Why is Bitcoin So Bullish?

I’m going to weigh in on this question of why Bitcoin is moving so bullishly in 2019. Before I start, my pat answer is that it is sentiment. If you know my work, after a failure of the February 2018 rally, just after the top, I stated our bear was going to be more protracted than I expected and marked the $4600-$3000 area for a bottom. While that area may ultimately break, though I doubt so now, $3000 proved key. I mark $3120 as significant bottom that should hold. You see, I generally don’t need to figure out the why when price action is bullish. I just trade what is evident.

But if we move past the ‘easy answer’ and on to a deeper look at what may be driving this sentiment, we can find ‘reasons’. And, this I will explore.

I see three main driving forces that are meaningful. While other events may have catalyzed price action short term, they are not substantial enough to drive a trend. The three trend driving forces are: Refugee Capital, Institutional Hoarding, and ‘the Shorter’s Disease’.

Refugee Capital

While I may or may not be able to claim originality of this phrase, ‘Refugee Capital’ I have coined the term fresh for this article. I was looking for an all encompassing term that captures the flight of capital out of the banking systems of the world, which may be caused by any number of reasons.

One reason for flight may be the failure of a fiat system. We’ve seen a certain degree of Africans flee to Bitcoin in the last ten years as fiat crises ensued, like the Zimbabwe hyperinflation. And recently hyperinflation in Venezuela drove an increase in Bitcoin purchase. To me, this phrase also describes capital flow out of Hong Kong due to political insecurity. Or, there may be a hiding of capital from bankruptcy courts. A friend of mine told the story of someone he knew in the US that hid funds from bankruptcy court by buying Bitcoin. And, this, in my view falls under the umbrella of ‘refugee capital’. Note there are ways of doing this legally and illegally, so don’t blame me if I stir your mind toward criminality.

You see, Bitcoin is very useful for sending your funds to a refugee camp in the virtual world. Once one owns Bitcoin, provided they have the private keys safe, they don’t have to move capital at all. They simply walk across the border, download a wallet app, and enter their keys. There is no moving at all. Once Bitcoin is purchased, the person las vacated the fiat system of their country and its border controls.

Institutional Hoarding

What I mean by institutional hoarding should be obvious. As I described in a recent article here on FA Trader, I knew when Bitcoin futures showed up, that we were seeing the creation of the hedging mechanism for a set of institutions long Bitcoin. Now consider that the CME Bitcoin futures continue to hit volume records throughout the bear market and our more recent and bullish days. While Bitcoin trading volume on retail exchanges dropped into basement levels into the $3100 bottom in Bitcoin, futures grew in briskness. This is circumstantial evidence that institutions grew in crypto interest, whether long or short, while retailers ran for the hills.

Real data for this is hard to come by but I have a few points to share from my research. Let’s look at the holdings of Galaxy Digital, which can be found here. Galaxy Digital is a leading crypto liquidity provider for institutions. Let’s look at the their ‘investment outlook’ through the eyes of their financial statements. Throughout 2018, their ‘investment’ column on their balance sheet, which is described in statements as that portion of their crypto holdings not available to trade climbed from $121M in the 1st quarter of 2018 to $179M in the 4th quarter of 2018. While on face value this may not seem significant, now consider that most cryptos lost more than 80% of their value during that time. In terms of ‘coin quantity’ that is a significant accumulation. It seems they were selling some in 2019 as the value is $202M after Bitcoin increased by almost three fold.

