Asian Markets Consolidating Lower

ASIA/PACIFIC

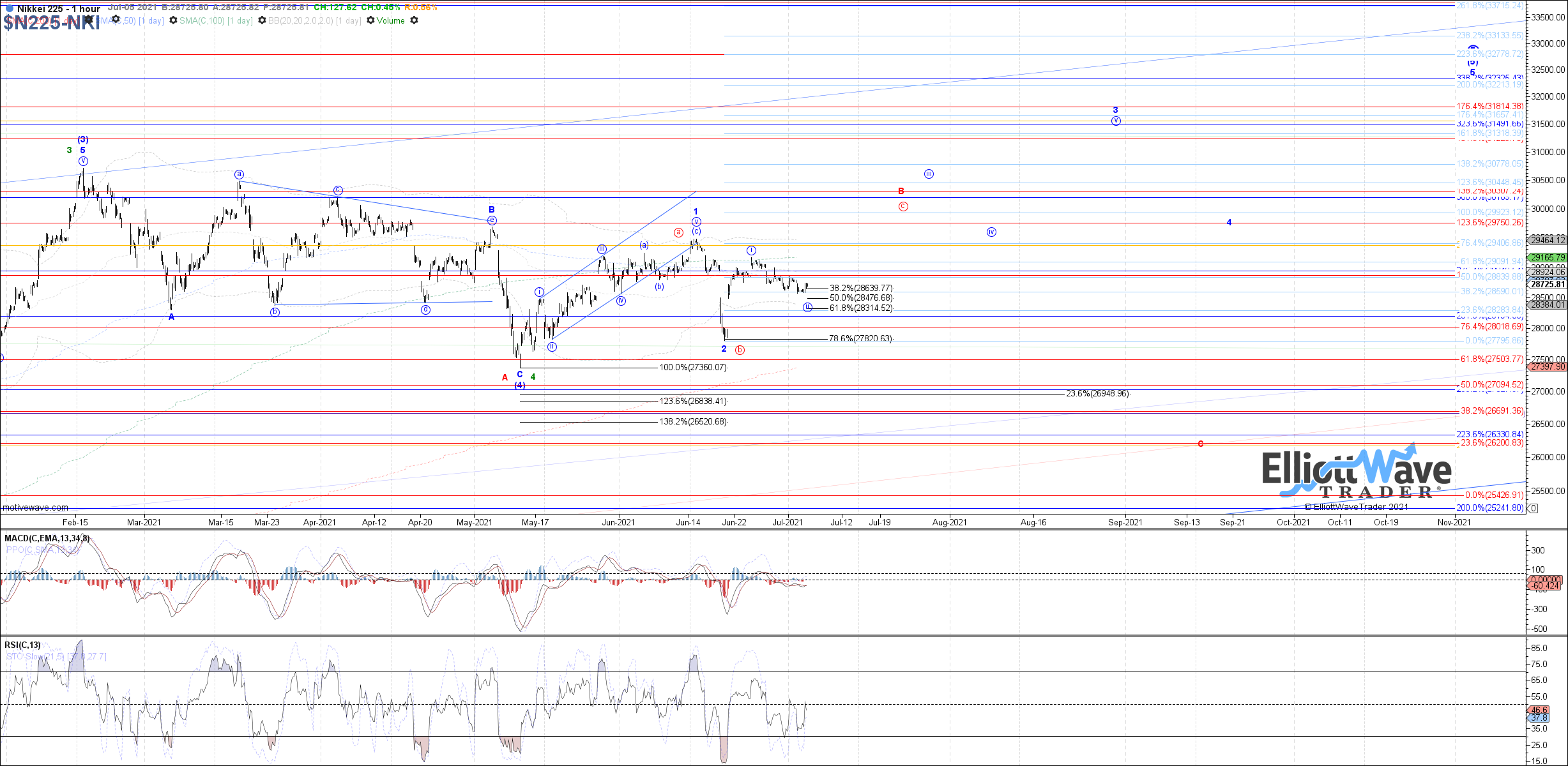

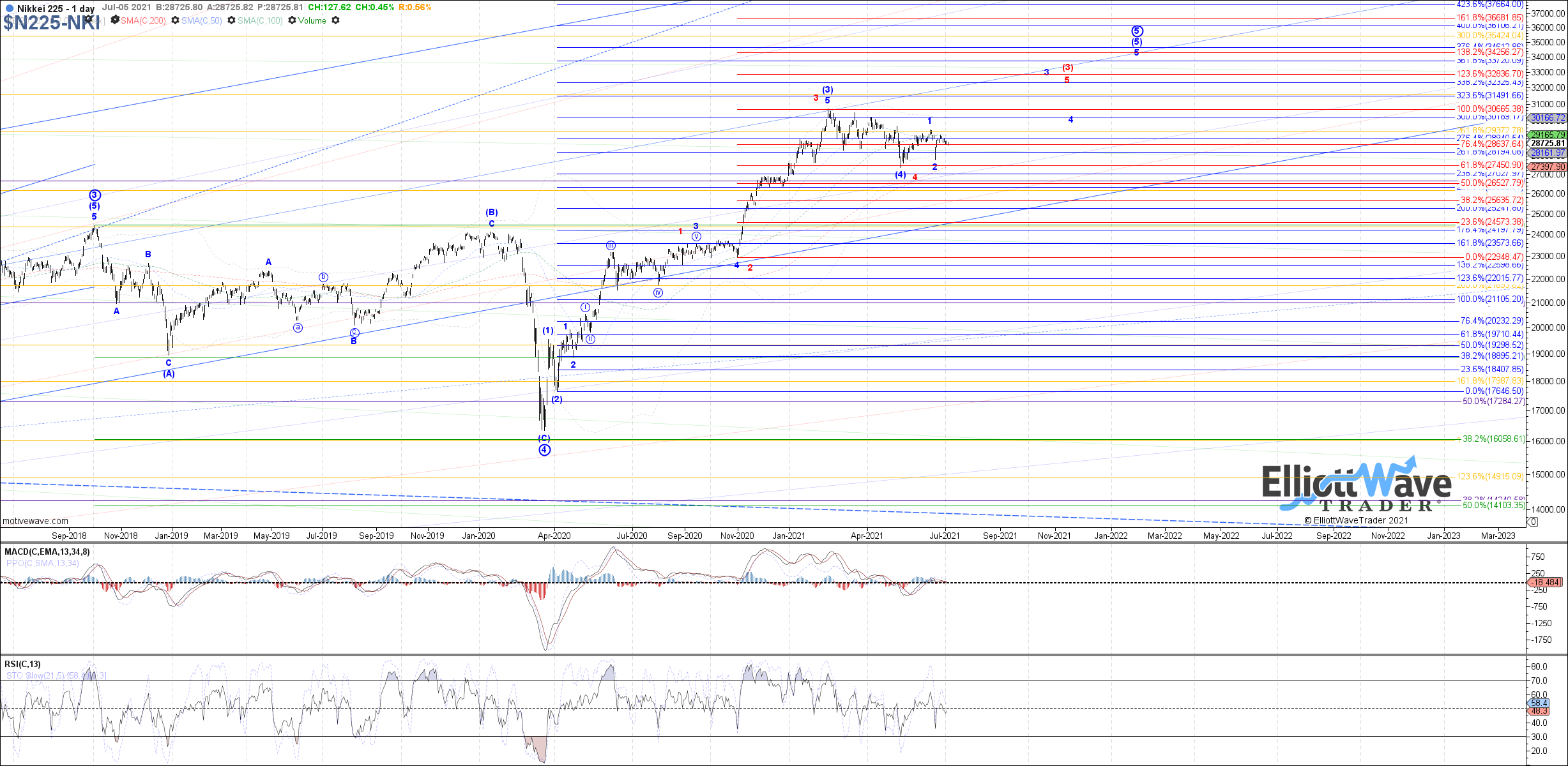

N225: The Nikkei consolidated lower last week, retracing into the target support cited between 28640 – 28315 for blue wave ii of 3. There remains room for a little bit more near-term downside to test the lower end of that support range if needed, and overall the potential i-ii remains valid as long as the June low holds. If price manages to turn back up above 29175, then it should target 29925 – 30450 next as blue wave iii of 3 or red wave c of B.

