Nightly Crypto Report: Looking Up, But For How Long?

Short Term Traders

General: We rallied through $50,250 in the evening, and corrected most of the day. As of writing our intraday pullback looks constructive, so I favor higher. Just note that I can't yet say that the ultimate bottom is in. However, the current action should give us legs to climb higher in the coming days. And, certainly my downside count is being pushed the limit. And, I expect to be able to tighten stops on long positions in order to stay out of trouble. If we look upward in Bitcoin and Ether, I see the potential of a higher B wave top. I've also marked the best levels I have for that top with a blue box. Should we push through that box, a move to $65K Bitcoin, and $2300 Ether becomes far more likely.

B waves can be puzzling to those that are new to Elliott Wave. Just when you think you've broken through, the analyst gives you another one. That's necessary when the correction looks incomplete and the rally less than impulsive. Further, B wave can present as false breakouts, where we break the previous all time high only to sink back into corrections. This is why I am sticking to caution. Not because I don't think this is worthy of a long trader, but because I simply want your mind girded for potential hazards.

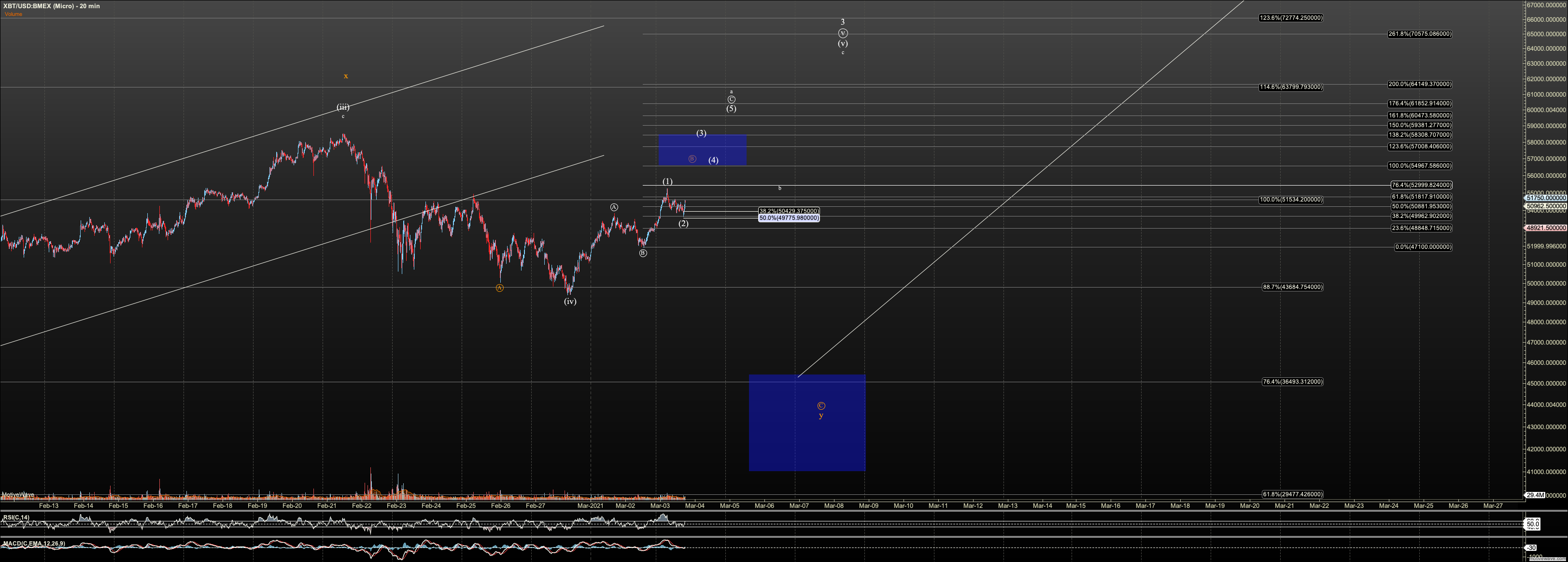

Bitcoin: Per above, with the move over $50,250, I expect a move higher. The structure of this move is murky but I favor the white count provided we can bottom in (2) and push higher. However, trading this count will require moving a stop as the orange B wave region is not far away between $55,000 and $58,300. The moment I see an impulsive reversal out of that region, I'll favor downside. Right now the most trustworthy stop which should promise downside follow through if broken is $47,100.

