2020 Closes With Crypto In A Swagger

General

Waxing nostalgic, I look back on 2020 as an interesting year. We started the year in a massive 1-2,i-ii setup promising six figure Bitcoin prices, prior to the March 2020 breakdown. After the breakdown we considered that we had to wait much longer than expected for those levels. Fortunately, the support level I called out -- the infamous $7125 -- was very important, so those that minded it did fine. (I did, but not in GBTC in that first routing.) After said breakdown we rallied in corrective structure, leaving questions that this rally is sustainable. Yet we've seen a massive breakout that has yet to tease a bearish pivot. Ride this train into 2021 as long as it has wheels, but do manage your risk as we go. What cryptos giveth, they also taketh away.

The messy structure in the early months spurred me on in a lingering goal to work on quantitative signals. I hope you agree that this was a big add to the service and I expect continued success on this front. It has not only changed my trading in crypto but my trading in equities, futures, and options as well. There will be more to come in 2021.

As far as today's report, I see no change in structure, however, I have edited the pros where important, and edited key levels above and in the sections below, where important.

Bitcoin

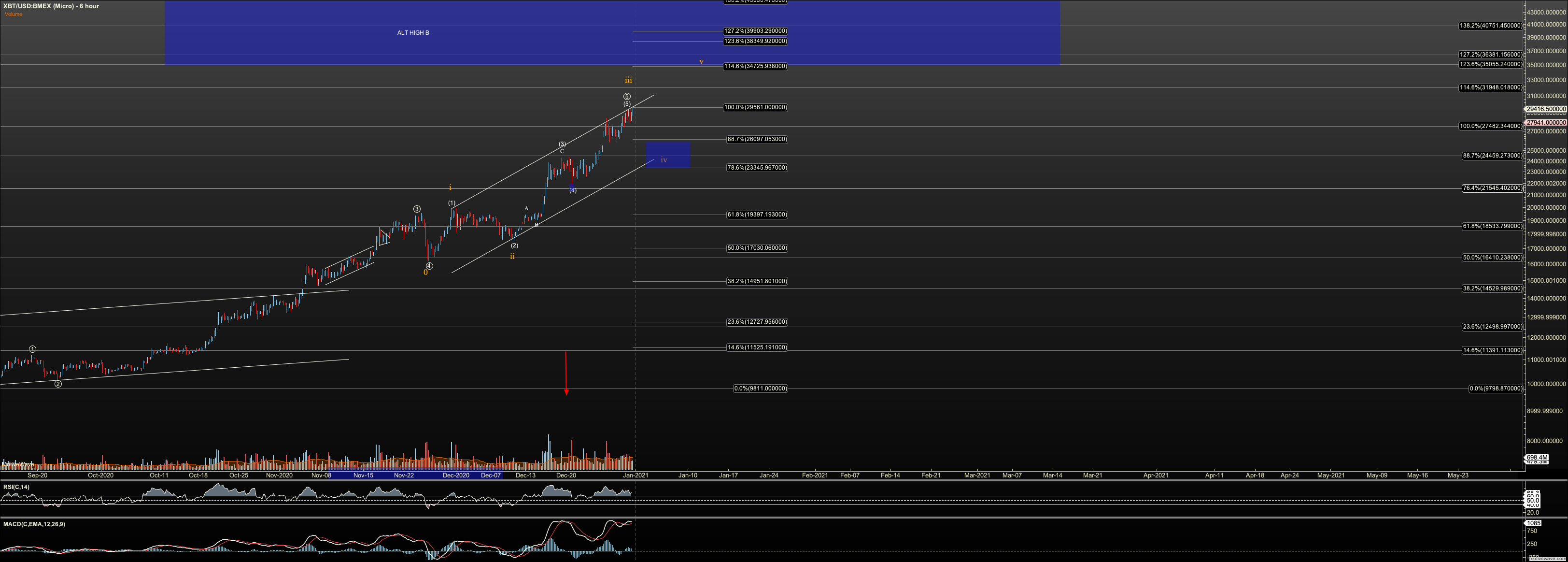

We have met my expectation for white five/orange iii. Again, I prefer the orange count over the white, which in the end is just an extension of white if our bear market pivot breaks. At this point, I view orange iv as valid over $23440 and if it holds, should setup a run to $35K. This target has changed a bit because of extension in orange iii.

At this point, $16,930 is viewed as the key pivot between a major B wave top and a continued march upward. Just remember that the $27K to $30K has two layers of confluence, giving reason to be cautious here. That doesn't mean you should sell outright as I am not. But you have to consider what our pivots below would mean to your position if they didn't hold.

I continue to hold my core based on the Core Algo, with puts as defense.

Ethereum

Ether has lagged Bitcoin a little here, but that is not expected with the ETHBTC chart breaking down long term. Micro support for white count is $640. So far, this is playing out in slow fashion but remains over support. As long as $640 holds we should see $864.

Conversely if Ether falls through $547 here, the door to a drop to $400 would be open.

ETHBTC

We have a bounce off a key fib for the first of the third wave. If correct, we've only seen the A wave of circle-ii, a degree that was added today.

I've also added the orange ABC which would suggest we are still in 2. But this will only be viewed as the case if we rally over the current top labeled white 2. I only bring this up because our push off the low was quite strong for a wave two of this degree.

GBTC

I still prefer to see more complexity in (4), but GBTC spent the day higher in the local range so there is some doubt we'll see a lower hit in (4). If Bitcoin can find even a small pullback, I'm sure GBTC will put in a lower (4) pullback but I continue to watch $25 as key support.

I also added a note on where I see the key, 'last ditch' pivot for the difference between white and orange. That is at $18.30. If this breaks, orange fails and we have a B wave top in GBTC.

I am long again based on my MOMO algo and EW based allocations, and am holding cash for the next Magicbus signal.