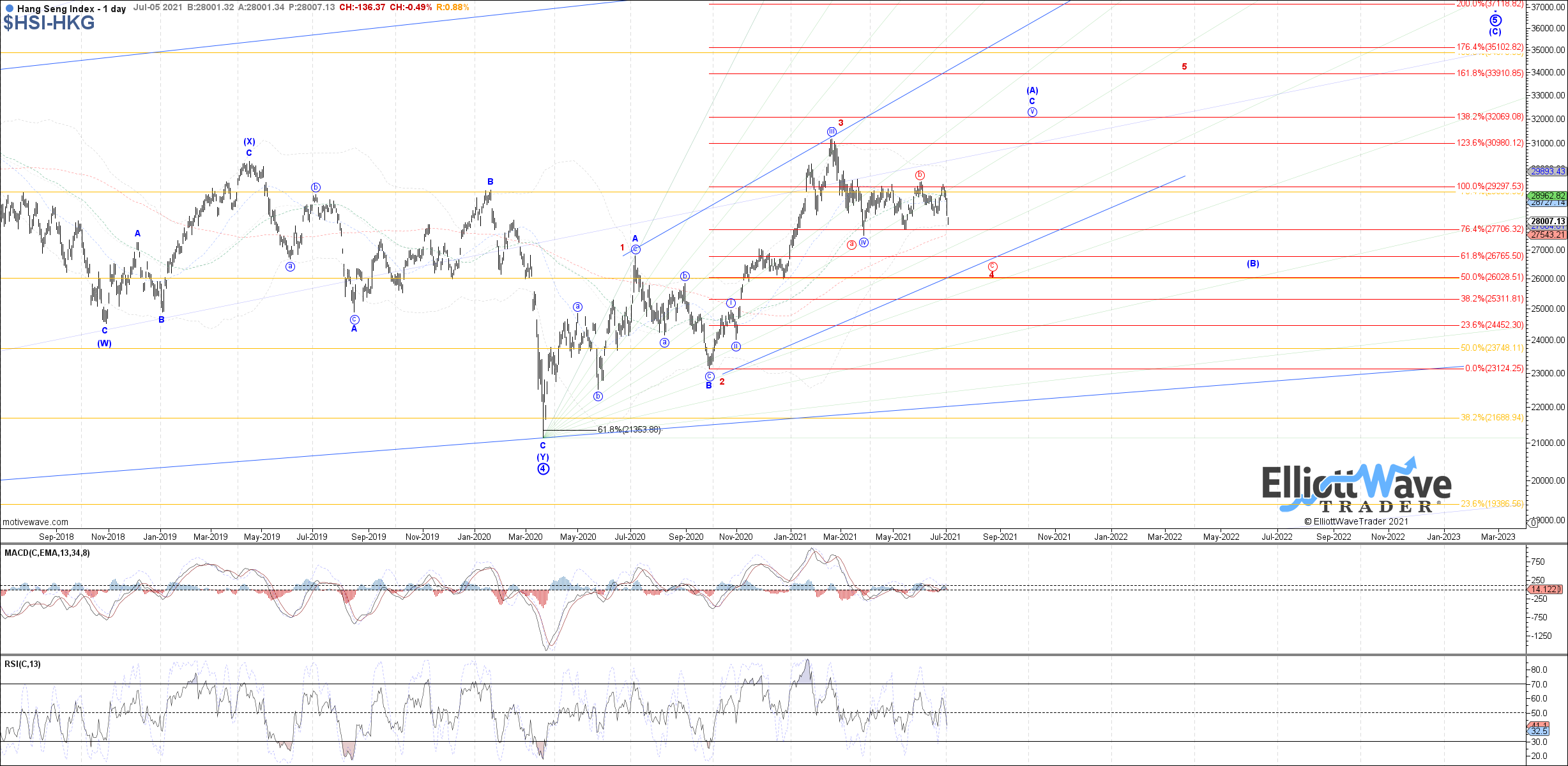

HSI: The Hang Seng turned sharply lower last week, maintaining below the prior June high and therefore still valid as a potential (i)-(ii) start to the red c-wave to the downside. If price manages to make a sustained break below the May and March lows, it would further confirm red wave (iii) of c filling out with 26000 as a potential target to reach overall before the c-wave completes.

SSEC: The Shanghai Composite started to turn lower last week as well, but not quite with the same conviction as the HSI. In this case, price is still above the prior June low, so that remains the next support to break if price is starting the red C-wave to the downside. Otherwise, price needs to get back above last week’s high to open the door to anything immediately bullish, below there and pressure should be down.