I have my core back up to 100%, but note that I am going to have a tight leash on it. Once (2) on my chart bottoms, I'll move my stop to that low.

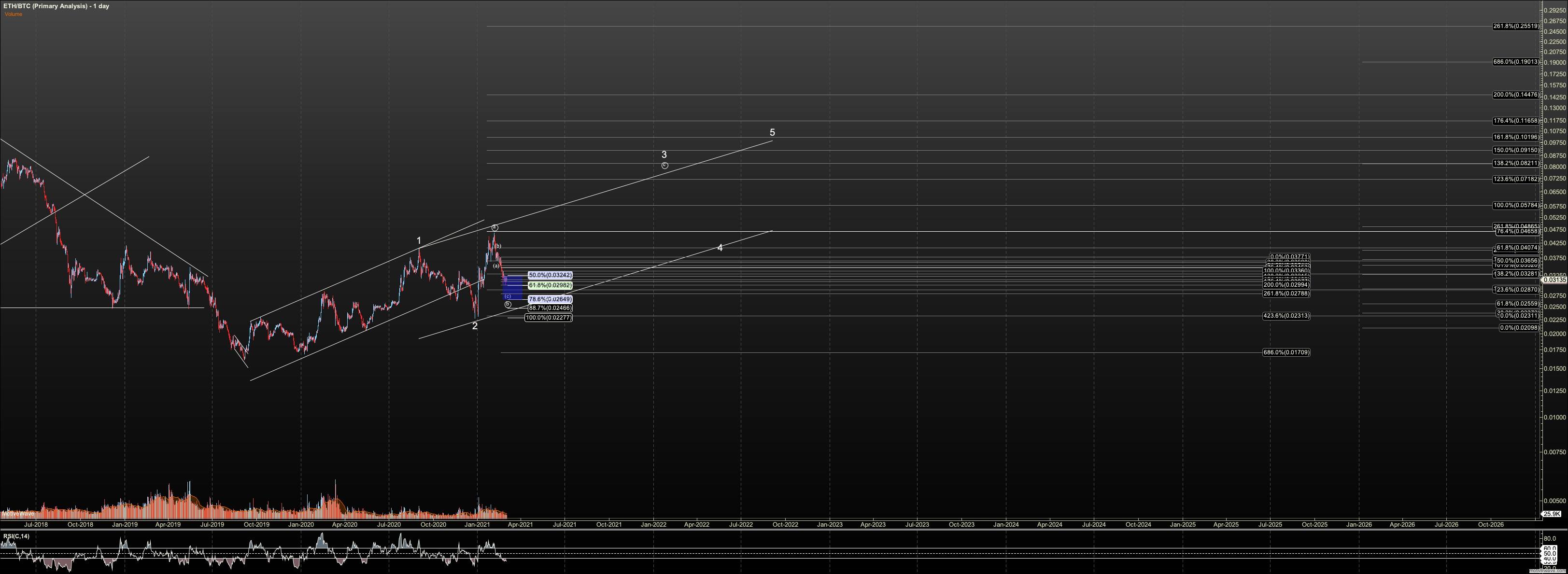

Ethereum: Though I consider Ether questionably bullish compared to Bitcoin, I'm going to look for higher right now. My skepticism is borne of the fact it is just barely above the wave 4 support it broke on the way down. However, should we fill in white count without being stopped by the orange b wave resistance, its lot improves. The B wave resistance lies between $1800 and $1960. As of now I do not want to see Ether break below $1457. Currently, that looks unlikely as our intraday pullback appears constructive.

