October Surprises, Guaranteed - Market Analysis for Sep 27th, 2020

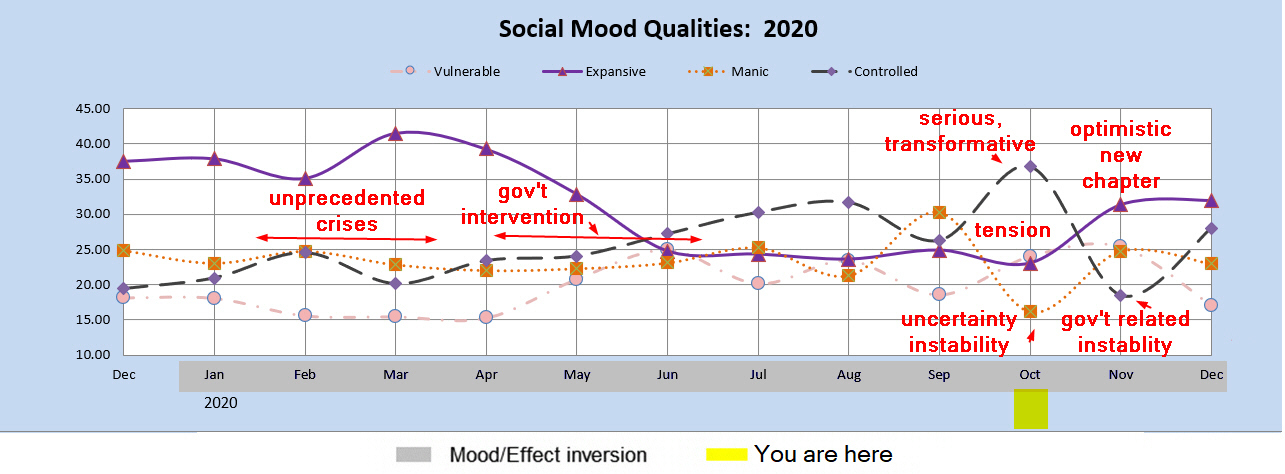

It’s almost expected to have some kind of October surprise in a U.S. presidential election year. These are usually strategically launched anti-campaign bombs lobbed at the opposing candidate. What if I told you that there are currently detectable October surprises in store for the American people and perhaps the world at large? With September still to be completed, this is as clear today as an “Unprecedented Global Crisis” was detectable for February and March of this year even as 2019 was yet finishing up and Covid-19 still unheard of. It’s as apparent as an intensive crisis intervention effort by the government was seen for April and May which would include attempts at ameliorating the issues “plaguing” the U.S. as well as propping up markets before the month of March had even completed its first week. How is this done? It’s a matter of picking up on which way we are collectively “looking” ahead of time.

For whatever reason, the themes of what we are collectively looking at, our social focus, resonates with the themes that show up in the news as well as market behavior shortly afterwards. By collecting information about these themes from top internet searches (where we are looking), we can get a picture of the general types of events in the news as well as likely market conditions days, weeks, or months ahead. This has been demonstrated time and time again.

The source data for the month of October, the themes of top searches from a few months earlier, came from quite a few topics of a serious nature. This was the month John Lewis died, as well as the tragic drowning of Naya Rivera. Well-known actor John Travolta was a top trend, but not for a celebration of a latest film. It was due to the passing of his wife. Herman Cain, a former presidential candidate also passed at this time. When all of the themes for the period are coded into eight categories and the relative amounts in each category are added together this results in the spaghetti-like chart below:

Normally, the pattern showing for October would reflect somber themes and profound change, such as “9/11” at which time the United States before and after was forever different. This pattern often accompanies mass casualty events or times that well-known people die. However, this year so far has been in an inversion period where the social mood picture and its expected effect are opposite from normal. With the inversion, October’s anticipated themes would include uncertainty, surprises, inflation, giddiness, instability, protests, and in this particular variant of the pattern, some increased risk of violence. If the current assumption of continued inversion is incorrect, we will likely have a much more serious October in store.

Taking a quick peak at November in hopes for clues of a likely election winner, if the inversion continues as expected, then instead of an “optimistic new chapter” for November we can expect “government related instability.” I’ll let you ponder what that might mean about election results for yourself. One thing I can say, is that if the inversion assumption is incorrect and October ends up with the serious profound change theme after all, most Americans will be much more happy with November.

If you have found this article of interest, you might enjoy checking out our posted market outlooks in the MarketMood section at Elliott Wave Trader. The MarketMood algorithm takes the source internet search trend data and converts that into expected market movement for the stock market, gold, oil, and the U.S. Dollar. Information filled reports are posted daily, and additional bigger picture reports and updates are posted as needed.