Buyers Defend 3920 Ahead Of FOMC

Context section:

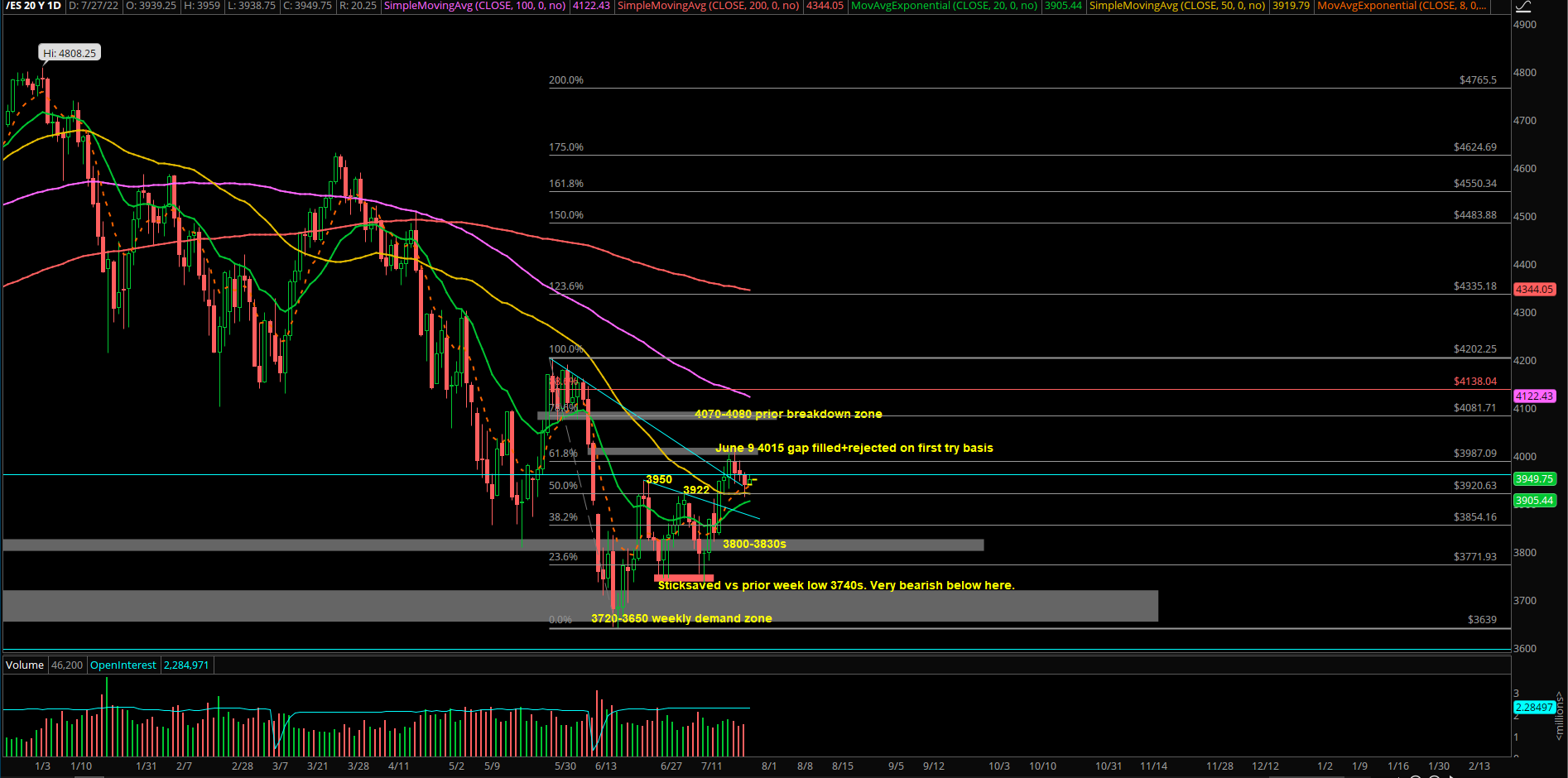

- Price action remained trending down below daily 20EMA since the mid Jan 2022 breakdown of 4650s on Emini S&P 500 (ES). Price has not stayed above daily 20EMA for more than 40 sessions this year.

- Intermediate trend turning neutral as price action broke above the previous 3 week’s range of 3950s-3720s and consolidating around the highs. Short-term trend remains bullish given last week’s breakout above daily 20EMA.

- We need to be mentally prepared given the volatile week ahead with earnings+ Weds FOMC+Thurs GDP+ Friday month end. Namely, megacap tech earnings with GOOG MSFT on Tuesday, META on Weds, AAPL AMZN on Thurs.

- Overall, we’re still expecting month of July to be an inside month until price proves otherwise. (Month of June = 3639-4189 massive range.)