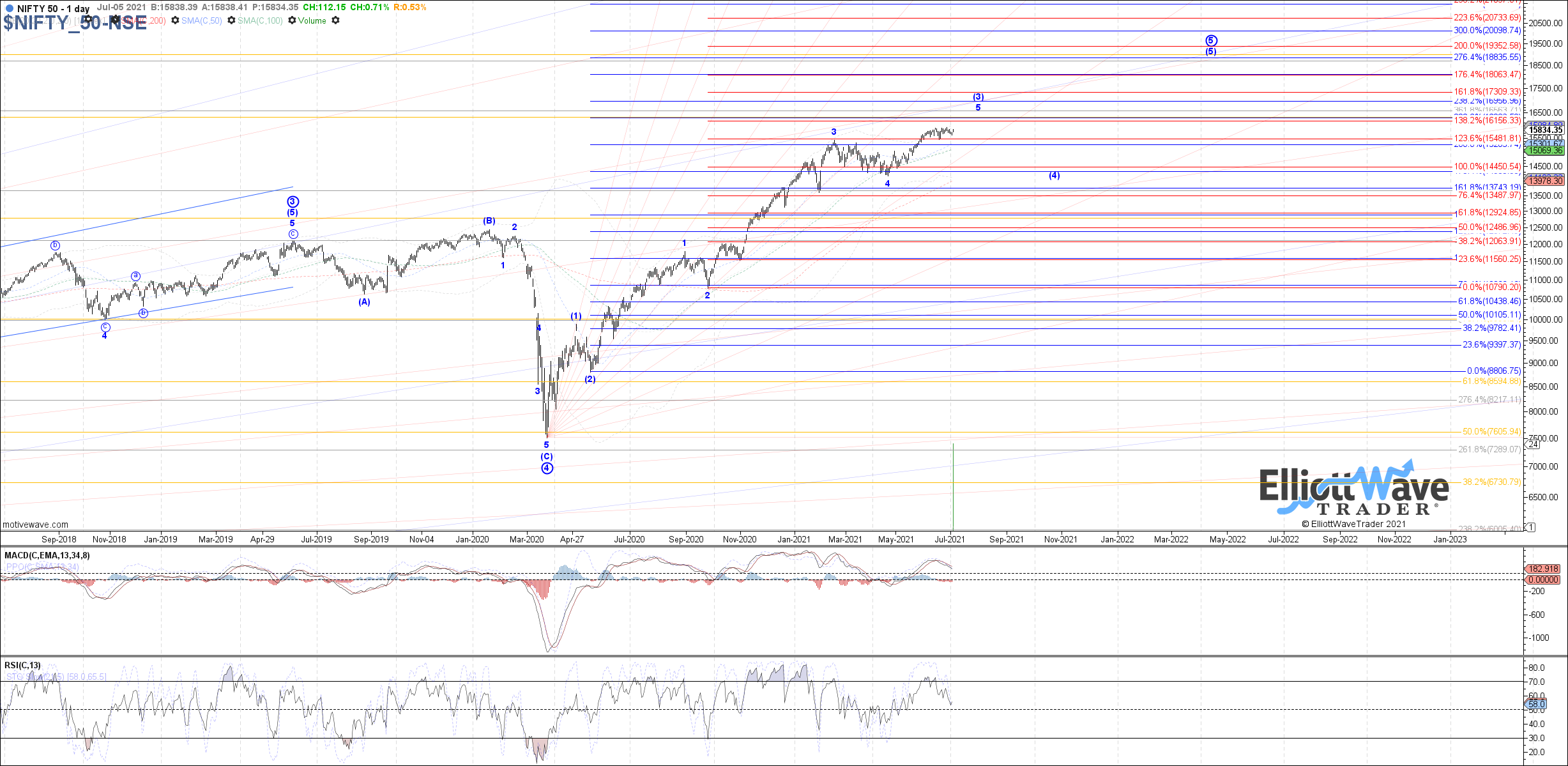

NIFTY: The Nifty consolidated sideways last week, so far still maintaining below the prior June highs. However, price has not otherwise turned back down below June low either to confirm the wider flat wave iv filling out. If price does manage to turn back up above the prior June highs from here, it would likely be an extension of wave iii with 15980 – 16200 as the next fib resistance to watch. Otherwise, back below last week’s low improves odds of the wider flat wave iv attempting to fill out.