I am going to keep my Ether short as a small hedge since I am now more long Bitcoin than yesterday. It will drag my PnL a bit as we climb, or soften a landing if we drop.

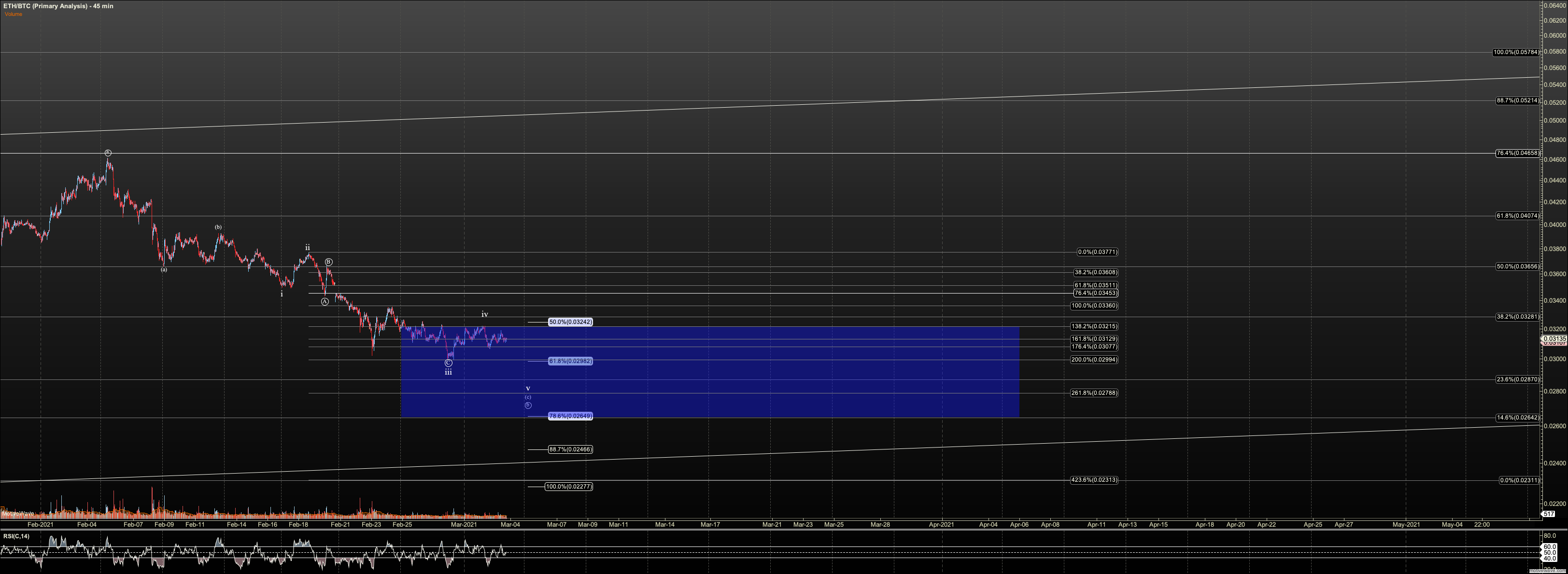

ETHBTC: We may now have a wave iv in place. Therefore, I'll watch for a reversal pattern upon new lows. For now it appears we may overshoot the previous target of .0313 and complete near .0267.

I rarely add the micro to this chart as I don't watch it this closely, but I provided a zoomed in view to show how close we are to a potential bottom.

GBTC: I still don't have enough clarity for a bullish count in GBTC but I squeezed one out so to speak. The best I can tell is that a rally to $53 in Circle-A would make a strong case for a breakout, provided the pullback in Circle-B is clearly corrective.

I am flat in GBTC.