Market Analysis for Sep 24th, 2020

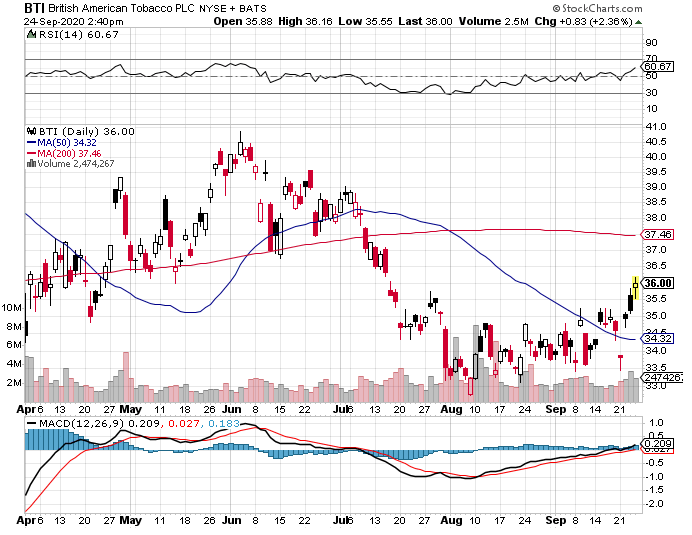

BTI is up over 2% today, with a bit of a breakout going on.

Zac and Garrett began highlighting a bullish technical pattern weeks ago, and I featured it as a fundamental long in both a Deep Dives report and a Where Fundamentals Meet Technicals report in the past several weeks as well.

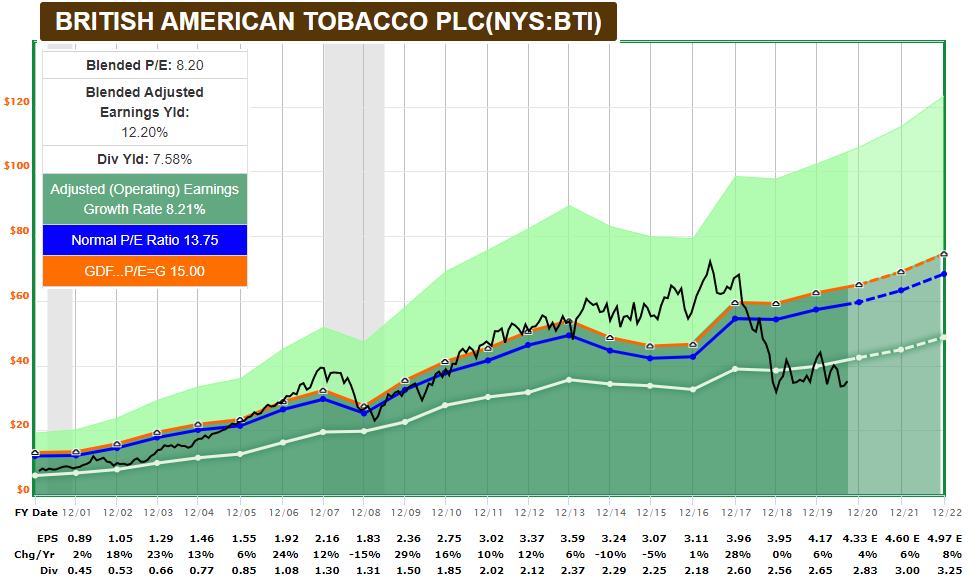

The tobacco industry has been up against secular decline, but nonetheless has outperformed the S&P 500 over the past 25-30 years and more. In recent years, many of them have been struck to lower valuations, which makes them more attractive on a long basis from current levels. BTI pays a big dividend and is at a low valuation that, unless it gets hammered by a ton of bad news, is likely to shift higher in time.

In recent news, the company recently announced plans to buy back some of its 2022 debt as part of its deleveraging process.