A Tale of Two Health Insurers

In this issue of “Where Fundamentals Meet Technicals”, I take a look at two healthcare insurance companies. Both are long-term bullish, but with possibly quite divergent intermediate-term outcomes.

UnitedHealth Group

United Health (UNH) is the single largest publicly-traded health insurance company in the United States, as well as owning the third-largest pharmacy benefits manager, OptumRX. It’s one of the largest companies in the United States, across sectors, period.

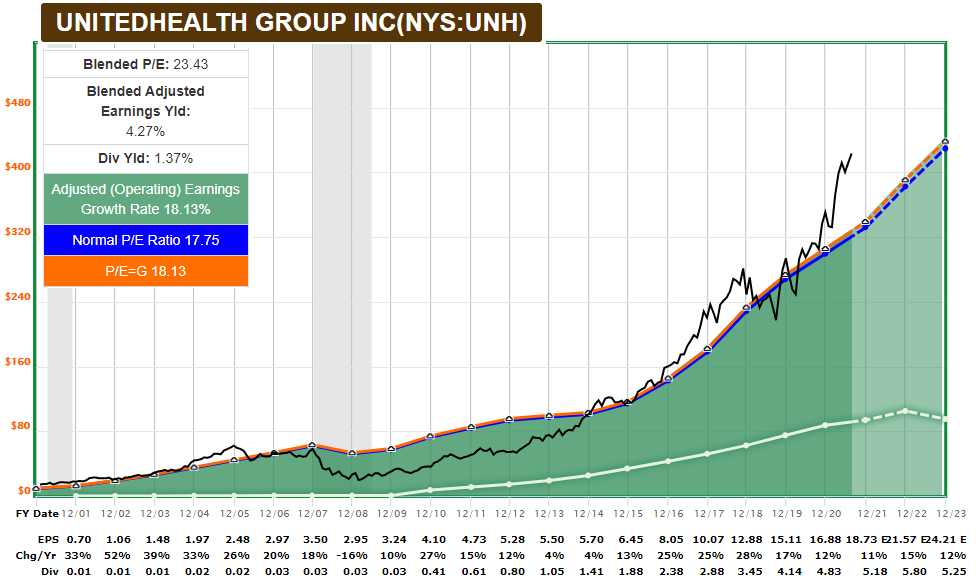

It has been an absolute powerhouse in terms of consistent compounding of long-term returns:

Chart Source: F.A.S.T. Graph

However, as the chart shows, its currently somewhat elevated in terms of valuation compared to the historical average. While I remain long, planning to hold for 5+ years, it is indeed vulnerable to a correction at any point.

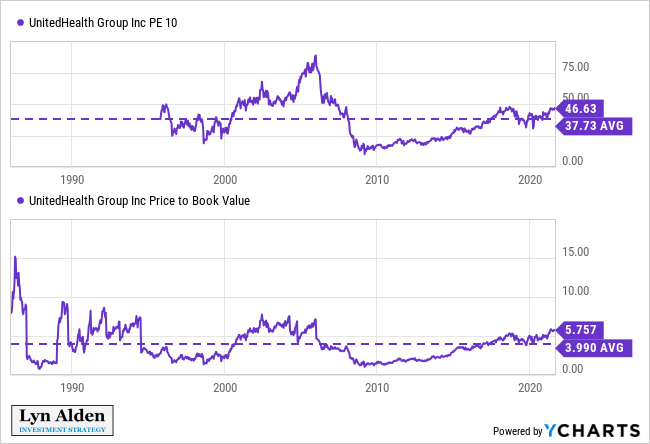

Garrett’s recent chart shows that we’re not necessarily at that point yet, but that a correction should be on our radar, technically speaking:

The company has a fairly high CAPE ratio and price/book ratio. Overall, I would say the company is “fully valued”, meaning I don’t consider the valuation to be unreasonable, but it’s not exactly some source of major alpha or opportunity at this time, other than simply being a buy-and-hold as a long-term compounder.

Cigna Corp

Cigna (CI) is a moderately large health insurance company, and also owns the second-largest pharmacy benefits manager, Express Scripts. It’s a smaller company overall than United Health, but larger terms of pharmacy benefits management, and still quite large in absolute terms.

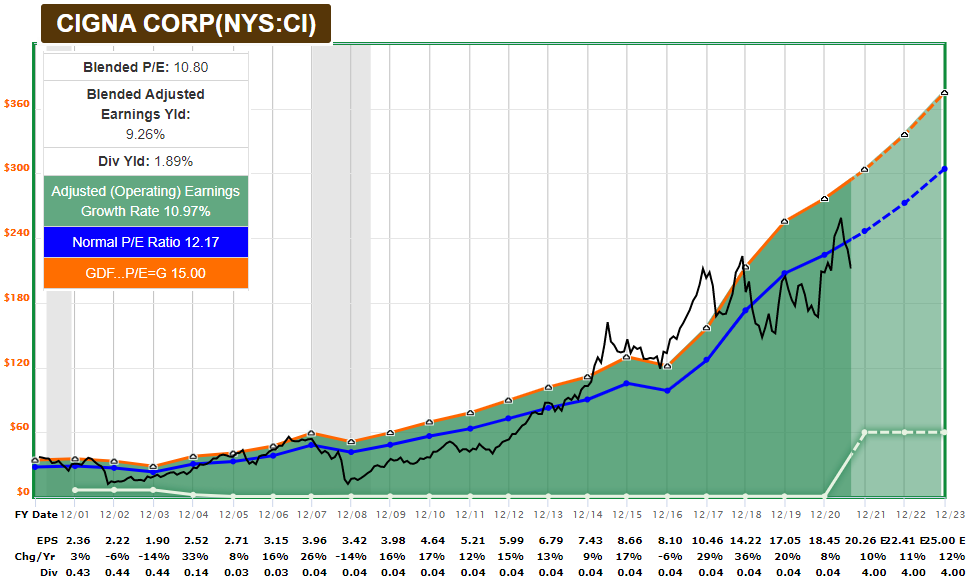

While it has performed very well in terms of returns, it is much cheaper than UNH, both absolutely and in historical relative terms:

Chart Source: F.A.S.T. Graph

Garrett’s recent chart doesn’t have a confirmed bottom in place yet, but looks much better for forward return potential than UNH:

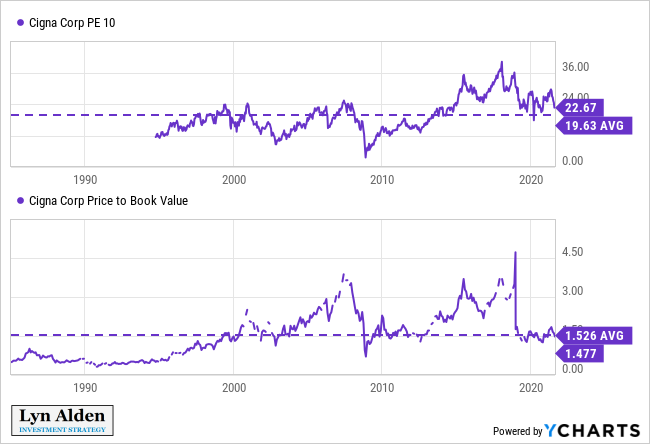

The valuation is attractive in absolute terms, in my view:

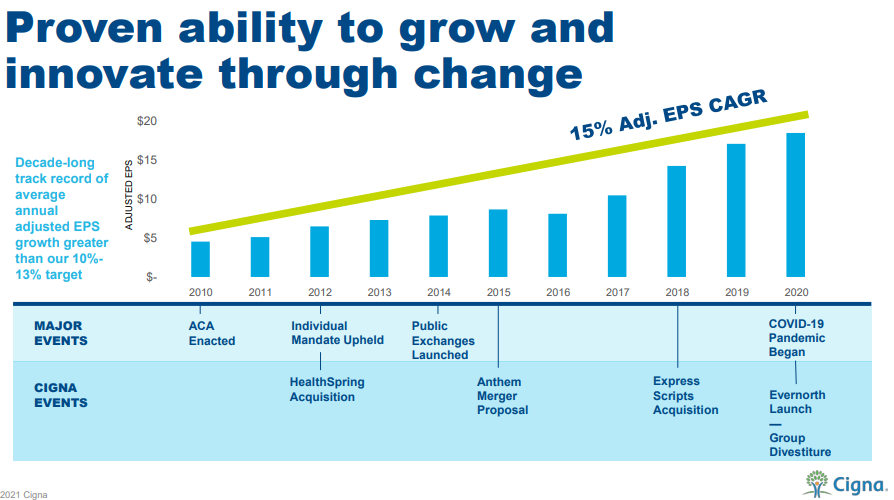

This valuation discount for Cigna relative to United Health is warranted to some extent, but the company has had a good track record for a while now. Here's a glimpse into their history:

Image Source: Cigna Q2 Presentation

Cigna also recently announced an accelerated share buyback program:

Today's announcement is further evidence of the confidence of the management team and our Board of Directors in Cigna's financial strength and long-term growth strategy," said David M. Cordani, President and Chief Executive Officer. "This accelerated share repurchase is consistent with our commitment to return a significant amount of capital to shareholders. When combined with our previously completed share repurchase and a greatly increased dividend, we will have returned more than $7 billion of capital to shareholders in calendar year 2021.

Many companies buy back stock when their shares are expensive and cut buybacks when economic troubles occur and their shares are cheap. I like seeing Cigna buyback some shares here when it is inexpensive and producing good cashflow.

Balance Sheet Comparisons

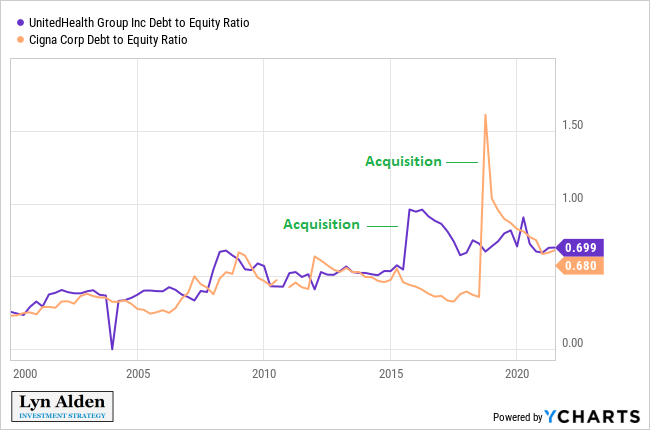

Cigna acquired Express Scripts a few years ago, which temporarily boosted their leverage ratio. However, they have deleveraged from that acquisition, and are now back down to normal. This chart shows the debt/equity ratio of both companies:

United Health has an A+ credit rating, and Cigna has an A- credit rating. So, both of them are on the top half of investment grade and in good shape, but United Health is better. It does deserve a valuation premium, but at this time, I think Cigna presents a better overall value for a 3-5 year view.

Between United Health, Cigna, and CVS, they control about three quarters of the US pharmacy benefits market. CVS is the most diversified, with retail pharmacy operations, the largest pharmacy benefits manager, and moderately large health insurance. United Health is the biggest in terms of health insurance, and third in terms of pharmacy benefits management. Cigna has moderately large health insurance operations, and is number two for pharmacy benefits management.

I like owning all three of them to reduce single-company risk, but I have a long-term preference towards Cigna and CVS at these levels.