Riding the Stockwaves: Technical Update on Cameco, CCJ (NYSE ticker)

“Uranium miners like Cameco are well-positioned as bullish investments over the next 3-5 years in my view, and are not strongly correlated with other asset classes. “

—Lyn Alden Schwartzer from her 3/23 Where Fundamentals Meet Technicals update

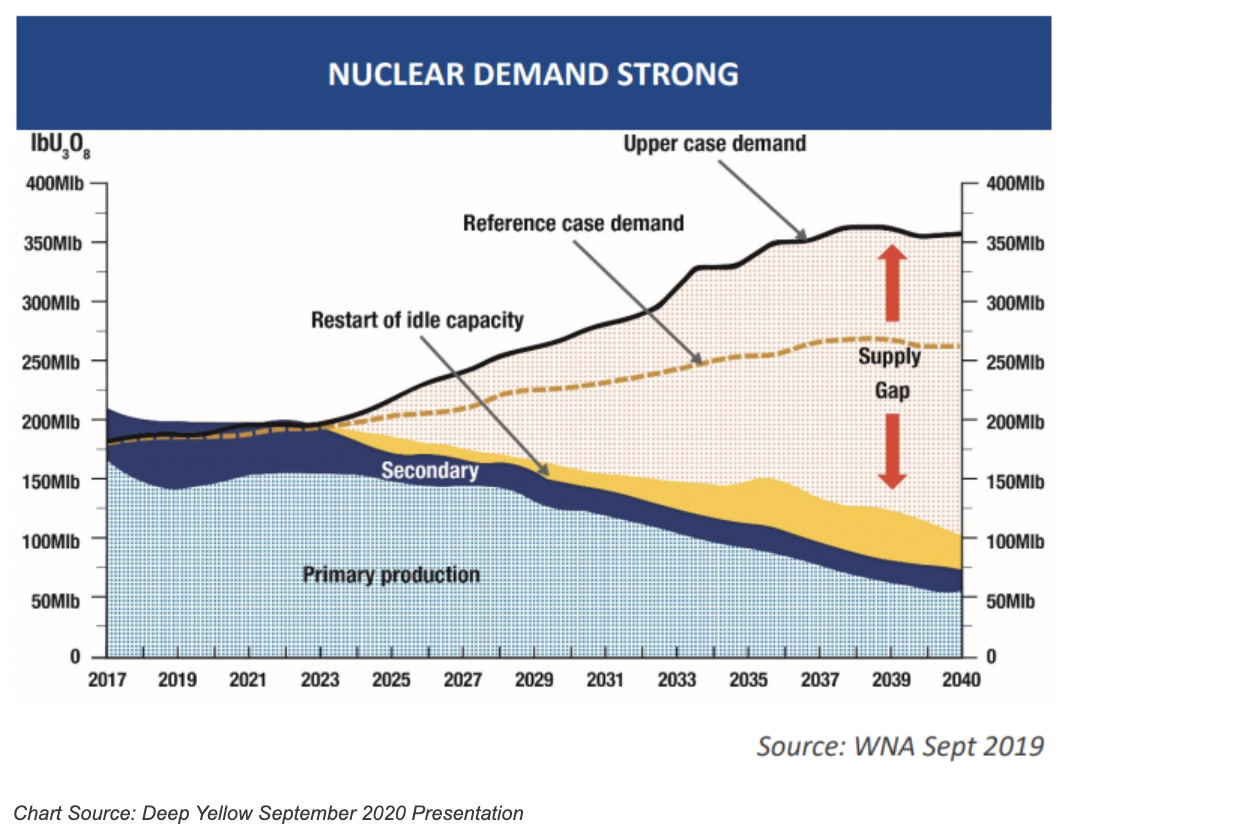

Uranium formed a major bottom in 2016 and steadily, much of the developing world is investing in nuclear power.

In the same article from March 23rd of this year, Lyn Alden Schwartzer referred to uranium as “...an under-owned commodity. It’s not one of the big ones like oil, copper, gold, or silver.”

Also from the article, Lyn added that, “[a]lthough the western world has stagnated in terms of building nuclear power facilities, Asia, the Middle East, and other parts of the world continue to do so.

“Uranium itself has been in a long bear market below all-time highs, but since its bottom in late 2016, and since then has been in a persistent uptrend. And yet, it remains below the cost of most forms of production.”

Cameco CEO, Tim Gitzel, also struck an optimistic tone regarding growing demand on the most recent Earnings Call from February 10th.Gitzel said that, “[a]round the globe, we are seeing an increasing focus on electrification for various reasons. There are those that are installing baseload power, those who are looking for a reliable replacement to fossil fuel sources, and finally, there is new demand for things like the electrification of transportation.”

Later on that same call, he added that: “ . . . demand for nuclear power is growing and not just the traditional uses of nuclear power. There is a real focus on, and significant investments being made in the development of non-traditional uses, like small modular reactors. Growing demand for nuclear power means growing demand for uranium.”

Cameco, as one of the larger players in the Uranium Mining space, is well positioned to benefit from the growth in uranium demand.

Lastly, in an earlier update on the Uranium space from her February 9th “Where Fundamentals Meet Technicals” article, Lyn Alden Schwartzer spoke about the duration and time horizon of this opportunity developing in the Uranium space, saying that:

“. . . this is likely a 5-10 year bull story, as uranium is still below the cost of production. Asia and the Middle East plan to bring plenty of reactors online over the next decade, and there isn’t enough production to cover it. So, the industry is working through existing (secondary) supplies until they dry up.”