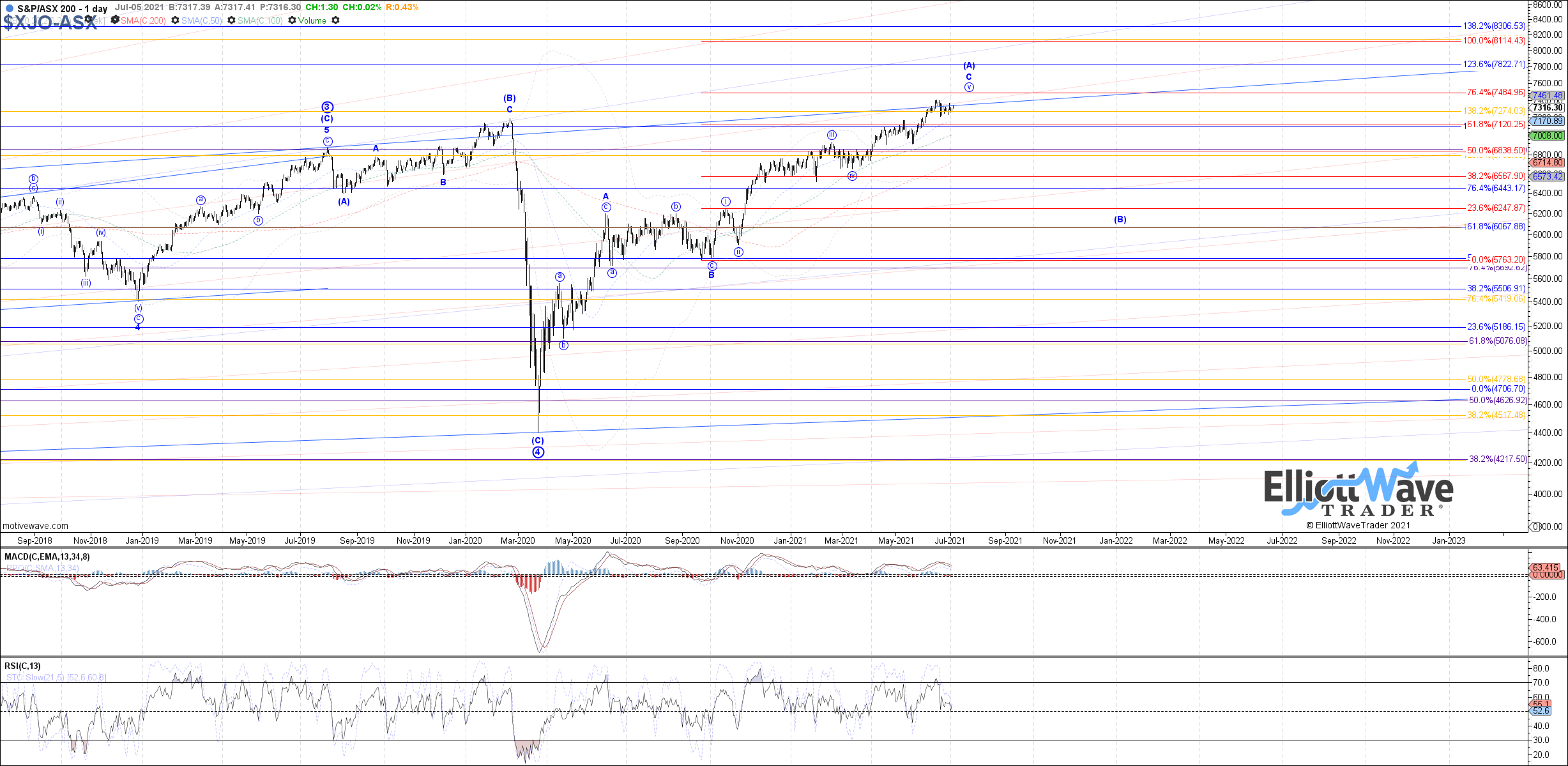

XJO: The ASX chopped around sideways last week, making it unclear whether price is currently filling out wave v of (v) already or still working on a wider flat wave iv. If price manages to make a sustained break above last week’s high, then odds improve that wave v of (v) is filling out. Back below last week’s low, and 7200 remains the next support for a wider flat wave iv.