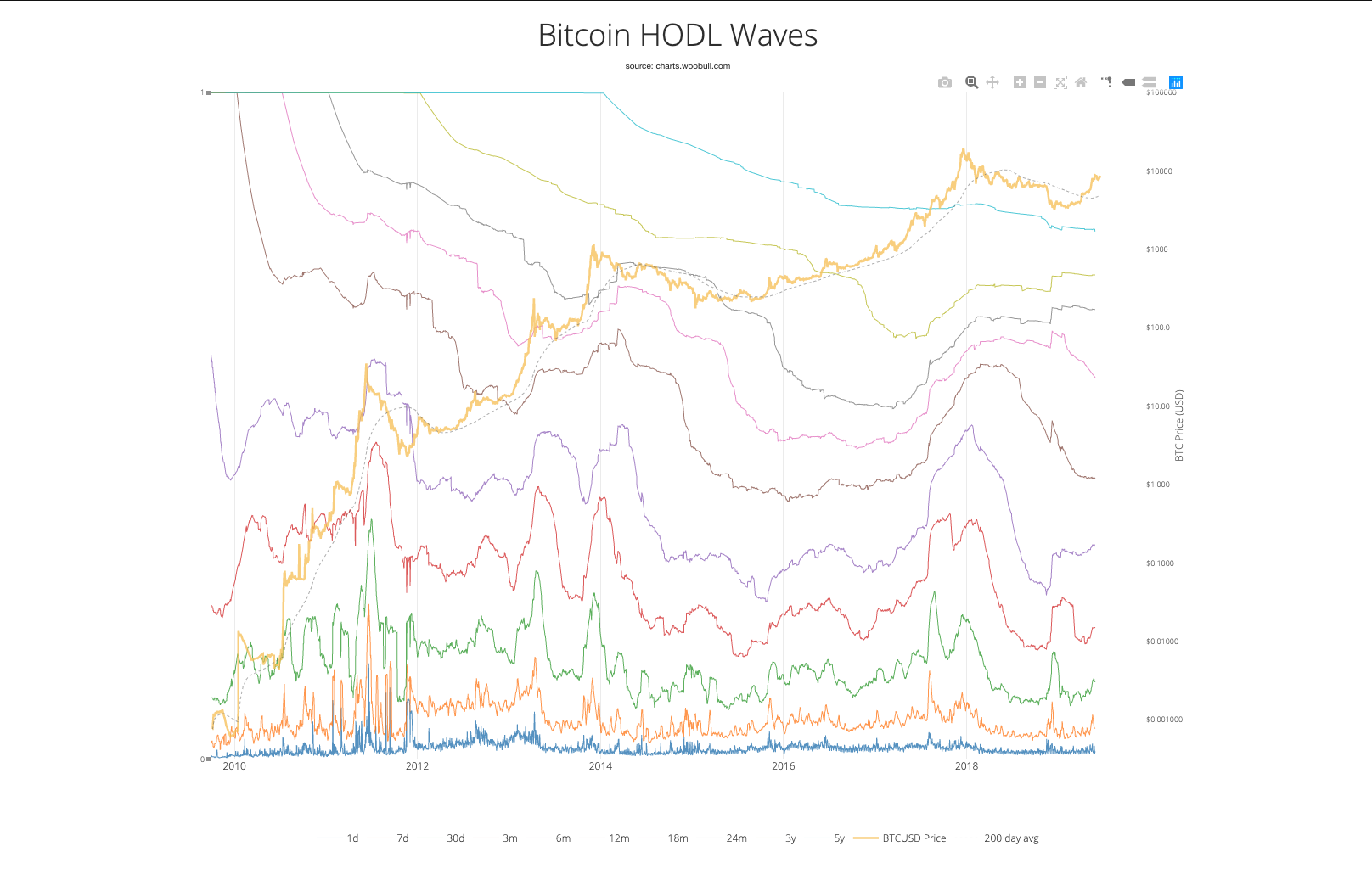

Another data point to consider is this method by Unchained Capital and visualized by Woobull charts. It is called the 'Hodl Waves'. Each line represents a duration of time that coin has sat in a wallet. If a line is rising, more coin is sitting for that duration in a wallet. And, at some point coin sitting in a wallet, if it doesn’t move, will move to a new duration line. What we can witness in this chart is hoarding in action, and as you see hoarding is ‘on the move’ again. Thanks to one of my subscribers, who goes by Xglider for pointing this chart out to me.

The key take away here is that Bitcoin is less available than it was 6 months ago. And, if this bull market continues, float, or that Bitcoin that is available on retail exchange will continue to decline. Now, note that institutions do not set the Bitcoin price currently. Retailers do as institutions trade this market OTC. What do you think will happen to price as retailers get very bullish on the back of thinning supply? To a degree we are starting to see the result.