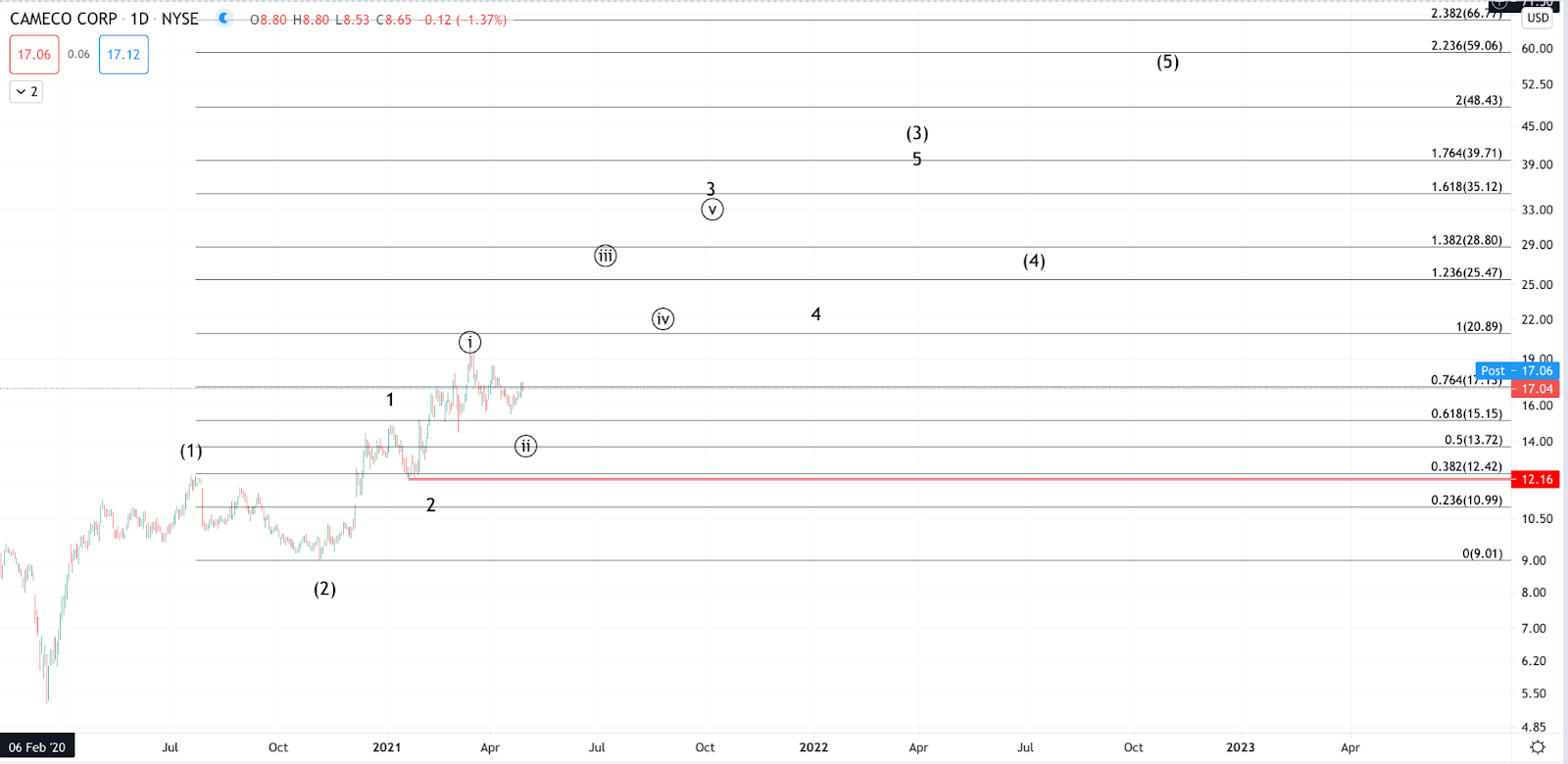

CCJ, up to 28.9% ytd as of the April 29th close, is likely still in the early stages of a very large multi-year rally. From a technical perspective, CCJ appears to have completed a very long term correction off the 2007 high at the March 2020 low, and, in our technical view informed by Elliott Wave analysis, we see the potential for bullish continuation in the years to come.

From the March 2020 lows, CCJ has formed an impulsive (1)-(2), 1-2. In Elliott Wave analysis, these are the premier patterns for continuation of the trend. That is to say, it’s not a guarantee that price will continue upwards in this case, but that a strong advance higher has the best probabilistic expectation. The initial wave (1) into the July 2020 was a 132% rally from the 2020 lows! In the subsequent pullback, labeled wave (2), into the November lows, CCJ retraced just under 38.2% of the preceding rally, which is a very standard support region within a strong trend.

After a bottom to wave (2) was struck in early November, price has rallied another 65% into the January high, forming another impulsive move to the upside, reaching the 50%-61.8% extension of the initial wave (1) projected upwards from the wave (2) low. In our Fibonacci “Pinball” Methodology, the aforementioned extension region is our standard expectation for a wave 1 of (3). Like all motive waves, wave (3) is expected to take shape as a 5 wave move with a large extension within its internal 3rd wave and no overlap between waves 1 and 4.The aforementioned move into the January high fulfilled expectations for wave 1 of (3). The subsequent pullback into mid-January was another clearly corrective decline and the cheaper prices were quickly bought, inducing another 5 wave rally.

At this point, and from a technical perspective, all the pieces are in place here for a large breakout, delivering a sustained rally to the upside. We see $29, a 70% gain from current levels, as reasonably achievable in 2021. So long as price maintains above the January 2021 low, at $12.16, considerably higher levels are expected in the coming years. Clearly, we see a solid fundamental and technical foundation, and good risk-to-reward associated with an investment in CCJ.