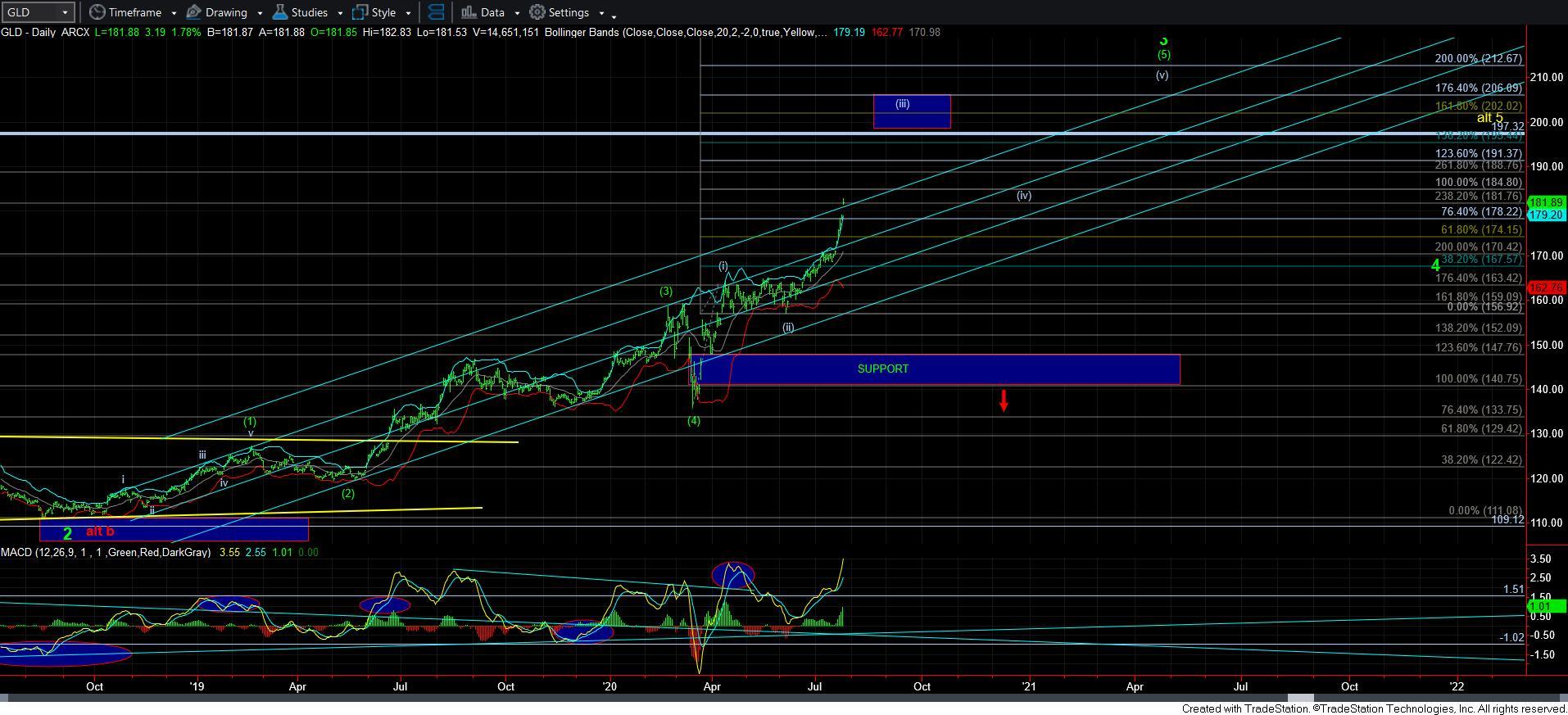

GLD Continues Higher - Market Analysis for Jul 27th, 2020

With the GLD breaking through the ceiling of the .764 extension, I think I am left with no choice but to assume the more accelerated count, as now shown on the 60-minute chart. While we were targeting levels north of 200 in GLD for wave [5] of 3, it seems the market wants to take a more direct route towards that target.

In truth, I am not wholly certain exactly where [3] and [4] will fall out within wave iii, but under all circumstances, I now have to assume that 175/76GLD is our micro support, which should not be broken below at any point in time now. And, as long as we hold that support on all pullbacks, then we are pointing north of 200 before this wave 3 off the December 2015 low completes.

Unfortunately, sometimes the market provides us with one of these accelerated counts, wherein we start with a series of 1’s and 2’s off low, only to be now accelerating in the 3rd wave. These are almost impossible to identify before they happen, as they are not as common as the standard impulsive structures we normally track. But, this happens to be one of the times we developed the series of 1’s and 2’s which did not allow me the opportunity to set up leveraged long positions in a standard set up.

Silver is the same general story, as we are likely completing wave iii of [3], with wave v of [3] likely pointing us over the 27 region. So, at this point in time, there is no difference in my silver chart.

This now brings me to the most difficult chart I am now tracking and that is the GDX. To be honest, when I take apart a number of mining charts, so many look like they still need that 2nd wave pullback. But, with GDX moving through the 43 region, I have to assume that any pullback we now get will only be a wave [ii] within wave iii. And, just like with GDX, we did not get our standard impulsive structure to develop to provide us with a low risk entry for leveraged long positions. Yet, I have to be honest in that I really do not have a high confidence micro count on GDX at this point in time, so I will have to take cues from other segments of the market.

While I seem to be lamenting my lack of ability to identify the ideal point in time to have added leveraged longs, it is clear that I am likely being too greedy. In fact, we have been riding these non-leveraged long positions for 5 years, and we have done extremely well with our mining stocks over that time. As I noted over the weekend, many of those stocks are 4X our initial buying point, and quite a number of other mining stocks are multiples of that. So, in truth, I seem to be letting my greed get the best of me at this point in time.

But, while I do not have a high confidence micro count on GDX at this point in time, I am going to simply ride my current long positions and as the micro structure becomes a bit more clear in the GDX, I will likely develop a much better idea as to where I want to begin taking profits. For now, I will be using the GLD and silver charts to guide me, and both of them still have some tremendous upside potential in the coming months.