The Shorter’s Disease

This last phrase I steal by one of our premier members at EWT, and teacher of us all who goes by the user El_Hombre_Espantoso or EHE for short. He describes those that perpetually look for short trades as having the ‘disease’. I’m here to tell you that leveraged retailers traders in the bitcoin trade have a chronic disorder, perhaps ‘trained’ by a voracious bear market. And, they are creating these immense price spikes on the retail exchange.

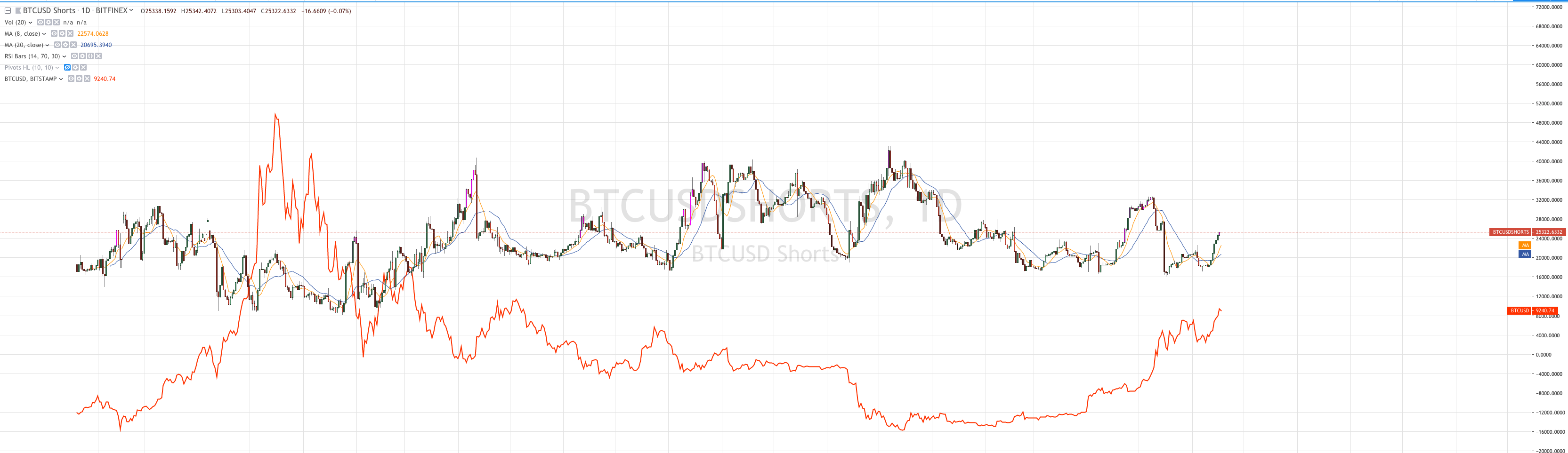

Here I attach roughly the last 18 months of the short interest on Bitfinex exchange. The candles are short interest and the red line is Bitcoin price. What I like about this data is Bitfinex is a major exchange but isn’t a derivative exchange. This means that when Bitfinex short traders have to cover they need to buy Bitcoin. This is different from Bitmex where traders are shorting futures, and just need to cover with futures. Buying a futures contract doesn’t suck up bitcoin supply. Bitfinex traders do affect supply. Now look very carefully at this chart, and you’ll see that short traders sometimes are on the right side of the trade and sometimes not. Sometimes they are rightly increasing their shorts into rises, and decreasing them as price declines. Note that times where price increased only slightly and the shorts were slowly covered. You know by that action that covering was not in earnest. It is orderly profit taking. Now look at the times, particularly in 2019 where the shorts ran for the hills. The big red bars in short interest show violent short covering. And, this often happened into violent price rises. This was very evident in our third of our third, or the heart of the third as we call it in Elliott Wave. The shorts had their asses handed to them. Excuse the ‘trader French’. We’ll see if they continue to be so demonstrably wrong.

Will these trends continue throughout 2019? I believe they will, and into 2020 as well. However, as important as these trends are, only price action is the timely and direct feedback mechanism a trader needs to make trading decisions. These trends are important, but waiting for them to accelerate or decline is a difficult game, as price will react far sooner than any of us will see these trends change.