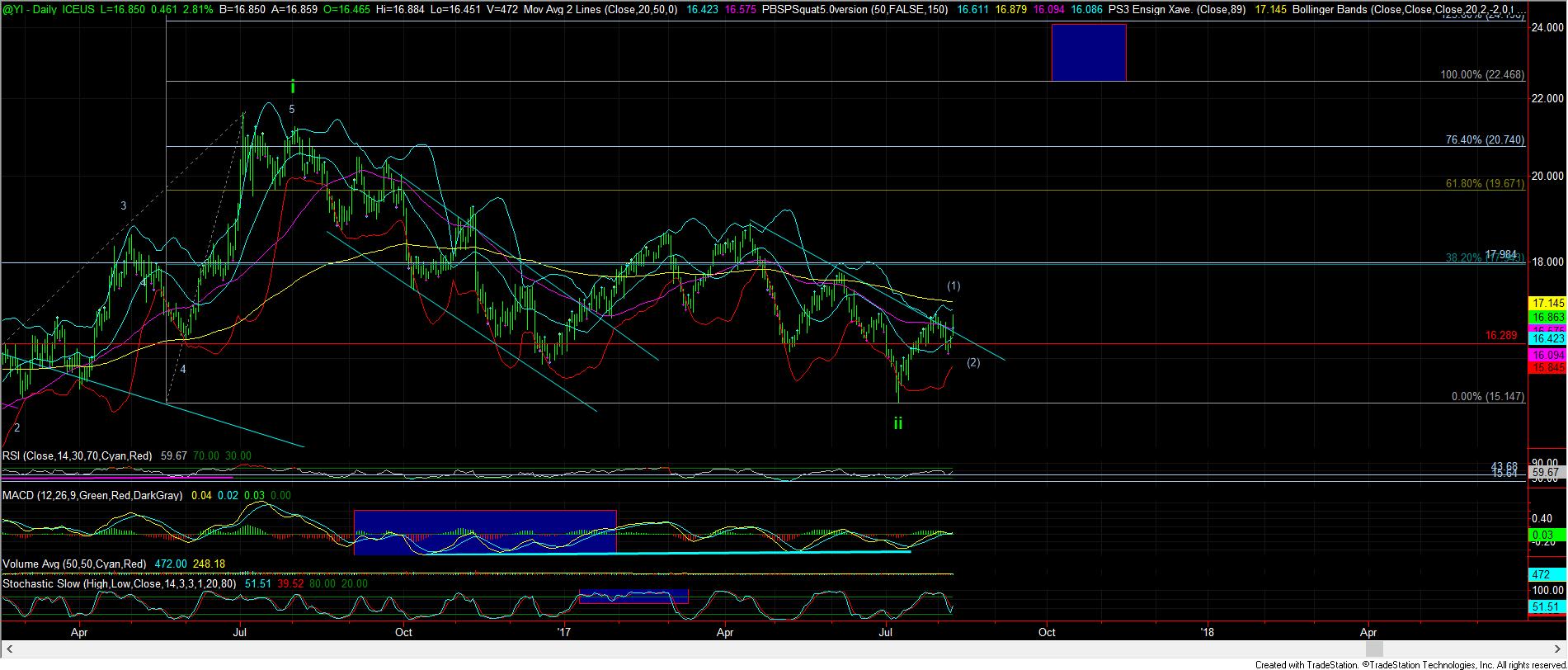

Over the weekend, I noted that if silver were able to hold the 16.10-16.20 support region, it can still launch us up towards a 5th wave to complete 5 waves up off the recent lows. The low struck this week in silver was 16.10, and we are now seeing a 5th wave higher. Ideally, I still want to see a smaller consolidation in a micro wave iv, followed by a micro wave v to complete wave 5 of (1), and taking us to our target box.

Along with the expectation of a higher push in silver, I also expected GLD would make a higher high, as long as it held over the .382 retracement at 118.75. Clearly, we remained over that level, and we have now pushed to a higher high. My primary expectation is similar to silver, in that I believe we can still push a bit higher, but as long as we do not see a high volume break out over 122, I believe we can see a strong drop in a c-wave of wave (2) back down towards our support region.

As far as GDX is concerned, the micro structure has been a mess since it bottomed. The only way to view that as an “impulse” is with a leading diagonal, which was quite overlapping. However, my expectation in GDX is the same as in GLD, in that I believe this is a corrective rally, which will terminate – likely this week – and then see a strong decline in a c-wave to complete its corrective pullback.

Since the market is likely setting up in a bullish break out, there is no question I may be wrong and the market may simply break out from this current set up. You see, when the market is set up for a heart of a 3rd wave, they can always surprise you with an immediate break out without any further pullbacks, despite my ideal set-up calling for one. So, as I said over the weekend:

Yet, as we noted last weekend, it is possible that the market has set up in a series of 1’s and 2’s off the recent lows, which is much more immediately bullish. That means that the next rally will not respect the resistance levels I have been providing you in my updates. During the week, I have moved that resistance up slightly on silver to account for a potential 5th wave higher. That upper resistance is now sitting in the 17.80 region, whereas GDX is still in the 24 region. GLD, after completing a nice 5 wave structure off the recent lows, can still push higher in an expanded b-wave towards the 122 region, but I would like to see that resistance maintain any b-wave rally for GLD. However, if we see the market break out over all these resistances, then it becomes clear that the heart of a 3rd wave is taking hold, and it would not be wise to get in its way.

For now, I still see the potential for the market to head a bit higher this week (and much, much higher should we take out those resistances cited above). But, my ideal set up would likely call for a strong drop to scare out more investors in this complex before the market takes off with the fewest possible participants as possible. You see, we need the rest of them to chase the market higher once we really break out, as that provides the fuel for a parabolic 3rd wave higher.

Lastly, I want to address something that I know you will likely see a lot written about today and tomorrow. Silver has now taken out a multi-month downtrend line, as you can see from the attached daily chart of silver. That often gets trend channel followers quite bullish. But, as I have warned many times over, the metals complex LOVES to exceed channels to get participants either very bullish or bearish, just before it strongly reverses. For this reason, I also see the potential for the (1)(2) set up I have been posting about for weeks. So, until you see silver break out through the 17.80 region with strong buying volume, I want you to strongly consider this potential as what will play out in the coming week or so.

In summary, as I have been saying for quite some time, I am maintaining a bullish bias of the complex until the July lows are broken. The set-up is one which can propel the metals up strongly, similar to what was seen in early 2016. But, my primary expectation is for one more pullback before that happens. Should we immediately break out instead, please do not get in its way, as the move will likely be quite strong.