Current parameters:

- Daily 20EMA = 3900s

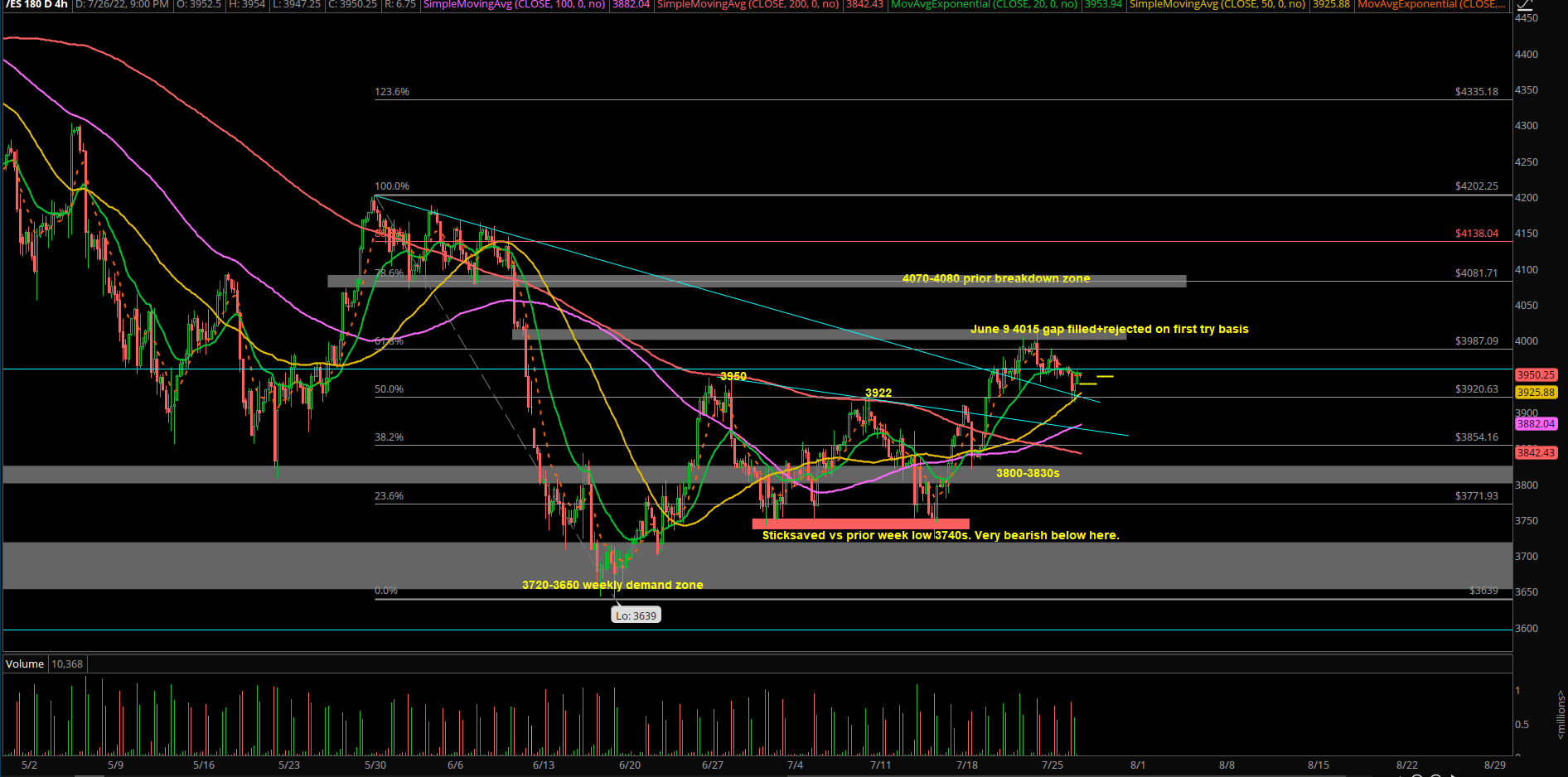

- 4hr 20EMA = 3950s

Tuesday played out as another range day per expectations. Key levels such as ES 3920/3950 and NQ 12180/12080 worked multiple times throughout RTH and provided scalp opportunities for both directions. As demonstrated in our room, we mainly focused on longs vs range low area as sellers couldn’t break the key supports. Daily closed another day above our 3920 (line in sand), keeping last week’s short-term uptrend alive.

Key ideas for July 27th:

- Fed day tmw so the usual caveat applies, expect higher volatility + whipsaw conditions.

- See where we open tomorrow for RTH and if still stuck trading inside 3965-3920 or tigher 3950-3920, we’ll continue to trade the range boundaries before 2PM FOMC.

- Short-term bulls technically remain in full control when trending above ES 3920. This is our ongoing line in sand since last week. Nothing has changed on this front.

- An intraday break above 3965 entices buyers to chase for another breakout attempt for intraday 3985 then 4000-4015

- A daily close above 4015, opens 4050-4080 in the coming days for follow-through.

- Zooming out, a daily close below 3920 (multi-day support) would be first sign of weakness/breakdown and further downside continuation into 3900/3850.

- Per prior reports’ discussion, as we head into Weds FOMC, we need to be mindful of higher timeframe sellers coming back and looking for swing shorts given this important 4000-4015 area or 4080 overhead represents great risk/reward. We are on the outlook for this potential given month of July is just an inside month setting up for Aug-Sept and beyond…bigger moves.

- Key levels are static, context is dynamic. Know your timeframes and adapt.

- Reactionary day-to-day market environment so capture points/profits and cut losers quickly, know your timeframes and adjust. We utilize a level by level approach.